As a researcher with a decade of experience observing and analyzing the cryptocurrency market, I must admit that the year 2024 has been nothing short of revolutionary for institutional Bitcoin adoption. The surge in corporate investment, driven primarily by Bitcoin ETFs, has undeniably reshaped the landscape of this nascent industry.

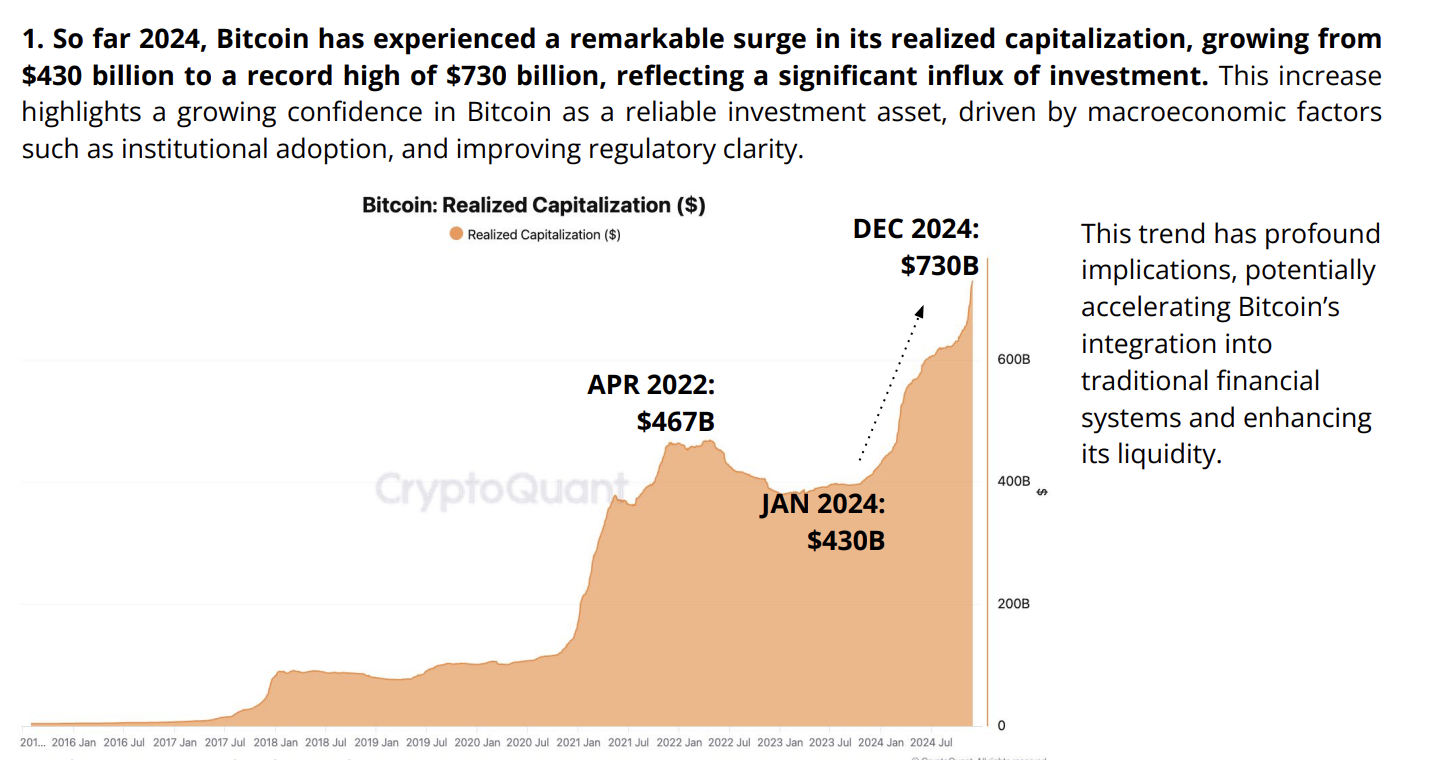

According to CryptoQuant’s recent analysis, the year 2024 stands out as a significant period for institutional Bitcoin adoption due primarily to Exchange-Traded Funds (ETFs). The influx of corporate investment has been substantial across the board, boosting the realized market capitalization by approximately $300 billion.

In my analysis, while Bitcoin did experience some technical advancements this year, it was overshadowed by the impressive growth of institutional investments. To put it in perspective, the impact of these institutional players in the market far surpassed that of protocols such as Runes.

The ETF Wave Into Bitcoin

In their recent weekly report, CryptoQuant, shared with BeInCrypto, highlights the surge in institutional adoption throughout 2024. The Bitcoin ETF secured approval from the SEC in January, sparking a frenzy of corporate investment. Since the start of the year, the realized capitalization of Bitcoin has increased significantly from $430 billion to an impressive $730 billion.

A significant portion of the capitalization can largely be attributed to the issuers themselves. For instance, Bitcoin ETF providers had amassed nearly five times as much Bitcoin as the global hash rate by late October. BlackRock, for one, holds over half a million dollars’ worth of Bitcoin, and the ETF market has been experiencing rapid growth. According to on-chain intelligence firm Arkham, the company purchased a billion dollars in Bitcoin by Wednesday this week.

Despite this, analysts have emphasized that Bitcoin ETFs aren’t the sole influential factor. These ETFs offer large institutions an effortless means to acquire Bitcoin exposure, but they’ve also lent a sense of legitimacy. Notably, some major companies are directly purchasing Bitcoin, thus bypassing the need for ETFs.

According to the report, there was an increase in corporate holdings of Bitcoin, with MicroStrategy significantly expanding its own from 189,000 to 402,000 units, making it the largest corporate owner of Bitcoin. Other companies, such as Marathon Digital, also increased their ownership, which seems to be part of a wider trend among corporations viewing Bitcoin as a strategic reserve asset. This trend is believed to have strengthened institutional demand for Bitcoin.

Notably, both MicroStrategy and Marathon have been active in Bitcoin investments as well. This week alone, they collectively invested $2.2 billion in purchasing Bitcoin, with MicroStrategy spending $1.5 billion and Marathon investing $700 million. The report suggests that these substantial purchases have boosted the liquidity, stability, and reputation of Bitcoin. Consequently, platforms such as exchanges and other related businesses within the industry have significantly benefited from this trend.

As a crypto investor looking back at 2024, I find it intriguing to see where Bitcoin gained traction among institutions. However, what stands out is that the technical capabilities of this asset have largely been overlooked in discussions about its success. The report suggests that the Runes protocol played a role in sparking interest across various sectors, but its impact on the overall market seems minimal.

According to CryptoQuant, Rune tokens almost hit a whopping $1 billion in total value this year. Yet, experts in the field have voiced concerns that the introduction of ETFs could lead to a trend of “decentralization reversal,” potentially turning Bitcoin into an asset mainly used for speculation.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-05 11:40