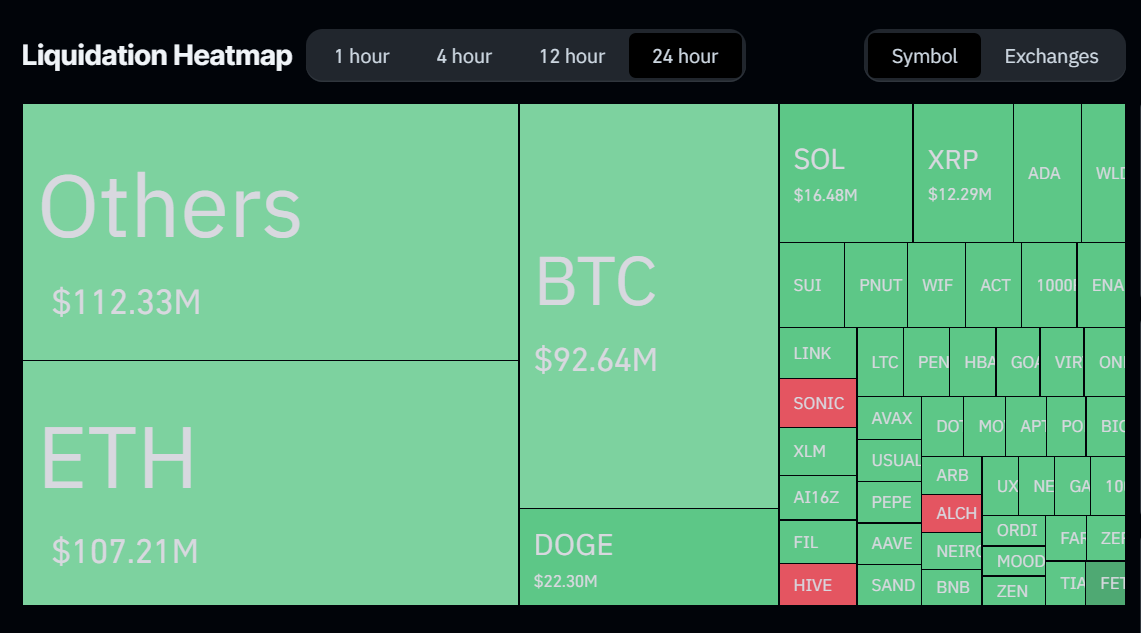

In the last day alone, approximately 157,000 traders have experienced forced settlements, amounting to over $480 million in combined assets.

Based on information from Coinglass, around $400 million worth of highly-leveraged cryptocurrency positions were liquidated. Subsequently, the value of Bitcoin decreased by more than 5%, after seven straight days of upward movement.

Sudden Crypto Liquidations Trigger a Market Pullback

As an analyst, I observed a 7% decrease in the overall cryptocurrency market capitalization, with Ethereum experiencing a significant drop of almost 8%. Notably, the largest single liquidation event transpired on Binance.

As a crypto investor, I noticed an interesting confluence of events recently. The surge in liquidations seemed to coincide with a sharp increase in the 10-year U.S. Treasury yield. Moreover, data from the Institute for Supply Management pointed towards robust growth in the U.S. services sector during December, exceeding initial expectations.

These heightened worries are centered around prolonged inflation issues. Typically, elevated returns can strain growth-focused investment options, such as cryptocurrencies.

Additionally, high open interest levels were a factor in the recent wave of liquidations. Over the past 24 hours, there has been a decrease in open interest exceeding $1 billion for both Bitcoin and Ethereum, indicating substantial deleveraging within the market.

In a recent post, prominent trader Daan noted that around $1.6 billion worth of Bitcoin Open Interest has been wiped out since yesterday’s peak, with similar losses seen in Ethereum at approximately $1 billion. He anticipates it will be intriguing to observe how this unfolds in the near future. The market remains volatile, as is common towards the end and beginning of the year.

Some experts suggest that the recent crypto sell-offs could signal a potential drop in Bitcoin’s price, potentially falling below its current support of $93,000, leading to a possible downtrend or bear market.

Jacob King posted on platform X that Bitcoin is once again following an 8-year pattern of resistance. Every time it hits this trendline, there’s a significant drop in value. He warns us to anticipate another major fall. His prediction for Bitcoin’s price by 2025 is below $30,000, suggesting history may be about to repeat itself.

Nevertheless, many experts remain optimistic about Bitcoin’s future, as illustrated by Rekt Capital’s prediction that liquidations could initiate a fresh four-year market cycle.

Based on predictions, we might witness a significant upward trend (parabolic price increase) prior to the expected 2026 bear market.

Economic Data and Federal Reserve Policy Impact

Today’s market turbulence might have been influenced by recent developments in the U.S. job market. The latest JOLTS Job Openings Report indicated a staggering 8.098 million job openings in November, which is higher than the anticipated 7.70 million. This unexpectedly high number could be a factor contributing to market volatility.

A robust job market might cause the Federal Reserve to keep elevated interest rates for a longer period than anticipated, potentially increasing stress on speculative investments such as cryptocurrencies.

More recently, the Federal Reserve indicated another possible interest rate decrease, though it suggested less frequent reductions might occur in 2025. Typically, decreases in interest rates have positively impacted Bitcoin’s price, whereas increases have tended to have a negative influence.

Today’s market sell-offs are affecting cryptocurrency-linked shares as well. The share price of MicroStrategy (MSTR) fell by 10% due to the general market slump, mirroring this trend.

2024 saw the company actively acquiring Bitcoins, including a recent purchase made just yesterday marking their first BTC acquisition for 2025. Notably, Marathon Digital Holdings (MARA), the foremost Bitcoin mining firm, experienced a 5% drop in its stock value recently.

In contrast to many other assets, today’s downturn has not impacted the Bitget token significantly. Amidst the extensive crypto liquidations, the Bitget token (BGB) bucked the trend and saw a rise of over 4%. This daily growth has pushed its January rally past the 10% mark.

Or:

While most assets have been impacted by today’s downturn, the Bitget token (BGB) was an exception. Despite widespread crypto liquidations, this altcoin defied the trend and recorded a gain of over 4%. This daily growth has now propelled its January rally beyond the 10% mark.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Persona 5: The Phantom X Navigator Tier List

2025-01-08 00:09