🚨🚨 Tariffs Wreak Havoc on Crypto Market: $10 Billion in Liquidations? 🤯

Ben Zhou, CEO of Bybit, is not mincing words. He claims that crypto liquidations since the new US tariffs could be a staggering $8 to $10 billion. But, of course, he’s not telling us the whole truth… or is he? 😉

During the 2022 FTX collapse, Zhou revealed that real liquidations were a whopping 4-6 times worse than reported figures. One can only imagine the horror stories he must have seen behind closed doors… 👻

Bybit’s Zhou Spills the Beans

Ben Zhou, CEO of Bybit, the second-largest crypto exchange by trading volume, has decided to give us a glimpse into the dark underbelly of the crypto market. And, oh boy, it’s not pretty… 😱

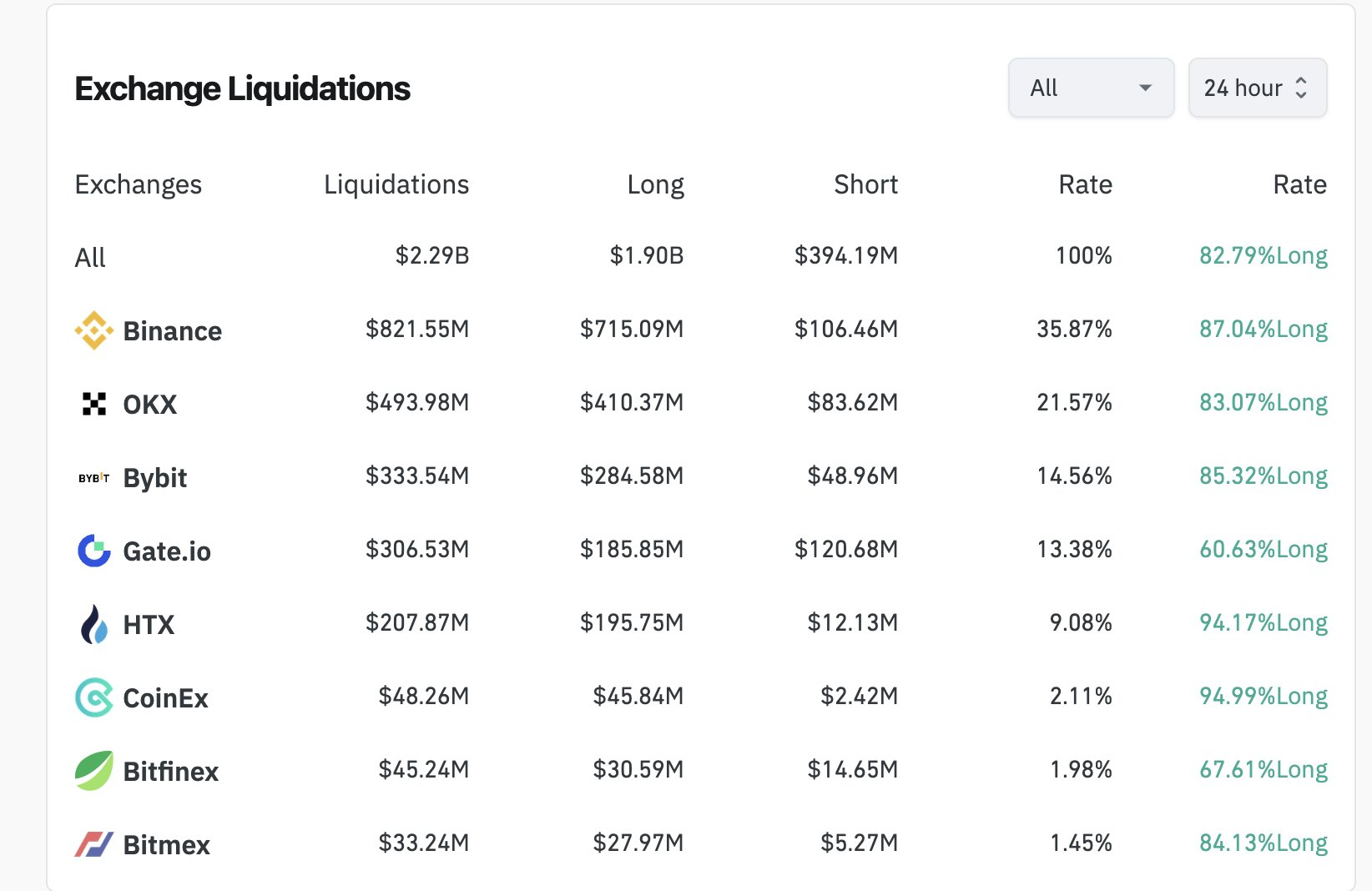

With the market already reeling from DeepSeek, a Chinese AI protocol that’s been wreaking havoc on US tech sector stocks, the tariffs have sent the crypto market into a tailspin. Losses of $2 billion were reported, but Zhou claims that’s just the tip of the iceberg:

“I am afraid that today real total liquidation is a lot more than $2 billion, by my estimation it should be at least around $8-10 billion. FYI, Bybit 24 hour liquidation alone was $2.1 billion. Bybit 24 hour liquidations recorded on Coinglass was around $333 million, however, this is not all of the liquidations. We have API limitation on how much feeds are pushed out per second,” Zhou said. 🤯

Zhou’s opinion on the tariffs is especially relevant because Bybit was heavily entangled with FTX. And, let’s be real, who doesn’t love a good FTX collapse story? 🤣

He stated that real liquidations were “at least” 4-6 times worse. Moving forward, Zhou said Bybit would be more transparent with liquidation data. But, will it be too little, too late? 🕰️

Bitcoin‘s price dropped below $95,000 in Monday’s rout, but the entire market took hits. BTC sell-offs inspired a similar dumping action in Solana, and Ethereum also hit a YTD low. It’s like a game of musical chairs, but with cryptocurrencies… 🎶

If Zhou is correct and the tariffs liquidated up to 5x the reported amounts, this could become a very painful moment for the market. But, as they say, “when life gives you lemons, make lemonade”… or in this case, when life gives you tariffs, make a buying opportunity? 🤔

Earlier in January, Arthur Hayes, former BitMEX CEO, predicted that BTC could drop to $70,000 in the current political climate, triggering a mini-financial crisis. But, as we all know, the crypto industry has experienced many serious bear markets. And, somehow, it always manages to bounce back. 💪

Bitcoin is still worth nearly double what it was 6 months ago, and these downswings exist in the context of monumental growth. This price cycle may present a buying opportunity for long-term holders as crypto will eventually recover. Or, at least, that’s what we keep telling ourselves… 😅

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2025-02-03 19:52