TL;DR

- As the US Department of Justice waved a very stern finger at ex-Celsius CEO Alex Mashinsky, demanding he be tucked away for 20 years—a whole Dostoevskian novel’s worth of prison—CEL, the native token, shot up in price like a startled cat. Deception and financial trickery? Allegedly years in the making.

- May 8: Mark your calendars for a court drama worthy of its own TV adaptation.

CEL Has a Dramatic Reaction

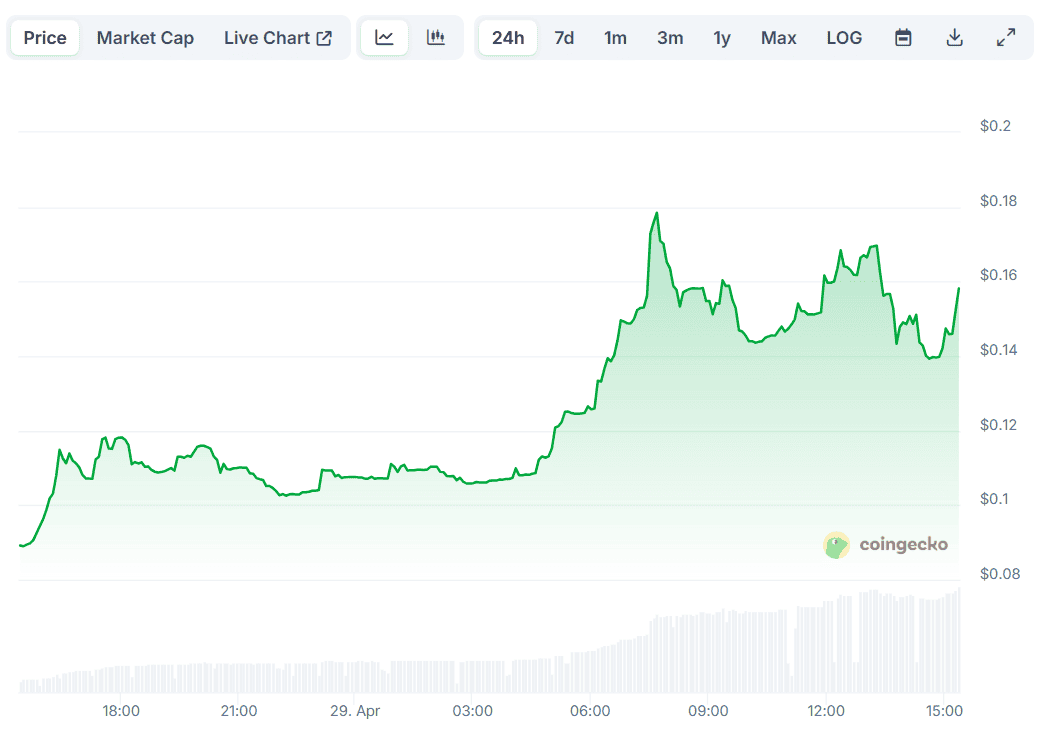

In what could only be described as a ballet of numbers, the price of CEL—Celsius Network’s beloved, long-suffering token—did what nobody expected. Languishing below $0.06, then pirouetting up to $0.08, the thing positively exploded: an 80% rally in 24 hours! It reached a dizzying $0.18 before sobering up and settling around $0.14, no doubt nursing a hangover and wondering what it did last night. CoinGecko, the town crier, chirps: up a respectable 70%.

But don’t be fooled by this little upswing—the ghost of CEL’s glory days haunts us still! In June 2021, CEL strutted at over $8, market cap flirting with $3.5 billion. Today? $5.1 million. Cue the tragic violins! 🎻

All this market melodrama kicked off after the DOJ pulled out its legal sabre, demanding Mashinsky spend two decades pondering his alleged “years-long campaign of lies.” Picture Inspector Woland, but less philosophical and more obsessed with prison time. The document paints him as the villain, profiting from “billions in losses” and leaving a trail of “victimized customers.” A classic tale: the innocent townsfolk, the evil capitalist, and—naturally—the mysterious government figure with a penchant for justice.

According to our modern-day inquisitors, he misrepresented deposit safety, cooked the books, and risked customer funds with as much caution as a drunk magician. Of course, he allegedly pumped CEL’s price like a hot air balloon so he could dump his personal stash at top dollar. The kind of plot twist even Bulgakov would find excessive!

“Mashinsky’s conduct made him rich at the expense of Celsius’s customers. When Celsius collapsed into bankruptcy, it wiped out the savings of ordinary retail investors who entrusted their cryptocurrency to the company based on Mashinsky’s lies,” the filing scolds, heavy on the Dostoevskian gloom.

The main character, Mashinsky, is scheduled for sentencing on May 8. He’s already admitted guilt on two counts—commodities and securities fraud. Turns out, the “Earn” program mostly earned him a cool $48 million. Would-be investors were guided to deposit like innocent Ivanushkas, none the wiser.

The Celsius Tragedy (or Farce?)

Once—a young, dashing crypto lender with ambitions of grandeur. Then came the summer of 2022, when the clouds grew heavy, and Celsius hit pause on customer withdrawals, swaps, and transfers. The plot thickened: bankruptcy, a gaping $1.2 billion hole in the finances, and debts to users totaling $4.7 billion. (A mere trifle, comrades!)

The following act: public investigations, damning accusations, then Mashinsky himself was pinched and later released on a $40 million bond, secured against his Manhattan palace. Every tragedy needs its fall from grace.

With November 2023, the court offered a new act—a reorganization plan! Celsius, no longer down for the count, re-emerged with a new character: Ionic Digital. Like a phoenix, but if the phoenix owed everyone money. This time, creditors got not just the ashes, but a slice of a Bitcoin miner.

By early last year, the great redistribution began. Over $3 billion in crypto and cold, hard fiat sprinkled among sorely affected users. By summer’s end in 2024, 93% of the promised funds had found their way into the hands of 250,000 creditors in 165 countries. As an encore, the company announced plans to distribute another $127 million. The curtain falls. Or does it?

Moral of the story? Hold on to your hats (and your tokens), because every crypto tale is just a half-step from the absurd. 🚀💸

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2025-04-29 18:35