As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed my fair share of market turbulence and volatility. The current dip in sentiment in the cryptocurrency market, as indicated by the extreme fear on the Crypto Fear & Greed Index, brings back memories of past bearish periods, such as the one following the collapse of FTX in 2022.

The emotional state regarding cryptocurrencies has plunged to “intense apprehension” following a significant decline in Bitcoin‘s price ($BTC) to around $53,500, which has triggered a substantial drop in the overall market value of cryptocurrencies, pushing it below the $2 trillion threshold.

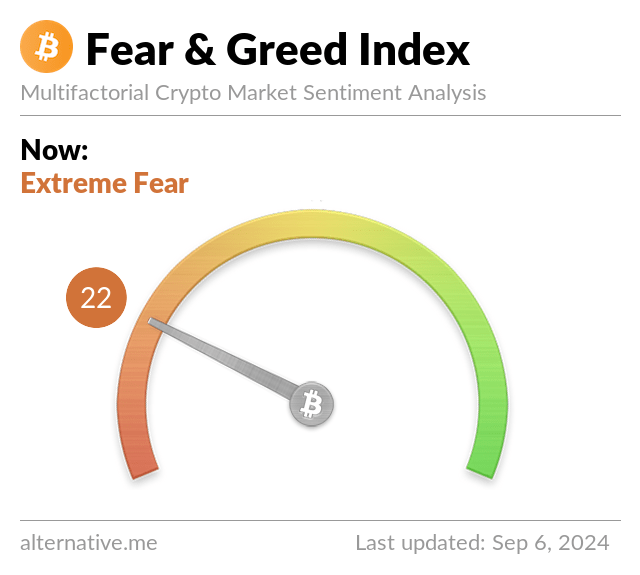

The Crypto Fear and Greed Index, a measure that combines investor sentiment and market outlook, has fallen to 22, indicating a high level of fear among investors.

In 2022, as Bitcoin (BTC) fell beneath $18,000, the index hit its lowest point at approximately 6 following the downfall of a well-known cryptocurrency trading platform, FTX.

The underlying worries arise from the possibility of a market correction happening in September, which might cause Bitcoin to dip below the significant threshold of $50,000. Recently, Arthur Hayes, the former head of cryptocurrency derivatives trading platform BitMEX, has expressed his view that such a price drop could take place over this weekend.

It’s worth mentioning that several experts are optimistic about the cryptocurrency, as MetaShackle, a cryptocurrency analyst on TradingView, has recently shared analysis suggesting the cryptocurrency is developing a significant “cup and handle” chart pattern, which could potentially trigger a substantial increase in its price.

According to the analyst’s post, this cryptocurrency formation is unprecedented in the history of cryptocurrencies, and it’s expected to have a breathtaking surge to heights that could leave everyone amazed.

The cup and handle pattern emerges when the value of a financial asset experiences a gradual decline followed by an upward curve resembling a ‘u’ shape, after which there’s a minor downturn that creates the ‘handle’. This pattern is often interpreted as a positive or bullish sign.

Since mid-August, investors who typically keep Bitcoin for relatively short durations have sold approximately 642,366 Bitcoins, equivalent to over $36.65 billion, into the market, according to a report by CryptoGlobe.

Previously, Morgan Stanley disclosed that they had expanded their investment in Bitcoin. This was evident in a report where they stated a 2.1% investment in BlackRock’s physically-backed Bitcoin ETF known as IBIT, within their Institutional Fund.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-09-07 05:47