Well folks, the crypto market’s got a case of the Mondays-on a Tuesday, no less! Bitcoin’s took a nosedive under $115,000, and the total valuation of all those magical tokens fell below $4 trillion. Yep, trillion. A lot of zeros.

- The crash is still in full swing, with liquidations doing their best impression of a carnival ride.

- All eyes are on the Jackson Hole Symposium-yawn.

- It seems investors decided to cash out after the recent rallies. Who saw that coming?

Top altcoins like Ripple (XRP), Ethereum (ETH), Solana (SOL), and Sui (SUI) all dropped more than 5%. Smaller coins like Raydium, Aerodrome Finance, and Bonk are playing the role of bottom feeders. 🐟

Crypto Market Crashing Like My Hopes & Dreams

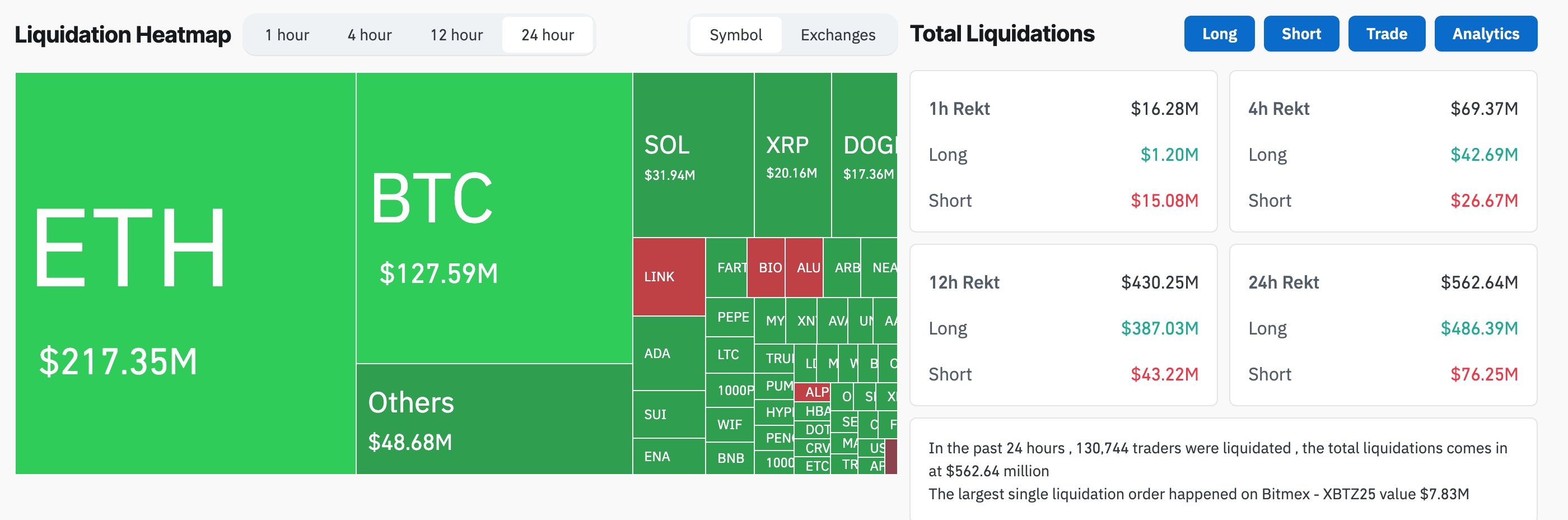

The reason for today’s tumble? Liquidations, my friends! Exchanges are putting the hammer down on highly-leveraged trades, forcing more sell-offs than a Black Friday sale. If you’re one of the 131,000 traders who got liquidated, my condolences.

In fact, the largest single liquidation was a jaw-dropping $7.83 million. That’s almost enough to buy your own island… if it was made of disappointment. 😅

As if that wasn’t enough, investors have been cashing in on recent rallies, so it’s a double whammy of misery today.

The Jerome Powell Show: Coming Soon to a Crash Near You

Don’t forget about Jerome Powell, the Federal Reserve Chair, and his big speech at the Jackson Hole Symposium. It’s like the Super Bowl of economic events, only less fun.

Thanks to recent inflation reports, the market’s stopped dreaming about rate cuts. Powell’s probably going to drop a “cautious” speech, which is code for “sit tight, the economy’s still a mess.” Oh, and we’re also waiting to see what those new Trump tariffs are gonna do to the situation.

Technical Stuff: Because Who Doesn’t Love a Good Explanation?

But wait-there’s more! Technical factors are piling on. Many altcoins had been cruising at overbought levels like a teenager with a credit card, which means, yep, pullbacks are inevitable. Ethereum, for example, hit a multi-year high of $4,785. That pushed its Relative Strength Index to 87.6, which is like saying, “This is totally fine!” when your house is on fire. 🔥

Ethereum’s also way above its 50-day and 200-day Exponential Moving Averages. Looks like it’s time for a little reality check, folks.

So, Is the Bull Run Over? Spoiler Alert: Nope.

Don’t start crying into your keyboard just yet. This might not be the end of the crypto bull run. After all, ETF inflows are rising, and more treasury companies are hopping on the crypto bandwagon. The Fed’s probably gonna start cutting rates by year’s end, with more action expected once Trump takes over Powell’s seat. A little optimism for you!

Oh, and let’s not forget the U.S. Securities and Exchange Commission (SEC) could be approving several crypto ETFs before the year’s up. That’ll probably add even more institutional demand to the mix. So hang in there, folks-there’s still hope. Or at least a good chance for another crash. 😏

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-08-18 16:49