As a seasoned crypto investor with over five years of experience navigating the cryptocurrency market, I have learned to read between the lines and follow the footsteps of the whales. The recent surge in Cardano (ADA) whale accumulation has caught my attention, and it seems that the narrative has taken a bullish turn for ADA.

On November 20th, large investors or ‘whales’ sold a substantial amount of Cardano (ADA), causing a disruption in its upward trend. Yet, the focus has changed today, as it appears that these same Cardano whales are now accumulating the cryptocurrency.

The increased purchasing behavior indicates a potential return of ADA’s bullish trend towards $1, but is there evidence in the data to back up this bullish perspective?

Cardano Key Investors Change Their Stance

As reported by IntoTheBlock, there’s been an increase in Cardano’s large-scale investors offloading or buying 67.51 million ADA, suggesting a substantial change in the sentiment among cryptocurrency’s biggest players. The netflow figure indicates the gap between the amount of ADA that these significant holders have bought and sold over a defined timeframe.

As the volume of netflow grows, it often signals that whales are purchasing more assets than they’re offloading. This usually implies a positive outlook (bullish). On the other hand, a decrease in netflow may indicate increased selling by whales, which is often interpreted as a negative sign (bearish).

The $55 million rise in netflow corresponds to an 11% price hike of Cardano (ADA) within the last 24 hours. This accumulation by Cardano whales implies that ADA could experience further growth, with this increase potentially serving as a base for future value escalation.

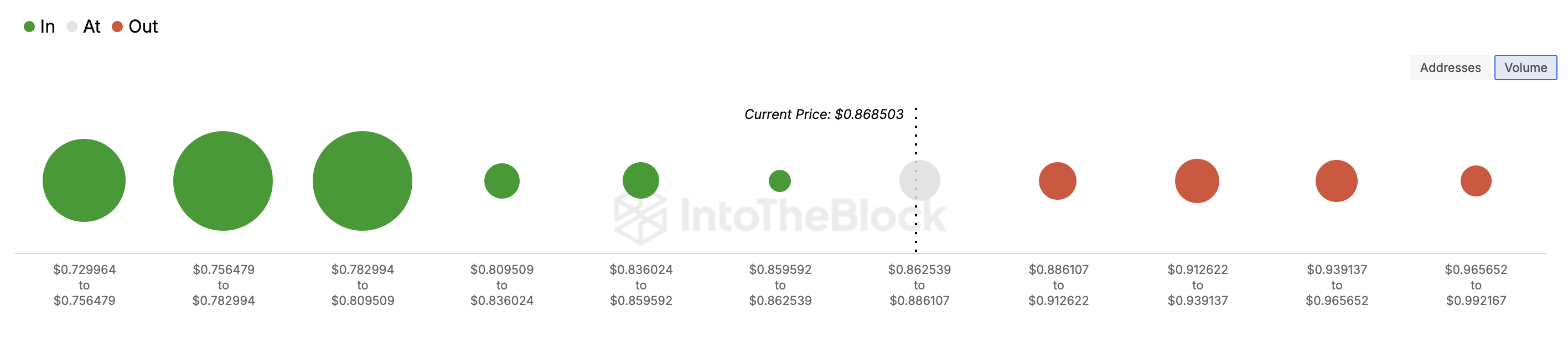

Additionally, the In/Out of Money Around Price (IOMAP) tool offers additional backing for this optimistic perspective. Basically, IOMAP categorizes token groups into three sections: investors who bought below the present price (in-the-money), those who bought above the current price (out-of-the-money), and those who broke even at the purchase.

This measurement plays a crucial role in pinpointing possible support and resistance levels. In simpler terms, when more tokens are “profitable,” this indicates strong support because numerous investors are making money, which may lead them to hold onto their investments rather than selling, possibly causing the price to increase.

In contrast, a larger number of “out-of-the-money” trades suggests resistance, as traders may choose to sell in order to recoup their losses. This selling activity can create downward pressure on the price.

At the moment, ADA’s IOMAP indicates that there is more significant backing for higher prices, with potential support areas being more dominant than resistance points, which suggests a possible continued increase in ADA’s price.

ADA Price Prediction: Move Toward $1 Almost Valid

On a daily scale, Cardano’s price has surpassed its significant Exponential Moving Averages (EMAs). More specifically, the 20-day EMA (represented by blue) and the 50 EMA (denoted by yellow) are now below Cardano’s current price. When the price is higher than these indicators, it suggests a bullish trend.

In contrast, when the cost falls beneath the indicator, the trend indicates a bearish outlook. Consequently, given the present trajectory, it seems possible that Cardano (ADA) could surpass its current price of $0.87 and potentially reach towards the $1 level.

If large-scale Cardano investors opt for selling and cashing out their gains, the projected price increase might fail to materialize. Conversely, the value could dip down to $0.68 instead.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2024-11-22 15:08