Once upon a time in the land of Switzerland, a rather ambitious investment firm decided to throw its hat into the ring and filed for an XRP ETF back in the balmy days of November 2024. Fast forward to today, and the equities exchange MEMX has waltzed in with a proposal to the U.S. Securities and Exchange Commission (SEC) to list this fund as a “Commodity-Based Trust.” Oh, the audacity! This cheeky classification hints at a potential regulatory makeover, putting XRP in the same league as its more illustrious cousins, Bitcoin and Ethereum, who have already donned their spot ETF crowns.

XRP ETF Filings Gain Momentum

But wait, there’s more! The latest MEMX filing is merely one of a veritable parade of applications, with a gaggle of financial institutions—Canary Capital, Bitwise, and WisdomTree—joining the fray to charm the SEC with their spot XRP ETF proposals. Just last month, the Chicago Board Options Exchange (Cboe) decided to throw its hat in the ring with not one, not two, but four separate XRP ETF applications. It’s as if they were all trying to outdo each other in a rather peculiar game of regulatory poker, all before Donald Trump’s recent victory, which suggests they were banking on a more amiable regulatory environment under a Republican regime. Who knew politics could be so entertaining?

Now, under the previous SEC chairman, Gary Gensler, who seemed to have a personal vendetta against cryptocurrencies (especially XRP), the SEC was cracking down harder than a schoolmaster with a ruler. In 2020, they filed a rather dramatic action against Ripple, claiming XRP was an unregistered security, leading to a legal saga that could rival any courtroom drama. However, in a plot twist worthy of a bestseller, a court ruled in 2023 that XRP is not a security when trading on secondary markets. Yet, the SEC’s approval for an XRP ETF remained as elusive as a cat at bath time under the Biden administration.

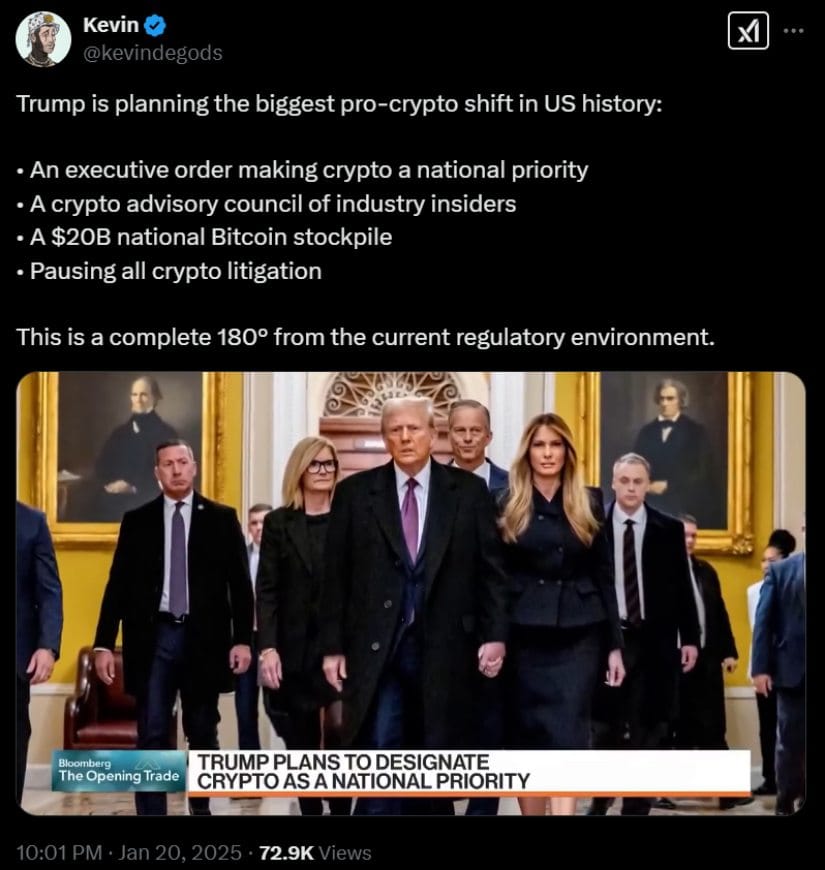

Trump’s Crypto-Friendly Stance and Regulatory Shift

But lo and behold! The political winds have shifted following Trump’s victory, dramatically increasing the chances of an XRP ETF approval. Shortly after the election, Gensler made a hasty exit, making way for crypto-friendly executives like acting SEC Chair Mark Uyeda and his replacement, Paul Atkins, to take the reins. Bloomberg ETF analyst James Seyffart, with all the confidence of a seasoned gambler, estimates a 65% chance of approval by the end of 2025, though the SEC has until October to make its grand decision.

Trump’s administration has already shown a penchant for all things crypto, even proposing to include Bitcoin in a national strategic reserve. If this pro-crypto sentiment extends to regulatory policy, we might just see XRP ETF approvals popping up like daisies in spring!

Shifting Market Sentiment and Investor Interest

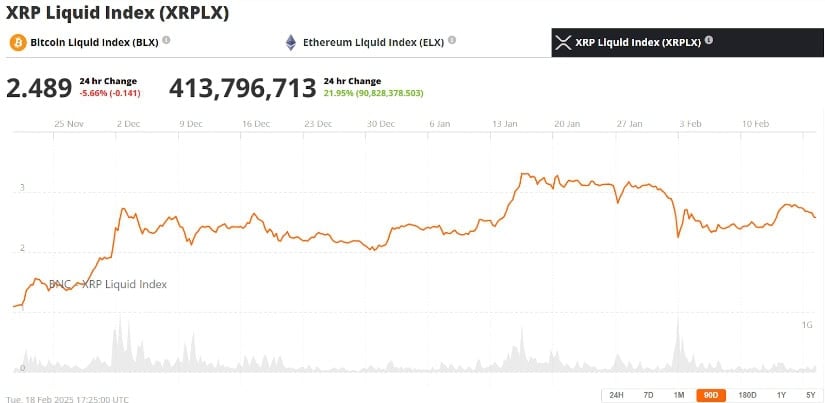

As if the plot couldn’t thicken any further, the heightened ETF activity coincides with a rollercoaster of volatility for XRP. The cryptocurrency had just breached the $3 mark, boasting a year-to-date surge of over 360%. But alas, it has since retreated by nearly 20%, now trading below $2.70. Analysts, with their crystal balls, attribute this wild ride to market speculation regarding the ETF filings and the ever-looming legal uncertainties.

Matrixport, a rather astute blockchain firm from Singapore, has noted that XRP’s Relative Strength Index (RSI) is hovering around 40%, a position usually associated with bullish momentum. They anticipate that increased price appreciation could be driven by regulatory clarity under the new administration. “The recent rebound could have further upside, particularly if the SEC revisits its legal case against Ripple Labs under the new U.S. administration,” Matrixport stated, likely with a wink and a nudge.

Watch – XRP Price Analysis Video

Regulatory Uncertainty and Commodity Classification

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

2025-02-19 20:29