If you thought your wallet’s rollercoaster was intense, wait until you hear about the crypto market in September. Bitcoin ETFs strutted in like they just won the lottery with a $333 million inflow, while Ether ETFs went the other way-down the drain, bleeding $135 million. Ah, the joys of digital finance! 💃🤑

BTC Gains Momentum While ETH Faces Fresh Outflows-It’s Like a Crypto Soap Opera 🎭

September kicked off with the kind of split personality that would make Dr. Jekyll and Mr. Hyde jealous. Investors threw their cash at Bitcoin funds faster than you can say “buy the dip,” while Ether was left crying in the corner, facing yet another wave of withdrawals.

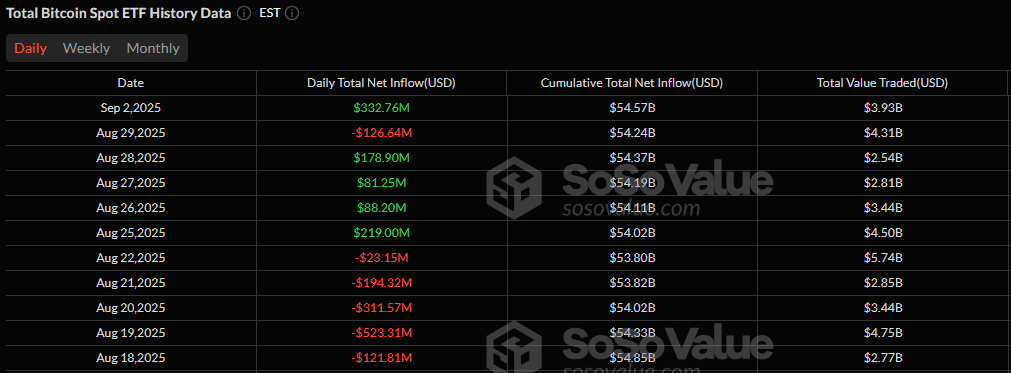

Bitcoin ETFs raked in a staggering $332.76 million, showing that maybe everyone’s finally convinced that Bitcoin’s the king – or at least the slightly less likely to make you cry. Fidelity’s FBTC led the party with $132.69 million, trailed by Blackrock’s IBIT and Ark 21Shares’ ARKB, which managed to clutch $72.86 million and $71.87 million, respectively. Because nothing says “trust me” like billion-dollar investments. 💼💰

Small change, really, but notable: $39.11 million for Bitwise’s BITB, $9.32 million for Grayscale’s Bitcoin Mini Trust, and a tiny $2.21 million for Invesco’s BTCO. Despite all this cash flooding in, total trading volume dipped to $3.93 billion-probably some investors realized they’d rather buy a coffee than watch their investment vanish-while net assets stabilized at $143.21 billion. Because if you’re going to ride a rollercoaster, might as well have a good view from the seat, right?

Meanwhile, Ether ETFs are busy the way a bad breakup is-outflow total reaching $135.37 million. Fidelity’s FETH led this sad parade with a whopping $99.23 million exit. Bitwise’s ETHW shed $24.22 million, and 21shares’ TETH and Grayscale’s ETHE took it on the chin with losses of $6.62 million and $5.28 million, respectively. Trading volumes held strong at $1.85 billion-because even amid drama, crypto traders can’t stay away-but total assets only held steady at $27.22 billion, like a sibling who refuses to leave the house even after you’ve changed the locks. 🙄

In the end, this wild divergence in investor confidence suggests that Bitcoin is rubbing its hands together, feeling confident after recent chaos, while Ether might be sitting there, wondering if it’s about to face another storm-or just tired of the constant drama. Ah, the thrill of crypto-where fortunes are made, lost, and sometimes, just wished away. 🎢🚀

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

2025-09-03 19:58