Oh, the Ethereum Foundation-those lovable nerds with more ETH than sense-decided to unload another stack of digital gold into stablecoins. Because nothing says “financial strategy” like panic-selling before brunch. This time, they dumped 1,000 ETH via CoWSwap’s TWAP feature, which sounds like a noise a depressed robot would make. 🐮💸

“It’s for research and grants!” they chirped, as if we wouldn’t notice they did the exact same thing last month-except ten times bigger. $43.6 million worth of ETH, gone faster than my motivation to exercise. At this rate, they’ll be funding “research” into how to cry into a crypto wallet.

1/ Today, The Ethereum Foundation will convert 1000 ETH to stablecoins via 🐮 @CoWSwap’s TWAP feature, because apparently, we enjoy watching numbers go down. #DeFiOrDie

– Ethereum Foundation (@ethereumfndn) October 3, 2025

Of course, Twitter’s armchair economists had opinions. “Why sell when you can just borrow against it?” they screeched, as if DeFi lending platforms aren’t just glorified casinos with slightly better math. Others suggested private deals with “big crypto treasuries,” which is just a fancy way of saying, “Let’s ask the guy who still owns a Bored Ape for money.”

The Art of Pretending You Have a Plan

The foundation insists this is all part of their “treasury policy,” a phrase that sounds impressive until you realize it’s just corporate-speak for “we’re winging it.” They want “returns above benchmark” while also being “stewards of DeFi,” which is like saying you’ll eat kale and drink margaritas every day. Spoiler: One of those things is happening more than the other.

Meanwhile, their grant program is on pause because-shocker-too many people want free money. They’re now prioritizing “Ethereum’s most pressing needs,” which, based on gas fees, probably includes therapy.

Earlier this year, they shuffled leadership like a deck of cards at a magic show. New co-directors! Reorganized teams! Layoffs! It’s like a corporate soap opera, but with more blockchain jargon and fewer attractive people.

Ethereum: Still King (But the Crown’s Getting Heavy)

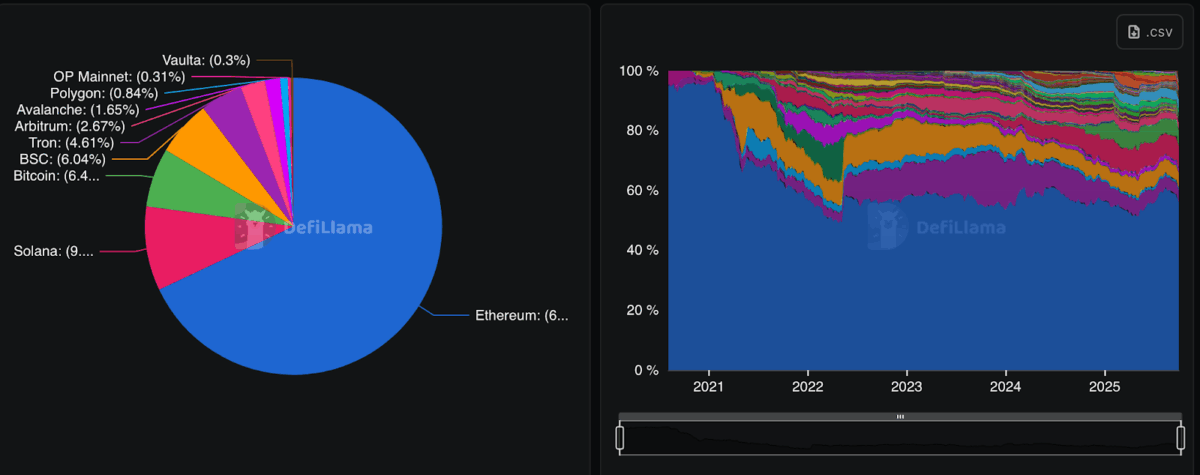

DeFiLlama data confirms Ethereum still dominates, holding 61% of locked funds. Solana trails at 9%, Bitcoin at 6.4% (because, sure, why not), and Binance Smart Chain at 6%, which is basically Ethereum’s weird cousin who shows up uninvited to parties.

Since 2020, Ethereum’s been the top dog, but Solana and Arbitrum are creeping up like that one friend who “just wants to hang out” but definitely wants your Netflix password. The DeFi space is diversifying, which is code for “Ethereum can’t get complacent unless it wants to end up like MySpace.”

So yeah, the foundation’s selling ETH, tightening belts, and pretending they’re not sweating. Ethereum soldiers on, DeFi thrives, and somewhere, a crypto bro is crying into his ledger. Same as it ever was. 🤷♂️

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- USD PHP PREDICTION

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-10-04 10:45