Oh, do cast your gaze upon the crypto market, which continued its recent bloodbath on Wednesday, November 12, as if it were a jaded stockbroker who’d just lost his third pair of trousers. Bitcoin (BTC), that perennial rascal, led the wider altcoin market in heightened selling pressure, much like a mischievous poodle leading a stampede of confused chickens. 🐾💥

The total crypto market cap dropped by 2% to hover around $3.42 trillion at press time, a figure so modest it could fit in a teacup. BTC price slipped below $102k again after the bullish momentum failed to gain traction, much like a man in a bowler hat trying to outrun a charging rhino. 🐃🎩

Main Reasons Why Crypto Dropped Today

Low market demand amid notable fear of further crypto capitulation

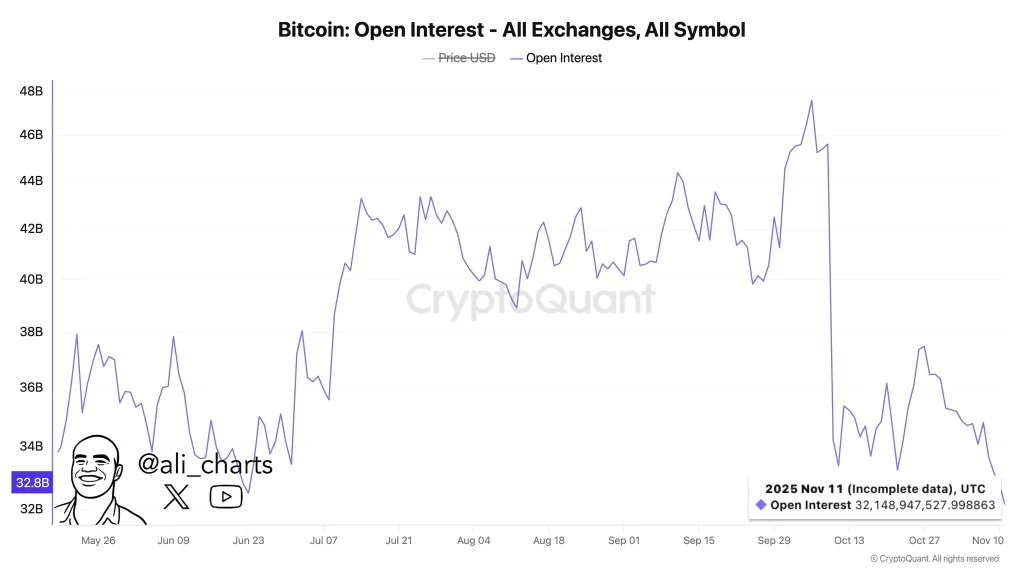

The overall capital inflow to the crypto market has significantly declined in the recent past, as shown by the spot Bitcoin and Ethereum ETFs. Notably, Bitcoin’s Open Interest (OI) across all crypto exchanges has dropped to a seven-month low, a figure so desolate it could make a ghost weep. 😢

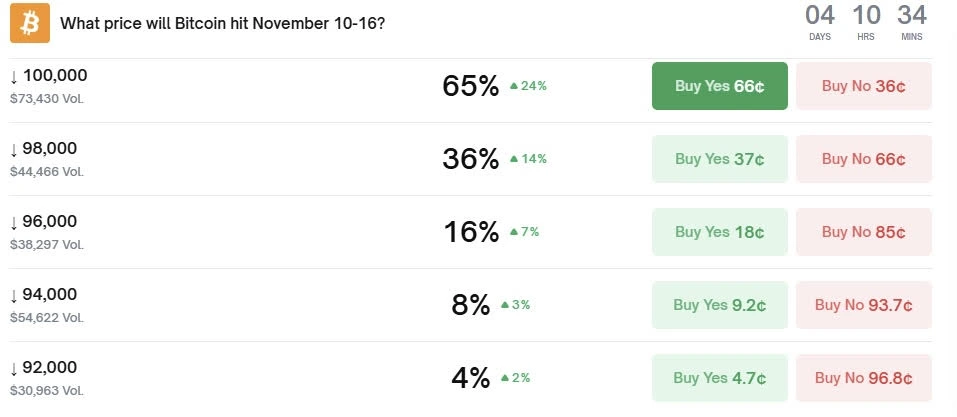

Meanwhile, Polymarket traders have been betting that the Bitcoin price will continue to drop further in the coming days, potentially below $100k. It’s a game of Russian roulette with a side of existential dread. 🎲💣

Heavy liquidation of long crypto traders amid fears of Hyperliquid attack

Following the wider crypto correction, more than $612 million was rekt from leveraged traders, with around $502 million involving long traders. The crypto market was also gripped with fear of a potential attack on Hyperliquid, the largest DEX futures platform. It’s as if the market’s collective sanity was being auctioned off to the highest bidder. 🏛️💸

It appears that Hyperliquid bridge has stopped processing withdrawals. No activity in 21 minutes

– Conor (@jconorgrogan) November 12, 2025

Technical headwinds amid sell-the-news impact due to the reopening of the U.S. government

Bitcoin price has led the wider altcoin market in bearish sentiment as gold investors enjoy more gains. As the wider crypto market recorded bearish sentiment in the past 24 hours, the Gold price surged 2% to trade at about $4,200 per ounce at press time. A tale of two markets: one weeping into its champagne flute, the other sipping it with a smirk. 🥂📉

The technical headwinds in the wider crypto market coincided with the reopening of the U.S. government after 40 days of shutdown. Although the re-opening of the U.S. government is positive for the economy, the crypto market experienced a potential sell-the-news impact. One might say it’s the financial equivalent of a man walking into a bar and immediately regretting it. 🍻🚪

Is the Bull Market Over?

The crypto bull market 2025 is likely to resume in the coming weeks fueled by the Fed’s money printing. Furthermore, Gold price has likely topped out and has been forming a macro double top, which is bullish for the wider crypto bull market. All hail the alchemy of inflation! 🪙✨

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR Fate/stay night — best team comps and bond synergies

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-11-12 23:19