Ah, the crypto market! A place where dreams are made and fortunes are lost. Today, we find ourselves on Capitol Hill, where the US Senate Banking Committee is set to hold a key hearing on digital asset market structure.

As the industry’s top figures, including Ripple CEO Brad Garlinghouse, prepare to testify, the market has seen a slight rebound. But let us not forget the real stars of the show: the US-listed crypto stocks! Here are three to watch closely today:

BTCS (BTCS)

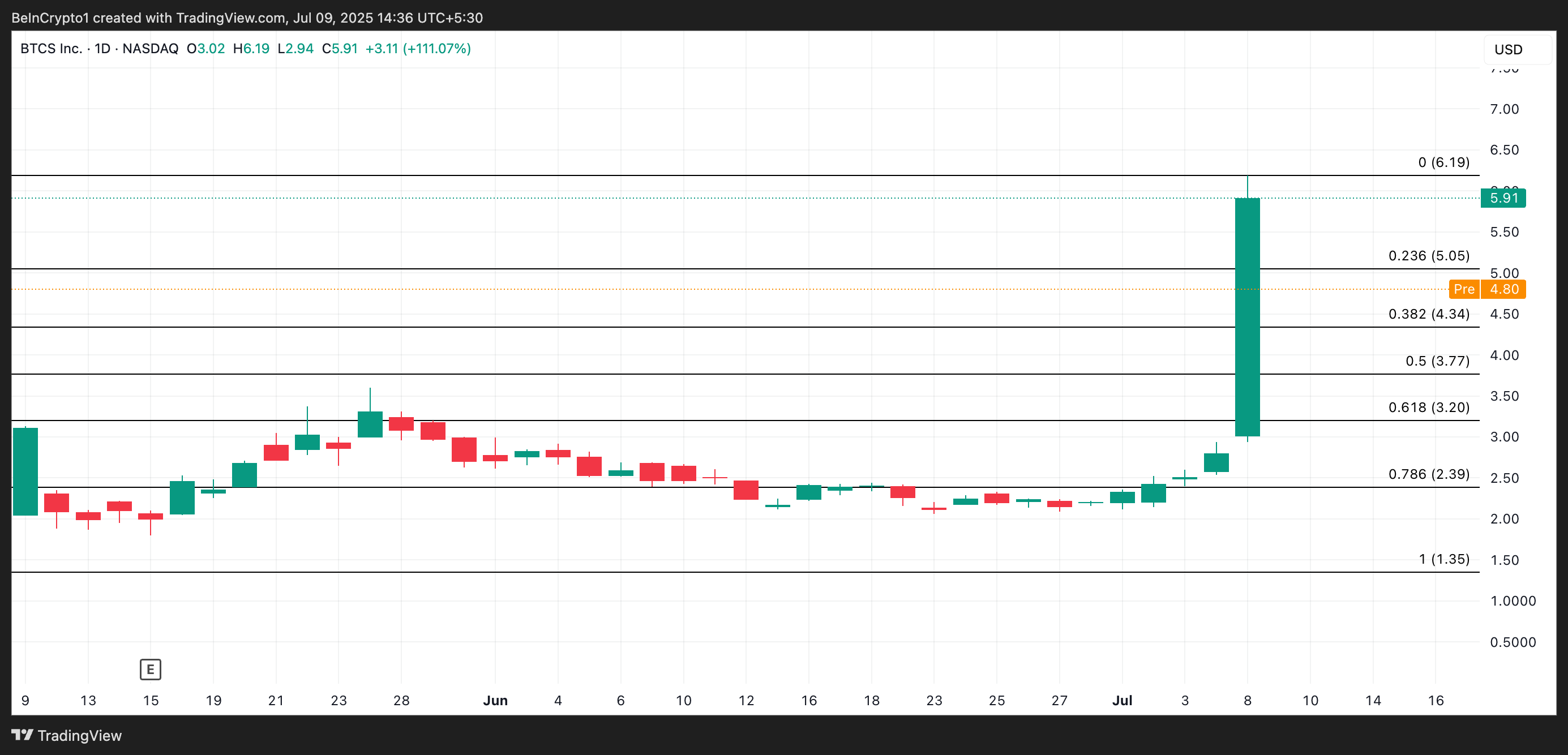

BTCS shares surged 108.93% to close at a three-year high of $5.91 on Tuesday after the company announced a bold initiative to raise $100 million in 2025 to acquire Ethereum. The Maryland-based blockchain infrastructure company said the move reinforces its long-term vision to become the leading publicly traded firm focused on Ethereum.

The company plans to use a hybrid DeFi-TradFi capital formation model—including ATM equity sales, convertible debt, on-chain borrowing via Aave, staking rewards, and block-building through Builder+—to minimize dilution while maximizing ETH accumulation and shareholder value.

The price of BTCS hovers around $4.80 during pre-market trading today. If demand surges at market open, the stock could attempt to rally back above yesterday’s close.

However, if bullish momentum fades, it risks slipping below $4.34 support.

CleanSpark (CLSK)

CLSK climbed 2.38% to close at $11.60 in the latest session, following a bullish operational update released on Monday.

In a July 7 press release, the company announced it reached a major milestone in June 2025—achieving 50 EH/s of operational hashrate, becoming the first Bitcoin miner to do so entirely through fully self-operated infrastructure. This marks a 9.6% month-over-month increase in hashrate and improved fleet efficiency to 16.15 J/Th.

The Bitcoin miner also revealed that it has secured 179 megawatts of additional power under contract, supporting future hashrate growth of over 10 EH/s.

During pre-market trading, CLSK is priced at $11.63. If buying continues when the market opens, the stock could rally toward $12.96.

However, if buy-side pressure fades, it could fall below support at $11.42.

Soluna Holdings (SLNH)

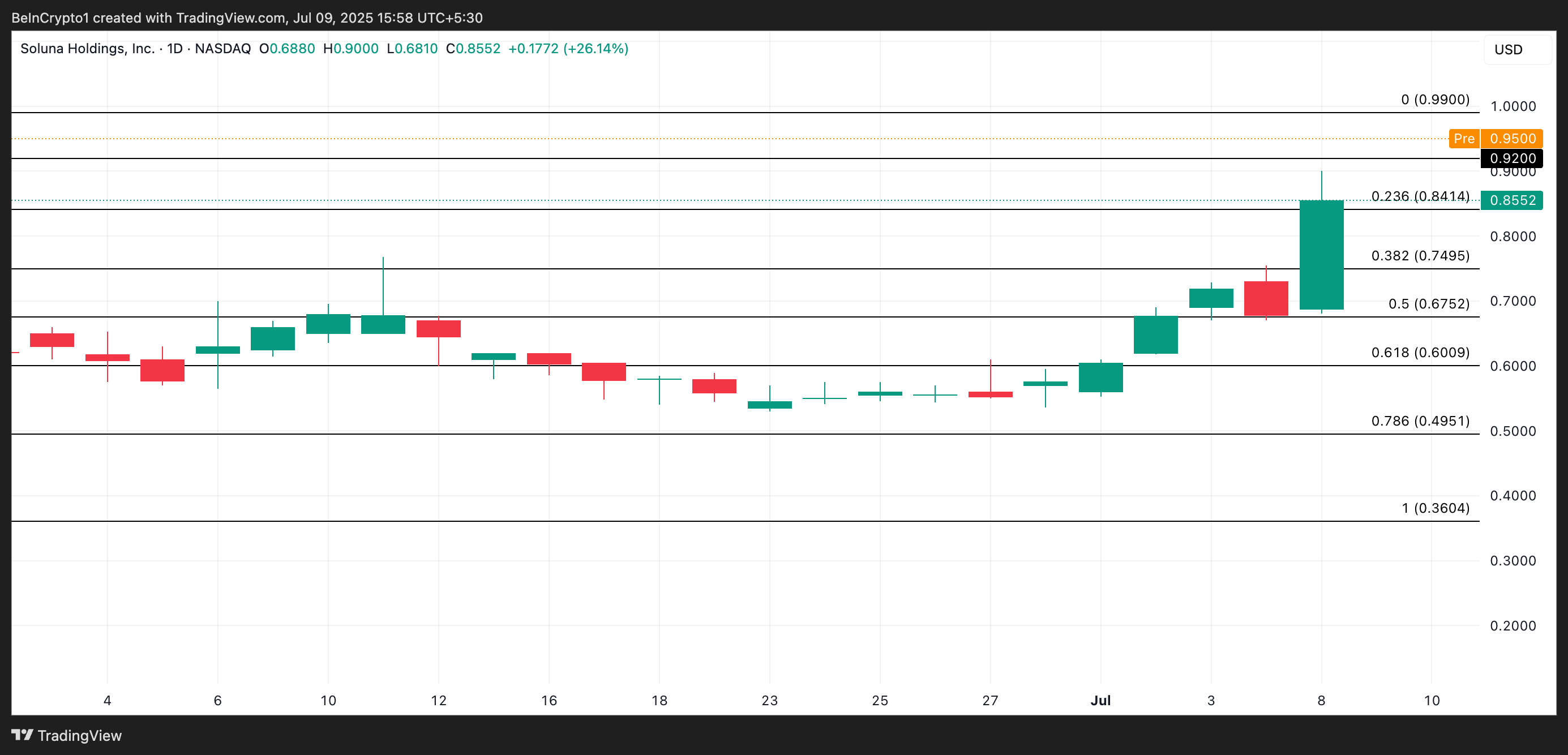

Soluna Holdings shares climbed 27.88% to close at $0.85 on Tuesday after the company announced a major expansion at its Texas-based Project Dorothy 2 site.

The company revealed a 30 MW hosting deal with a leading Bitcoin miner—its third such agreement with this long-term customer. With the new contract, Project Dorothy 2 is now fully marketed and contracted, solidifying Soluna’s capacity buildout.

As of the pre-market session today, SLNH trades at $0.95. If the bulls maintain control at the opening bell, the stock could test resistance near $0.99.

However, if buyers fail to sustain demand, the price could slip below $0.92.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- USD PHP PREDICTION

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-07-09 15:51