As a seasoned crypto investor, I’m always keeping an eye on the latest trends and investment flows in the digital asset space. The recent inflow of $2 billion into cryptocurrency investment products over the last month is certainly a positive sign.

Over the past month, there was an inflow of approximately $2 billion into investment products related to cryptocurrencies. The most recent week added around $185 million to this total, pushing the year-to-date inflows beyond the $15 billion threshold.

According to the latest report from CoinShares, there were inflows of approximately $148 million into investment products linked to Bitcoin last week. At the same time, there were outflows of around $3.5 million for those betting against Bitcoin.

In the past week, investments in Ethereum‘s ETH-based products surged by $33.5 million. This influx followed the SEC’s approval of listing spot Ethereum ETFs in the United States, increasing the year-to-date inflows to a modest $11 million.

During the recent period, investments in Solana ($SOL), a competitor to Ethereum, totaled approximately $5.8 million. This brings the year-to-date inflows for such products to around $35 million. On the other hand, funds that invest in various digital assets recorded approximately $2.7 million in outflows last week.

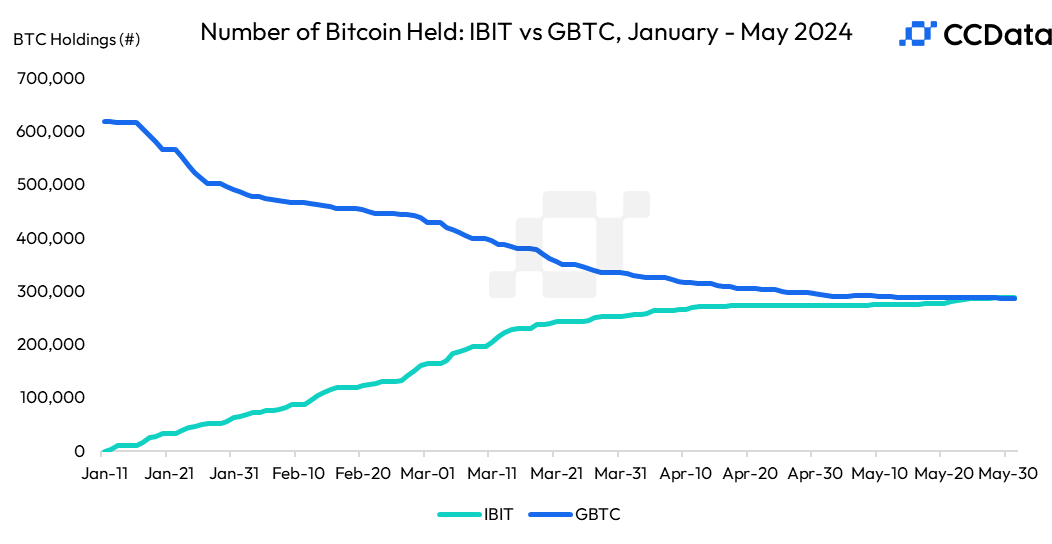

As a researcher studying the cryptocurrency market, I’ve discovered that so far this year, investments focused on Bitcoin have amounted to an impressive $14.74 billion. This surge can be attributed in part to the introduction of spot Bitcoin Exchange-Traded Funds (ETFs) in the US. These new ETFs have generated substantial inflows and made headlines when BlackRock’s iShares Bitcoin Trust (IBIT) surpassed Grayscale’s GBTC to claim the title as the largest publicly traded Bitcoin investment fund.

Significantly, CoinShares reports that Ethereum has experienced a shift in investor attitude based on recent data. Previously, Ethereum had undergone a ten-week streak during which investors withdrew over $200 million from related investment vehicles.

The rise in Ethereum flows occurs following the SEC’s approval of spot Ether ETFs last month, leading to an increase in Ethereum accumulation by large investors (ETH whales) since then.

Approximately 800,000 dollars’ worth of Ethereum, equal to around 3 billion in current value, has been transferred out of cryptocurrency exchanges within the past week, as reported by an industry expert from CryptoQuant.

Analysts have pointed out that the recent large-scale withdrawals from centralized Ethereum exchanges in the US might be due to institutions gearing up for an Ethereum Exchange-Traded Fund (ETF), aiming to satisfy anticipated investor interest in this potential financial product.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- Everything We Know About DOCTOR WHO Season 2

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 10 Shows Like ‘MobLand’ You Have to Binge

- All 6 ‘Final Destination’ Movies in Order

2024-06-05 05:08