Bitcoin Treasuries’ November report is out, and let me translate: corporations are hoarding crypto like it’s 2021 and their CFOs just discovered TikTok 📊💸. Bitcoin? Ethereum? Solana? XRP? Sure, throw ’em all in the corporate sock drawer. Who needs diversification when you’ve got vibes?

DAT Tickers Look Tired, But “Disciplined” Strategy = Just Don’t Panic-Sell Yet

Bitcoin Treasuries says companies are treating crypto like a buffet-grab a little BTC, a sprinkle of ETH, and gasp even XRP. Why? Because nothing says “long-term strategy” like buying the dip while your stock price does a swan dive 📉🦆. Bonus points if you can say “unrealized losses” without crying.

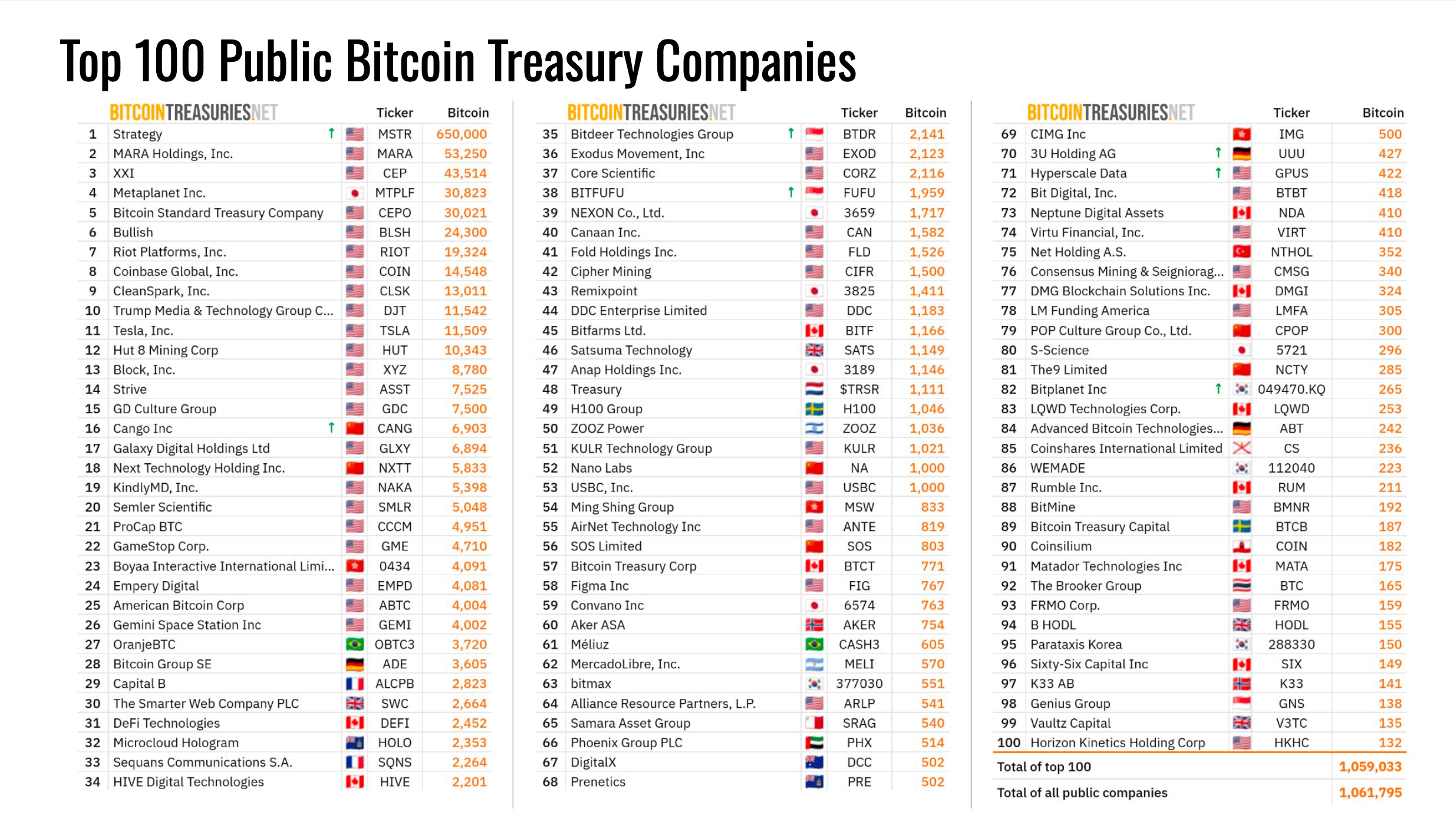

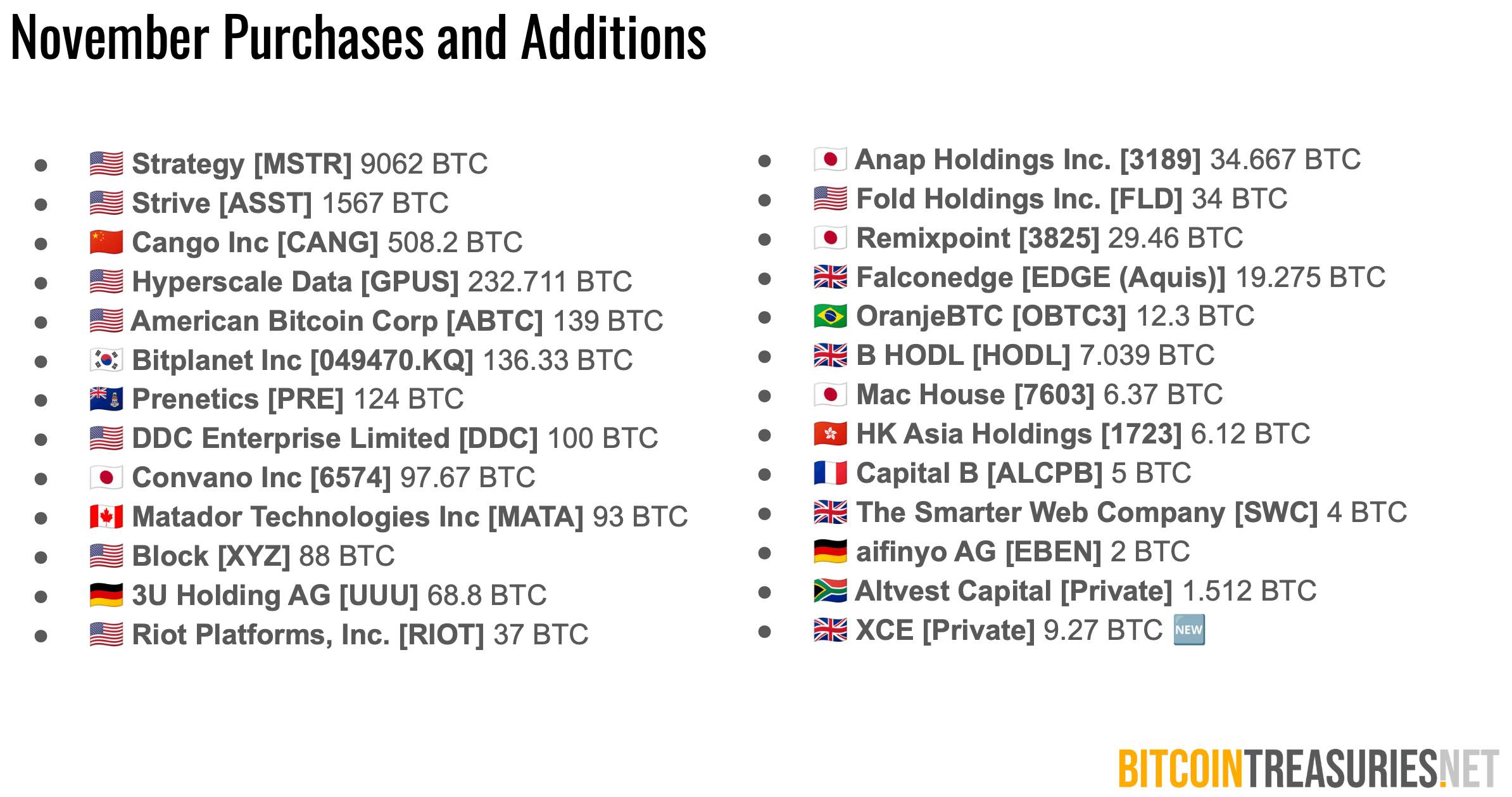

Bitcoin remains the prom queen of corporate crypto, with 10,761 BTC added in November. Total stash? 4 million BTC, worth roughly “enough to buy a small island nation 🏝️.” Fun fact: 65% of companies are underwater on their BTC buys. Congrats, you’ve got a $363B crypto tanning bed!

Speaking of Scrooge, Strategy added 9,062 BTC. Their balance sheet? 649,870 BTC. Meanwhile, Asia and Europe are like, “We’ll take that baton 🏃♂️” with non-U.S. BTC holdings hitting 100,000. Because nothing says “globalization” like everyone buying the same volatile asset!

But wait! Bitcoin dipped under $90K, leaving 65% of buyers with “unrealized losses.” Translation: Boards are now having fun meetings. “Should we HODL or just throw confetti at the stock price?” 🎉 Only 50 firms saw gains. The rest? Just here to vibe.

Ethereum’s treasuries grew to 6.36M ETH (~$20B), but $4.5B in losses? Smooth move, ETH fans 🎮🔥. Solana’s 20M SOL stash ($2.9B) is mostly held by Forward Industries, who’s like, “I’m not obsessed, it’s just… a lot of SOL.” Even XRP’s getting a seat at the table, thanks to Evernorth’s 473M XRP (~$1B). Next up: Dogecoin? 🐕🚀

Regulators are side-eyeing 39 companies (looking at you, Strategy & Metaplanet) for crypto overexposure. MSCI might delist them, causing “billions in mechanical outflows.” Sounds like a rom-com titled When Indices Attack 🎬💔.

Bottom line: DATs are “maturing,” which in crypto terms means “we’re tired but still buying.” Multi-chain strategies, global expansion, and mining firms integrating crypto? Sure, let’s call it “innovation.” I call it The Great Digital Asset Garage Sale 🕵️♂️🛍️.

FAQ ❓

- What’s a DAT?

A company that treats crypto like a diversified treasury strategy. Or a midlife crisis. We’re still deciding 🤔. - Which assets grew? BTC, ETH, SOL, and XRP. Because why not? Diversify that FOMO!

- Are DATs global yet?

Yep! Japan, China, Europe, and Hong Kong are all playing. It’s the crypto Olympics 🏅. - How much BTC is out there?

4 million. Worth $363B. Still cheaper than Elon’s Twitter purchase 💸.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-12-11 18:58