Ah, the grand spectacle of crypto stocks in the land of the free! Yesterday’s performance was as mixed as a jester’s wardrobe, with Strategy (MSTR) being the sole star to bask in the green glow, while GameStop (GME) and Coinbase (COIN) wallowed in the depths of despair. MSTR, that cunning fox, rose a modest 1.75% after Arkham revealed a treasure trove of over 70,000 hidden Bitcoins, solidifying its reign as the mightiest corporate BTC holder. 🦊💰

Meanwhile, GME, in a fit of folly, plummeted another 5.25% after investors raised their eyebrows at its audacious $500 million Bitcoin escapade, deemed a perilous leap amidst shaky fundamentals. And COIN, oh dear COIN, slid down 2.14% despite its grand announcement of 24/7 XRP and SOL futures, all while the specter of a $400 million data breach loomed large. What a tragicomedy! 🎭

Strategy Incorporated (MSTR)

Behold, Strategy (once known as MicroStrategy) was the only noble crypto stock to close in the green yesterday, rising 1.75% while the rest of the market wallowed in gloom. A mere days ago, Arkham Intelligence unveiled a staggering 70,816 previously unreported Bitcoins held by this firm, boosting its total to a princely 525,047 BTC—worth over $54.5 billion! A true feat, indeed! 💎

This revelation challenges the gallant Executive Chairman Michael Saylor’s public musings on wallet privacy, drawing attention to Strategy’s vast influence over the Bitcoin realm. Just earlier this week, they snatched up an additional 4,020 BTC, bringing their disclosed holdings to a staggering 580,250 BTC. Truly, they are the kings of the Bitcoin castle! 👑

On the technical front, MSTR has held its ground above the sacred support at $362 and now gazes longingly at resistance at $383. Should the winds of momentum favor them, a breakout could lead to a jubilant rally! 🎉

In the pre-market today, MSTR is down a mere 0.13%, a sign of minor consolidation after its recent triumphs. Analysts, those wise sages, remain bullish, with 15 forecasts predicting a 42.4% upside over the next year and a consensus price target of $527. 📈

GameStop Corp (GME)

Ah, GameStop, the jester of the stock market! Its latest foray into Bitcoin has sparked a fresh wave of skepticism among investors, sending shares tumbling like a clumsy clown. The company has confirmed it purchased 4,710 BTC—worth a staggering $500 million—as part of its grand plan to eventually allocate $1.3 billion to the cryptocurrency. 🎪

Despite the move being dressed up as a strategy to enhance liquidity and optimize returns, the market’s reaction has been nothing short of a farce. Analysts are scratching their heads, questioning the wisdom of imitating MicroStrategy’s Bitcoin-heavy approach without a solid core business to support it. 🤔

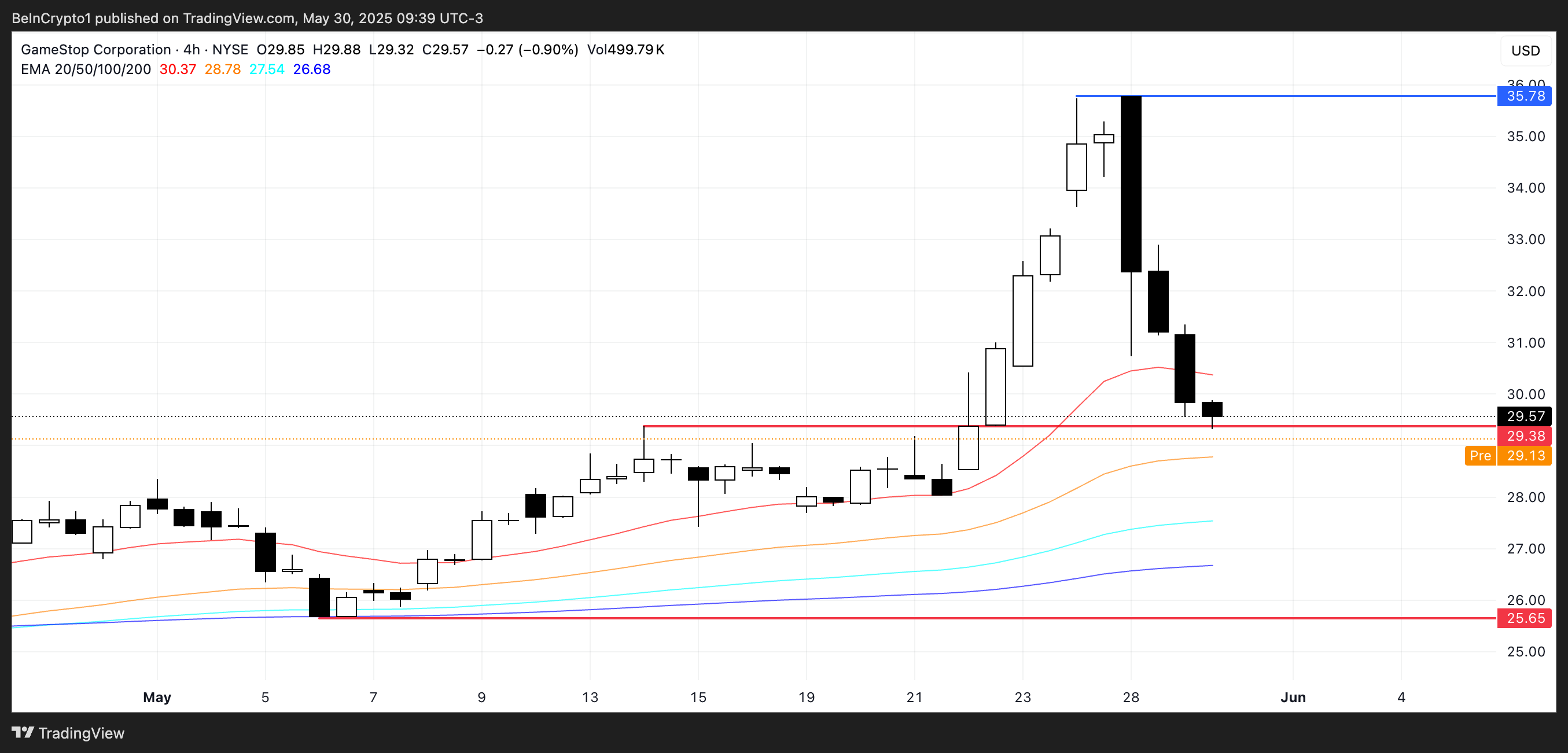

Technically speaking, GME is under pressure, testing the key support at $29.38. Should this level falter, the next target lies near $25.65, suggesting more pain could follow if the bearish winds continue to blow. The stock closed down 5.25% yesterday and is already down another 1.49% in the pre-market. Oh, the tragedy! 😱

Despite the loyalty of retail investors, Wall Street remains unconvinced by GameStop’s strategic shift, especially as sales have plummeted 28% year-over-year, and the once-thriving used-game market has withered away. What a sad tale! 📉

Coinbase Global (COIN)

Coinbase, the ambitious player, has expanded its institutional offerings by enabling 24/7 futures trading for XRP, Solana (SOL), and Cardano (ADA). A bold move indeed, aligning with its grand strategy to compete in both crypto and traditional finance markets! 💪

Previously, around-the-clock trading was a luxury reserved for Bitcoin and Ethereum futures. This marks a significant leap as Coinbase also ventures into commodity and equity index futures, signaling its ambition to become a full-spectrum derivatives platform. But alas, the joy of this announcement has been overshadowed by the dark cloud of a massive $400 million data breach linked to outsourced customer support agents. Oh, the irony! 😅

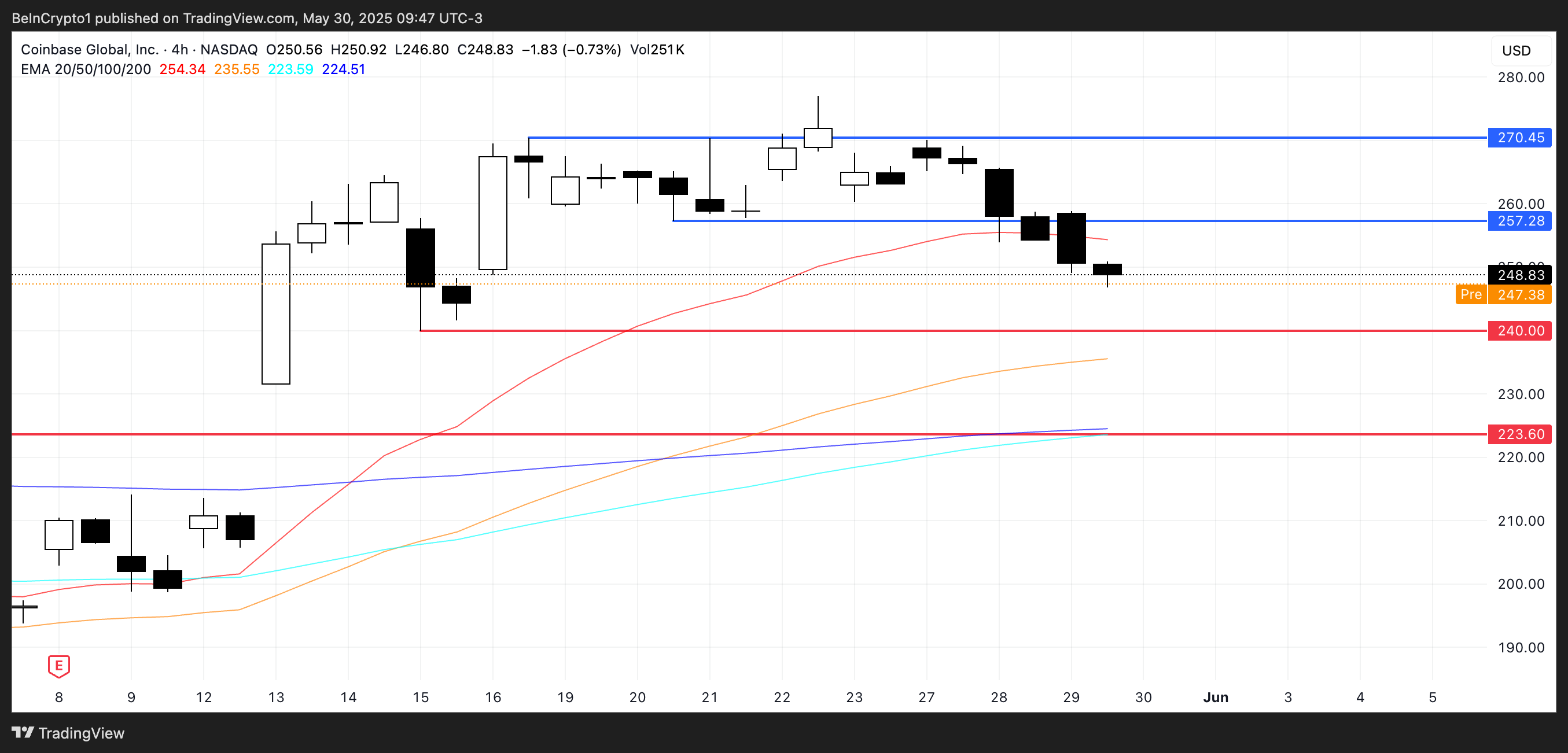

On the technical side, COIN closed down 2.14% yesterday and is currently down another 0.98% in pre-market trading. The stock is nearing critical support at $240; a breakdown below this level could lead to further misfortune toward $223.60. Yet, if the trend reverses, COIN may test resistance at $257, with a potential breakout pushing it to $270.45. A tale of two fates! ⚖️

Despite recent headwinds, sentiment among analysts remains cautiously optimistic: 26 forecasts project an average 8.36% upside over the next year with a target of $269.65. Out of 32 analysts, 13 rate COIN a “Strong Buy,” while 16 recommend holding the stock. A comedy of predictions! 🎭

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- All 6 ‘Final Destination’ Movies in Order

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

2025-05-30 17:56