In a most curious turn of events, akin to the unfolding of a tragicomedy, President Trump’s unexpected proclamation regarding EU tariffs has unleashed a veritable storm upon the soaring Bitcoin and its crypto brethren. The once-mighty digital titans now tremble, as the ominous realizations of a relentless bear market loom like a shadowy specter at dusk.

Alas! The exodus of investments from Bitcoin ETFs has reached unprecedented heights, as BTC plummets below the hallowed threshold of $85,000, with liquidations approaching a staggering $745 million. Are we perched perilously on the precipice of doom, or merely witnessing yet another farcical twist in the tale of digital currency? Nonetheless, dear community, we must fortify our spirits! 🐻

Did Trump’s Tariffs Pull the Trigger on Bitcoin’s Downward Spiral?

With palpable tension pervading the atmosphere, Trump’s proposed tariffs drift ominously over the markets, sending crypto into a frenzy reminiscent of a flock of startled pigeons scattering at the first whisper of danger. Previously, Bitcoin and its companions had managed a timid recovery following the delay of tariffs aimed at Canada and Mexico, but now they reel from the renewed threats about hefty charges against the European Union.

Trump, in his eloquent and concise fashion, hinted at an impending 25% tariff. Such theatricality! 🎭

“We have made a decision and we’ll be announcing it very soon. It’ll be 25 percent generally speaking, and that will be on cars and all other things,” Trump declared, channeling the spirit of a grand maestro in his inaugural Cabinet gathering.

As Bitcoin teeters on the brink of madness, newly imposed tariffs threaten to dissolve it into the abyss of despair. The week started with unfortunate losses, exacerbated by a monstrous $500 million outflow from ETFs, stoking fears of an ever-closer bear market, with its claws outstretched.

Today, the troubling tide of BTC ETF exits has surged to a historic high, and Bitcoin’s price has graciously dipped beneath $85,000 for the first time since the golden days of early November. Heavy sighs ensue. 😩

The Contagion: A Plague Spreads Across Crypto Stocks

The data of CoinGlass reveals an alarming total liquidation of nearly $745 million—what a shocking spectacle! This follows a ghastly $1.5 billion in liquidations witnessed just yesterday. And dear reader, let us not forget the crypto-themed stocks, which suffer as dishearteningly as a wilting flower in an unforgiving drought.

Strategy, that peculiar creature formerly known as MicroStrategy, remains inextricably woven into the fabric of Bitcoin’s destiny, with its staggering boasts of nearly $2 billion in BTC acquisitions. Yet! Its stock price lags behind like an uninvited guest at a festive gathering.

Alas, today, the piteous plunge of its stock only fans the flames of speculation regarding liquidation. Though some faint hope flickers as the stock price claws its way up, the journey appears fraught with peril.

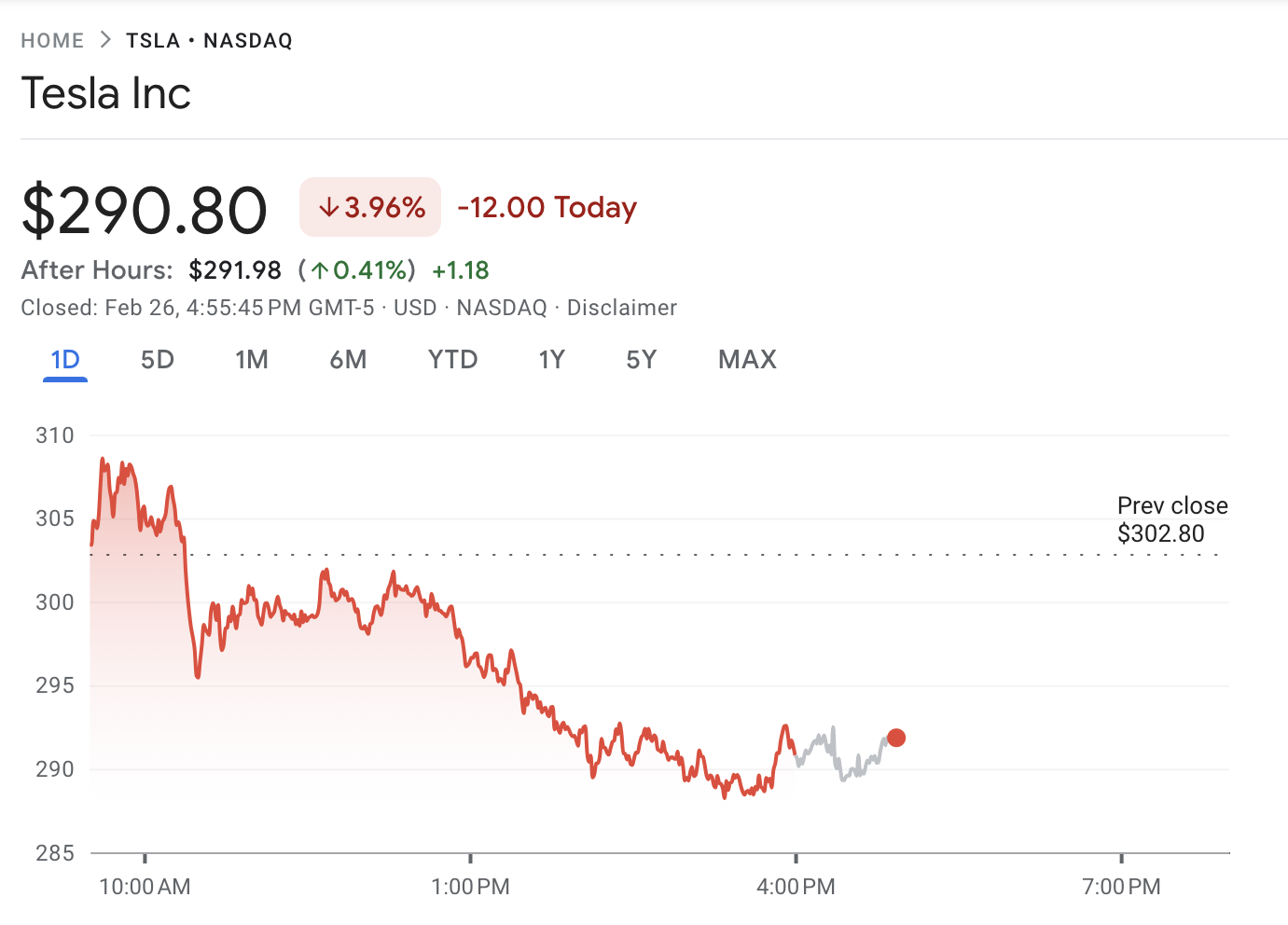

Coinbase too experienced tremors in its stock price, taking a hit thanks to Trump’s remarkable tariff whims, yet the firm’s revenue streams cast a diversified net. On the contrary, Tesla finds itself reliant on Bitcoin returns—what delicious irony!

With the crypto market stumbling and a growing frustration among traditional buyers, Tesla’s pricing is staring into the abyss with a gleeful chuckle. 😂

In conclusion, one may muse that Bitcoin and its crypto family have indeed taken a hard fall from grace, whilst Trump’s tariffs serve as either a convenient scapegoat or a minor inconvenience in a saga long foretold. Bearish indicators have been conspicuously parading for days, while Trump unleashed his tariff proclamations with a rather unceremonious flare.

But fret not! In a world where record-breaking hacks and audacious social media swindles thrive, one must ponder whether a correction is not just overdue but a kind and merciful release.

Yet, should the community’s most dread fears materialize in the immediate future, let not despair wash over our merry band of crypto enthusiasts! This tumultuous industry is no stranger to tempestuous bouts; it always rises phoenix-like from the ashes of despair.

Whether tariffs render Bitcoin a pittance of its vibrant past, we shall remain resolute and unwavering, as unyielding as the mighty oak before the storm. 🌳

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2025-02-27 02:39