Based on an in-depth study by CryptoQuant, it seems that the crypto market is nearing the last phase of its ongoing bullish trend.

In the current cycle that started in January 2023, experts predict it will reach its peak between April 2024 and June 2025. They’ve pointed out certain signs showing this market is maturing, so they recommend investors to exercise caution as things unfold.

Indicators of Market Maturity

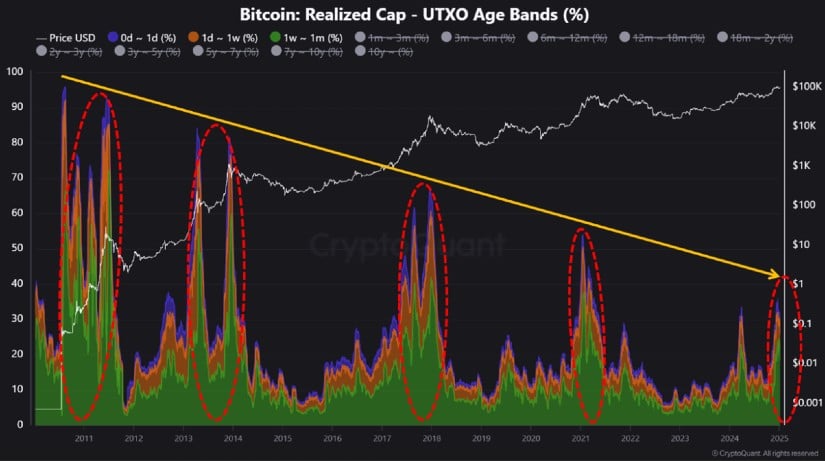

In simple terms, during Q4 2024, CryptoQuant analyst “Crypto Dan” pointed out that around 36% of Bitcoin‘s total value was made up of coins traded within the past month. Although this percentage is lower than what has been seen in previous bull market cycles, it indicates we might be approaching a crucial stage. Financial experts believe this figure could potentially surge even more before the cycle ends, which is usually a warning sign of an overheating market that often precedes a downturn or bear market.

According to Crypto Dan’s recent report (dated January 6th), the overall direction seems to be declining over the long term, hinting that the market might hit its highest point during either Q1 or Q2 of 2025.

Divergent Predictions

While some market analysts like Steno Research and VanEck are expressing optimism about cryptocurrencies, with forecasts of record-breaking highs for Bitcoin (BTC) and Ethereum (ETH) in 2025 and beyond, CryptoQuant’s perspective remains more reserved.

According to VanEck’s December blog post, it is predicted that Bitcoin could reach unprecedented highs at its peak, primarily due to increased investor faith and possible improvements in regulations.

Federal Reserve and Liquidity Concerns

Some analysts are cautious about possible obstacles. Markus Thielen from 10x Research highlighted the Federal Reserve’s monetary policies as a significant factor driving Bitcoin’s progression. An upcoming FOMC meeting might bring volatility, which could potentially weaken the optimistic trend.

According to John Glover, Chief Investment Officer at Ledn, Bitcoin may experience a temporary drop to approximately $89,000 in the near future, after which it is expected to regain strength and rise above $125,000 by the end of the quarter. The price levels around $105,000 could potentially create obstacles for Bitcoin’s continued upward movement due to reduced liquidity and resistance.

Risk Management Urged

At present, Bitcoin is close to $99,000, and analysts emphasize the necessity of careful risk management. The market’s technical signs are presenting a mixed picture. Although the Directional Movement Index (+DI) suggests a slight upward trend, the Average Directional Index (ADX) remains relatively low, indicating that more powerful momentum is needed to surpass resistance points.

According to a report from CryptoQuant, it’s recommended that investors start thinking about slowly selling their investments as the market approaches its peak cycle. It’s important to be aware and careful, especially with larger holdings, because the latter stages of the cycle can involve increased risk, as pointed out by Crypto Dan.

Outlook for 2025

2025 could be a critical year for the cryptocurrency industry, with it being potentially decisive in terms of success or failure. Factors such as groundbreaking crypto ETFs and perhaps even the creation of a U.S. Bitcoin strategic reserve are likely to have a significant impact on the sector’s trajectory over the next few years.

Even though this current market surge might offer significant profits, it’s crucial for investors to exercise caution. The blend of positive predictions and warning signs highlights the importance of adopting a balanced strategy as the market reaches maturity.

It’s exciting to speculate about potential Bitcoin price increases in the year 2025, but remember to maintain a realistic perspective, and never risk more money than you are prepared to potentially lose. This advice remains relevant regardless of the time.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DEXE/USD

- ALEO/USD

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Discover the Exciting World of ‘To Be Hero X’ – Episode 1 Release Date and Watching Guide!

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- Who Is Sentry? Exploring Character Amid Speculation Over Lewis Pullman’s Role In Thunderbolts

- ‘He Knows He’s Got May…’: Gwyneth Paltrow Reveals Husband Brad Falchuk’s Reaction To Her Viral On-Set Kiss With Timothee Chalamet

- Drake Announces Collab Album With OVO Labelmate PartyNextDoor; Teases Fall Release

2025-01-08 20:06