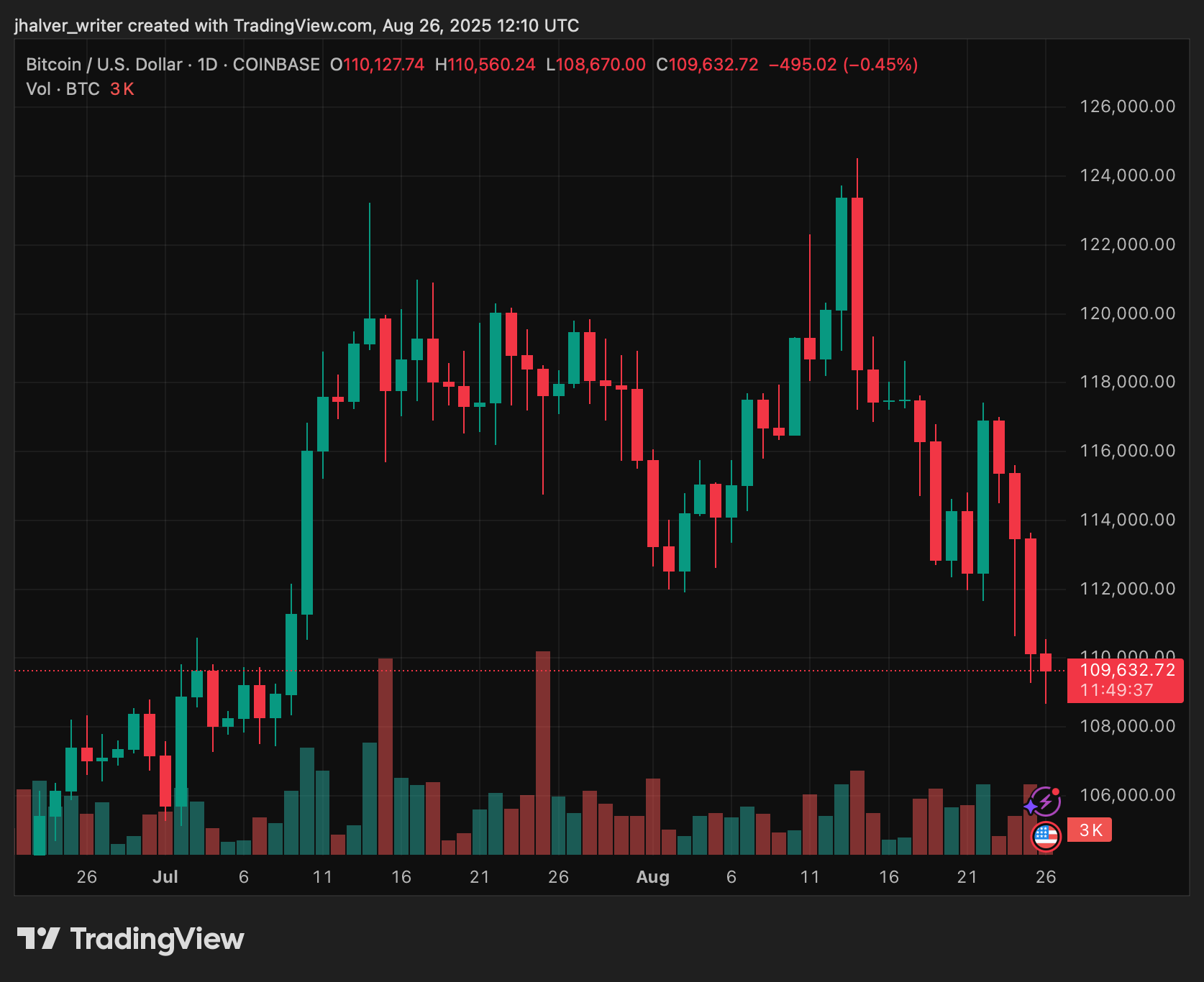

Ah, the crypto market! A realm where fortunes vanish faster than a poorly chosen joke at a royal gala. In the past 24 hours, a staggering $808 million has been liquidated, and Bitcoin (BTC) has dipped below the $110,000 threshold-proof that even the most bullish of investors can find themselves caught in the rain without an umbrella. One must wonder: is this chaos a prelude to a grand opera of opportunity or merely the overture to a tragicomedy of errors?

The gains from Federal Reserve Chair Jerome Powell’s “dovish” Jackson Hole remarks have evaporated like a mirage in a desert of speculation. Investors now ponder whether this dip is a velvet-roped invitation to the ball or a trapdoor leading to the abyss. Truly, the market is a masquerade where no one knows who’s dancing-or who’s fleeing.

Bitcoin’s Flash Crash: A Drama Fit for a Whale 🐳🎭

Data from CoinGlass reveals that long positions-those paragons of optimism-accounted for $696 million of the $112 million liquidated. Overleveraged traders, it seems, have been caught in the crossfire of their own hubris. Bitcoin alone saw $272 million vanish, while Ethereum (ETH) followed suit with $262 million. Solana, XRP, and Dogecoin, those digital peacocks, lost their feathers in droves, dragging the global market cap down by $200 billion. A performance worthy of Shakespeare, if one counts bankruptcy as a tragic ending.

The crash was exacerbated by a whale unloading 24,000 BTC ($2.7 billion), a move so dramatic it could rival the plot of a Netflix series. Over 200,000 traders were liquidated, with the largest single loss-a $39 million BTC trade on HTX-serving as a reminder that in crypto, even the wealthy can misstep.

Whales: The Market’s Secret Gardeners 🌱🐋

Whales: The Market’s Secret Gardeners 🌱🐋

Yet, amid the carnage, whales have been quietly scooping up BTC and ETH like connoisseurs at a wine tasting. One whale acquired 455 BTC ($50M), while another spent nearly $100M USDC to build a portfolio. BitMine Immersion, a titan of Ethereum, added 5,000 ETH to its reserves-clearly, they’re not here to play the victim. Perhaps they see the crash as a sale, though one wonders if their wallets are made of gold or merely optimism.

This “buy the dip” strategy suggests that whales, those aristocrats of the blockchain, view the turmoil as a chance to plant seeds for future glory. Analysts, ever the optimists, argue this is a “healthy reset”-a phrase that sounds suspiciously like a way to justify their own poor life choices.

The Road Ahead: A Tale of Two Thresholds 🚧📉

Bitcoin now teeters near $110,000, with the $105,000 support level looming like a judge at a beauty pageant. Should it fall, the market may descend into the $92,000-$100,000 range, where only the most resilient investors will survive. September, historically a month of crypto despair, adds further intrigue-will it be a season of gloom or a plot twist?

Yet, record-high futures open interest and institutional flows into ETH hint that hope persists. Whether this is a prelude to a deeper correction or a mere intermission before the next act, one truth remains: whales are betting on a rebound. After all, what is crypto if not a grand masquerade where everyone wears a different mask each day?

Cover image from ChatGPT, BTCUSD chart from Tradingview

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-08-27 00:34