As a seasoned analyst with over two decades of experience in finance and technology, I find myself both intrigued and cautiously optimistic about the recent surge in crypto trade volume. Having witnessed numerous market cycles and regulatory shifts, I must admit that the potential for growth in this space is undeniably exciting.

As a researcher delving into the dynamic world of cryptocurrencies, I’ve come across an intriguing piece of data: according to CCData’s latest report, the total trade volume in our industry peaked at an unprecedented $10 trillion in November. The potential regulatory friendliness hinted by former President Donald Trump seems to have played a significant role in fueling this remarkable growth spurt.

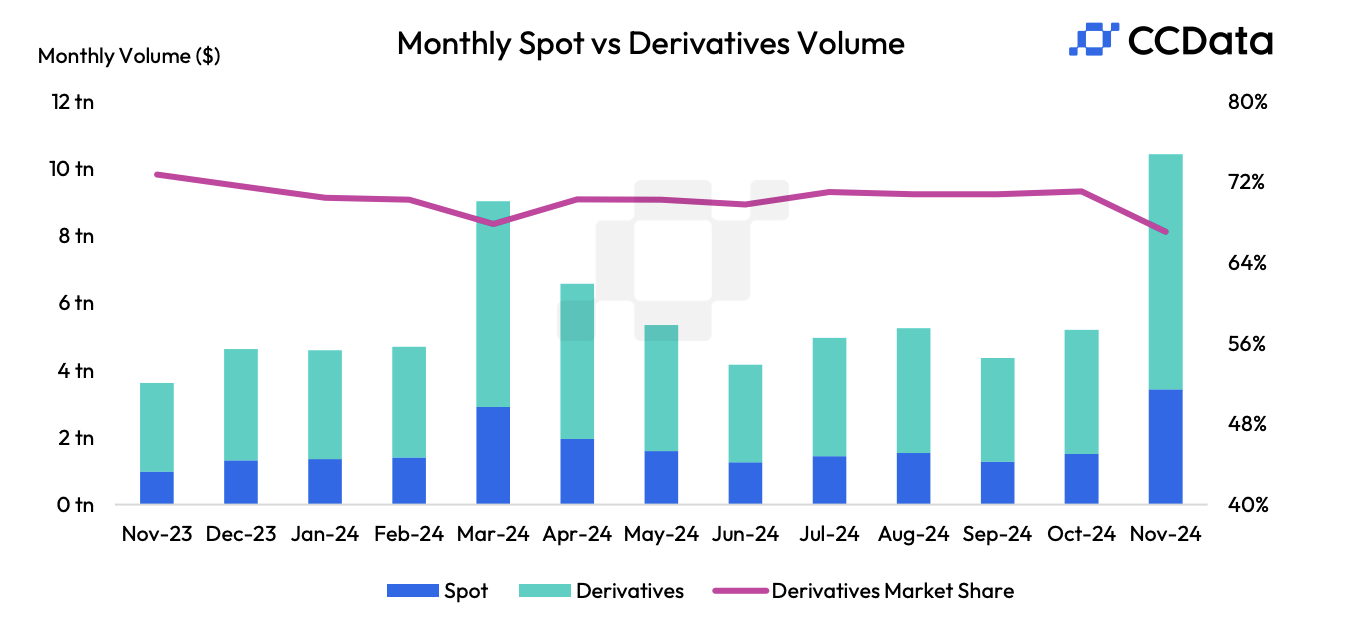

Trading derivatives significantly contributed to this rise, accounting for the largest proportion of transactions on centralized platforms.

CCData Exchange Report

The study examined trade figures from centralized platforms and uncovered some intriguing patterns in their development. Notably, Donald Trump’s election victory significantly influenced the industry as it anticipated a more favorable regulatory landscape. Jacob Joseph, an experienced research analyst at CCData, discussed this trend with Bloomberg.

As a crypto investor, I’ve noticed a growing enthusiasm for digital assets like Ripple, an asset that historically has faced intense regulatory scrutiny. This optimism isn’t just among individual investors; it’s also prevalent on the institutional side, as CME volumes have witnessed a substantial surge and there’s been a notable increase in spot Bitcoin ETF investments over the past month, as Joseph mentioned.

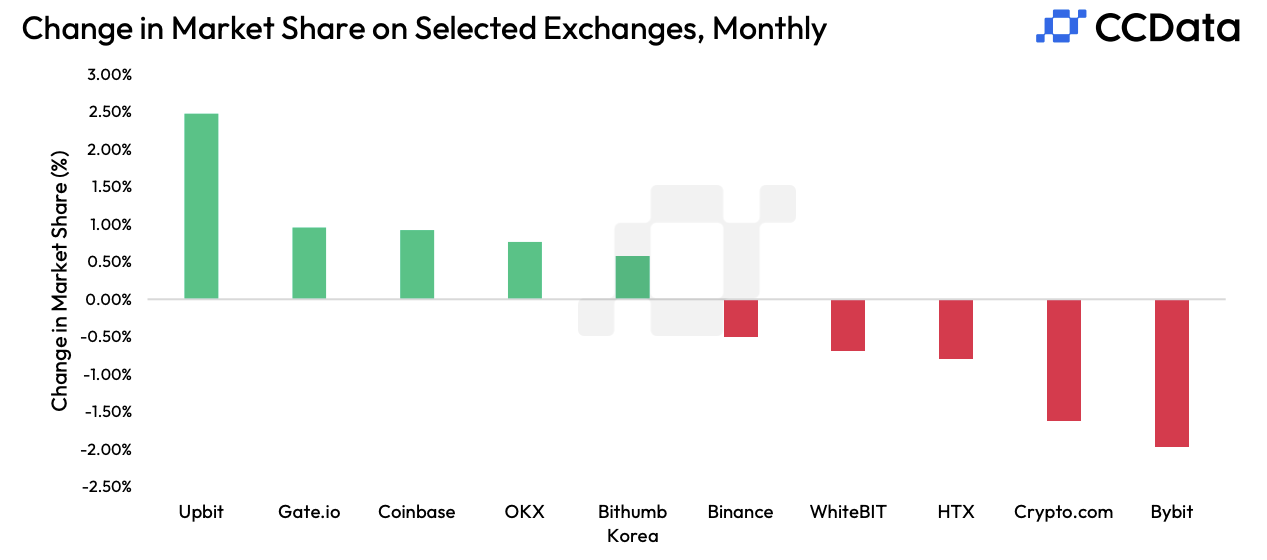

Nevertheless, it’s important to note that the expansion wasn’t limited to U.S. businesses alone; instead, CCData asserted that the swiftest-growing exchange was actually Upbit in South Korea. Remarkably, this exchange experienced a 358% increase in monthly spot trading. Incredibly, these growth figures were achieved even amidst allegations by South Korean regulators that Upbit had violated KYC regulations approximately 600,000 times.

The surge in crypto options trading significantly boosted these total returns as well. According to CCData, the volume of options on the Chicago Mercantile Exchange (CME) reached a record peak, with approximately $5.54 billion in Bitcoin options traded exclusively.

That represents a 152% rise, and other assets showed similar growth. Derivatives trades, in fact, represented the majority of overall volume.

In November, the OCC authorized Bitcoin ETFs for options trading, which could stimulate further options trading activity. It’s important to note that CCData’s data only encompasses direct cryptocurrency traffic flowing through centralized exchanges; therefore, trading volumes associated with ETFs are not included in their statistics. Nevertheless, the trading of these options led to substantial volumes, as BlackRock reported over $425 million in trades on its initial day.

In summary, the overall trading volume of both spot and derivative transactions on centralized platforms significantly increased by over 100% from October to November, reaching an astounding $10.4 trillion according to CCData’s estimation. This monumental achievement underscores the colossal bull market in the cryptocurrency sector.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-12-05 10:34