As a seasoned researcher who has navigated through various market cycles and witnessed the ups and downs of the crypto sector, I find Robert Le’s outlook for 2025 to be both encouraging and insightful. His analysis is grounded in a deep understanding of market dynamics, regulatory trends, and the evolving role of generalist investors and institutions.

The resurgence of investor confidence, as signaled by Le’s prediction, is a testament to the sector’s inherent potential and its ability to bounce back from setbacks. The focus on applications and real-world use cases, reminiscent of Amazon Web Services’ transformative impact, could indeed be the catalyst for unlocking the full potential of the crypto industry.

However, I must admit that I find it amusing how the crypto world seems to mirror the rollercoaster ride of a tech startup, with periods of meteoric growth followed by inevitable corrections and subsequent rebirths. It’s almost as if we’re all riding on Silicon Valley’s wildest rollercoaster, minus the popcorn!

In any case, I look forward to 2025 with a mix of anticipation and cautious optimism. After all, in the world of crypto, the only constant seems to be change!

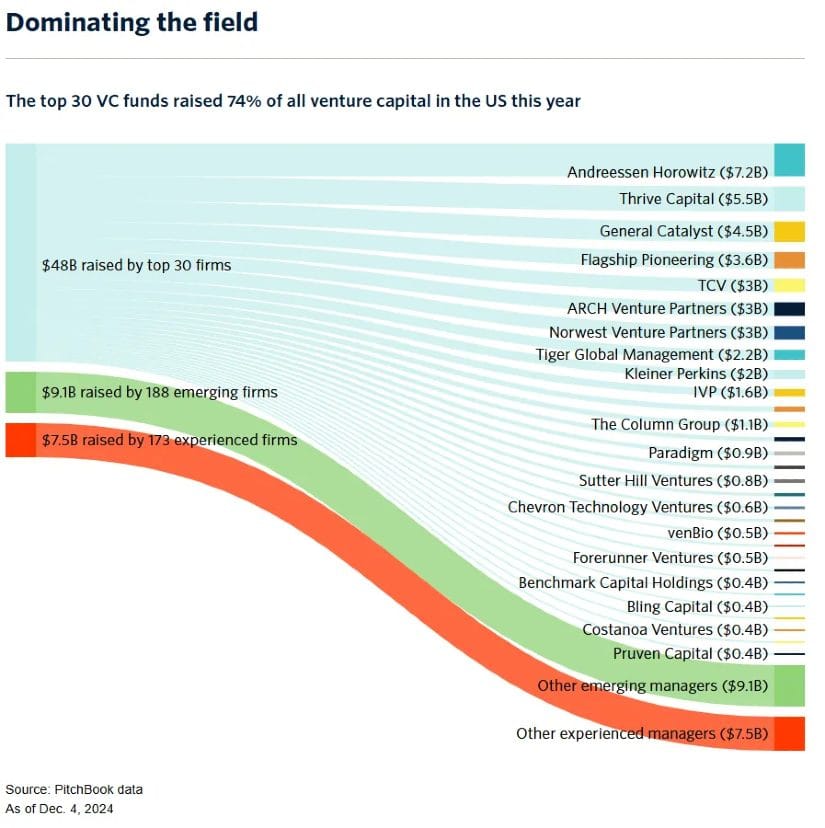

As a PitchBook analyst, I anticipate our sector to draw in more than $18 billion in venture capital funding next year, marking a significant 50% surge from the investment volume in 2024.

A Promising Outlook for 2025

In a conversation with CNBC, Le showed enthusiasm about the revival of investor trust in the cryptocurrency market. He predicted that over $18 billion would be poured into crypto through venture capital investments, highlighting the growing attention from both traditional investors and funds specialized in crypto.

Although the anticipated amount suggests a significant enhancement compared to the expected investment of around $11-$12 billion in 2024, it is still lower than the record-breaking figures seen in 2021 and 2022, where investments reached an annual high of $30 billion.

The Road to Recovery: 2023 and 2024 Recap

2023 saw the crypto venture capital sector experience significant challenges. A series of issues within the industry and intensifying regulatory oversight took their toll, with events like the demise of FTX being particularly notable. To make matters worse, rising interest rates further undermined investor trust, leading to a steep decline in funding.

2024 witnessed a recovery driven by achievements such as the approval of Bitcoin ETFs. Although it experienced a slowdown in the middle of the year, Le still noted that funding in 2024 showed a modest uptick, with investments increasing by between 10% and 20% compared to 2023.

Key Drivers Behind the Surge

Le attributed the anticipated growth in 2025 to several factors:

- Generalist Investors Return: Broader market participants are re-entering the crypto space, paving the way for larger-scale investments.

- Dry Powder in Crypto Funds: Crypto-native funds have substantial capital reserves but require participation from generalist investors to unlock growth potential.

- Institutional Influence: Established financial institutions are expected to leverage their regulatory expertise and networks, playing a critical role in shaping the ecosystem.

Shifting Focus to Applications

In the maturing market, Le anticipates a shift in strategy towards pouring resources into application-centric investments rather than just infrastructure projects. This includes developing user-friendly decentralized applications (dApps) and exploring novel ways to apply crypto technology in areas such as transportation and energy data.

He compared this transformation to the development of Amazon Web Services (AWS), which serves as the base for companies such as Uber and Airbnb. His viewpoint was that strong applications, constructed using cryptographic infrastructure, are crucial in fully unleashing the industry’s potential.

The Role of Regulation in 2025

Clear regulations are considered essential for promoting growth. Larry, in his recent remarks, showed a measured sense of hope regarding the regulatory landscape under the forthcoming Trump administration. He hinted that a new head at the Securities and Exchange Commission (SEC) might result in less frequent enforcement actions.

He additionally emphasized the possibility of advancements in legislation, like stablecoin bills or regulations tailored to cryptocurrency. Remarkably, the lack of fresh regulatory actions could potentially benefit the sector as well. As Le put it, “If policymakers and regulators choose not to act, that’s still progress.

Involvement from institutions, an emphasis on practical uses, and a stable regulatory framework might make 2025 a pivotal year for the cryptocurrency industry. As Le puts it, these factors combined create an ideal scenario for substantial progress, suggesting a bright outlook for crypto investment ventures in the future.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-03 18:00