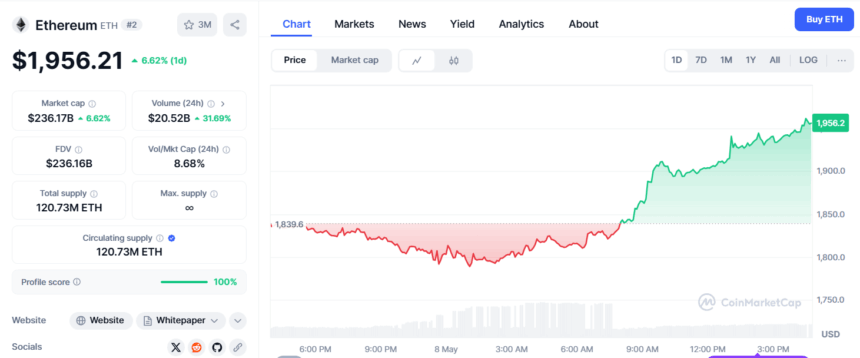

If you’ve ever wanted a case study in how the rich get richer, step softly into the world of Ethereum this week. The market’s been as bullish as a marching band after a Red Bull binge, with whales and their financially overfed friends swarming around ETH like it’s a buffet on a cruise ship. Ethereum’s price has giddily leapt 6.5% to $1,955 in the last day—possibly because someone somewhere threatened it with a bear market, and ETH replied by borrowing your credit card and sprinting to the mall. 🕺🛍️

In an 11-hour adrenaline rush (which I can only assume was fueled by snack cakes and existential dread), Abraxas Capital Management waltzed into Binance and Kraken and helped themselves to 41,269 ETH. That’s $75.46 million tossed into their wallet, give or take a million because, honestly, when you’re tossing around numbers this big, who’s counting? Oh right, the on-chain analytics folks at Lookonchain, who have made it their civic duty to name and shame every large transaction, like tattletales with calculators.

Apparently, this wasn’t even their first trip at the ATM. They made off with another $60 million a few hours prior, totalling over 74,000 ETH in a day. For normal people, “accumulating” just means eating too many carbs. For Abraxas Capital, it means stacking enough ETH to fund a small nation—or perhaps one influencer’s NFT habit.

Abraxas Capital continues to accumulate $ETH, withdrawing 41,269 $ETH ($75.46M) from #Binance and #Kraken in the past 11 hours.

— Lookonchain (@lookonchain) May 8, 2025

Abraxas styles itself as a band of stoic finance monks, having “managed the Elysium Global Arbitrage Fund since 2018.” I picture them in tailored suits and really expensive sweatpants, applying “disciplined, traditional finance strategies” to the crypto world—because if you can’t beat Wall Street, become it, but add a hoodie and fewer vowels.

ETH is trading near $1,956 at this very moment, just taunting anyone who didn’t invest in January, when it was, awkwardly, 47% higher. Still, if multi-million-dollar whale-watching is your hobby, the tides are shifting. The market mood had been about as grim as a salad at a Texas barbecue, but all this hyperactive accumulation has the air of a comeback montage in a bad sports movie.

What’s changed? Well, the Pectra upgrade came online on May 7, ushering in fundamental shifts, or at least giving community managers something bold to tweet about. Recent weeks saw ETH dipping below $1,800—blame trade tariffs or President Trump’s latest impersonation of a market meteorologist, promising storms and delivering hurricanes. The whales took one look at that dip and thought, “I’ll take your entire stock!”. Over 130,000 ETH hoovered up in April alone, which gives one hope—if you are the kind of person who finds hope in the avocado-toast-sized scale of rich people’s bank accounts. 🥑🐋

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-05-08 15:02