Today, around 3 billion dollars’ worth of Bitcoin (BTC) and Ethereum (ETH) option contracts are due for expiration, generating a lot of excitement and uncertainty within the cryptocurrency industry.

Prior to President-elect Donald Trump’s inauguration week, we see the approaching expiration of crypto options. Notably, Bitcoin has surpassed the $100,000 mark once again, leading the way in anticipation of his ascension.

Over $2.8 Billion Bitcoin and Ethereum Options Expire

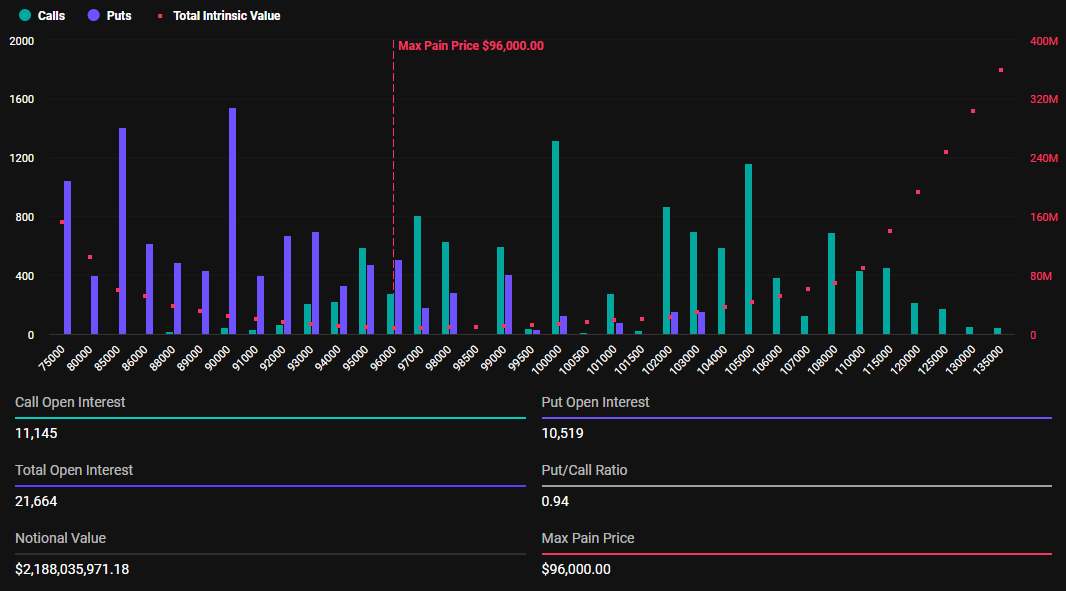

Based on information from Deribit, about 21,664 Bitcoin derivative contracts worth around $2.2 billion will mature today. Currently, the ratio of put options to call options for Bitcoin stands at approximately 0.94.

The point where the asset becomes a loss for the majority of its owners is approximately $96,000. In this scenario, most of these contracts would not yield any value.

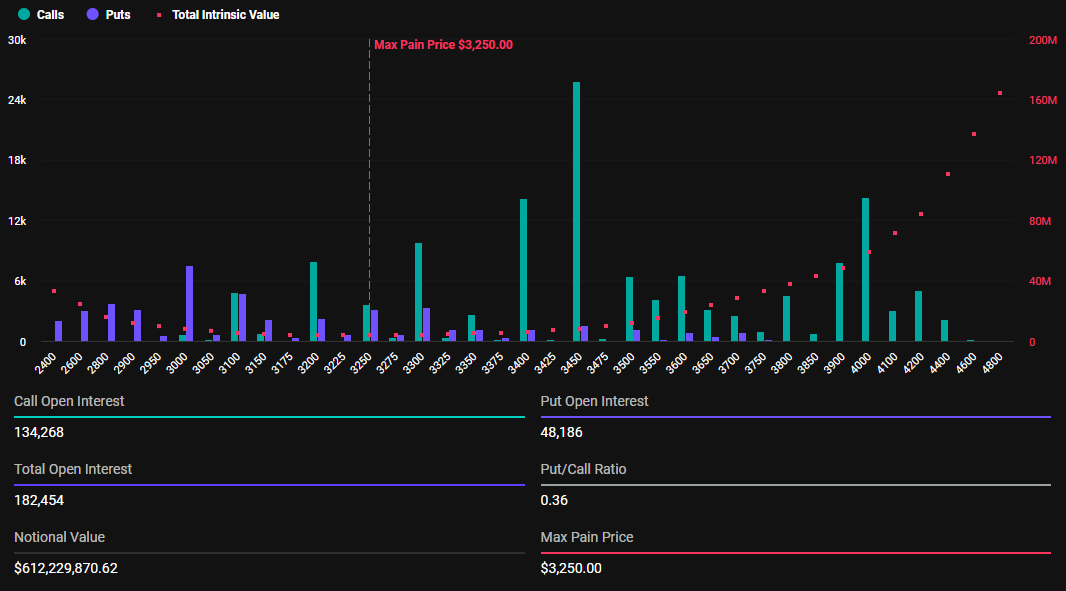

Approximately 182,454 Ethereum contracts are set to expire, totalling around $612.2 million in value. The ratio of put options (downside protection) to call options (upside potential) for these expiring contracts is 0.36, and the maximum potential loss, or ‘maximum pain’, is estimated to be at $3,250.

Expiration of options can frequently cause significant price fluctuations, so it’s crucial for traders and investors to keep a close eye on current events. Interestingly, the put-to-call ratios for both Bitcoin and Ethereum being less than 1 indicates a sense of optimism in the market. This means more traders are wagering on price rises, thereby indicating the overall market sentiment.

Bitcoin aiming to regain the $100,000 level reflects an overall positive outlook in the market. Simultaneously, experts at Greeks.live attribute this optimism to the expectation surrounding Donald Trump’s presidency, given his pledge to be a “crypto-friendly” leader, possibly shaping regulations favorably for the industry. Additionally, they point out that the absence of interest rate cuts could impact market sentiment positively towards cryptocurrencies.

Bitcoin surged past $100,000 once more, dispelling the muted market feelings from the weekend… As Trump prepares to assume office as the new U.S. President next week, it’s crucial to monitor whether he might implement policies beneficial to cryptocurrencies this month. The U.S. stock markets have shown growth in recent days, and the upcoming rate meeting at the end of the month is likely to maintain the current policy of no interest rate cuts, as reported by Greeks.live on Twitter.

Despite a rise in short-term option implied volatility (IV) and an increase in long strength, analysts suggest investors consider buying some short-term options. This recommendation is based on anticipated policy changes from the current government and an influx of ETFs (exchange-traded funds).

Moreover, Greeks.live points out that the buying and selling patterns of various geographical areas impact the value of Bitcoin. For instance, Asian and European traders sold Bitcoin, causing a decrease in its price. However, American traders stepped in to purchase it, which reversed the market trend into a positive one. This demonstrates the global interplay occurring within cryptocurrency markets.

Today, Asia and the EU appear to have offloaded their Bitcoin, but then the Americans stepped in and bought it at lower prices, causing the market to swing from a negative (red) trend to a positive (green) one for BTC.

Although this seemingly sarcastic remark about the market movement might suggest a focus on prices alone, it hints at a deeper narrative. Specifically, just prior to the expected volatility surrounding Trump’s inauguration, there appears to be a correlation between political events and investor sentiment.

According to recent data from BeInCrypto, the current price of Bitcoin is approximately $101,187, marking a noteworthy increase of around 2% compared to where it was trading at the start of the trading day on Friday.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-01-17 09:16