As a seasoned crypto investor with over a decade of experience navigating market volatility, I find myself standing at the crossroads of cautious optimism and measured skepticism. Last week’s drop in inflows was indeed a stark contrast to the previous week’s surge, but it’s not uncommon for such ebbs and flows in this dynamic market.

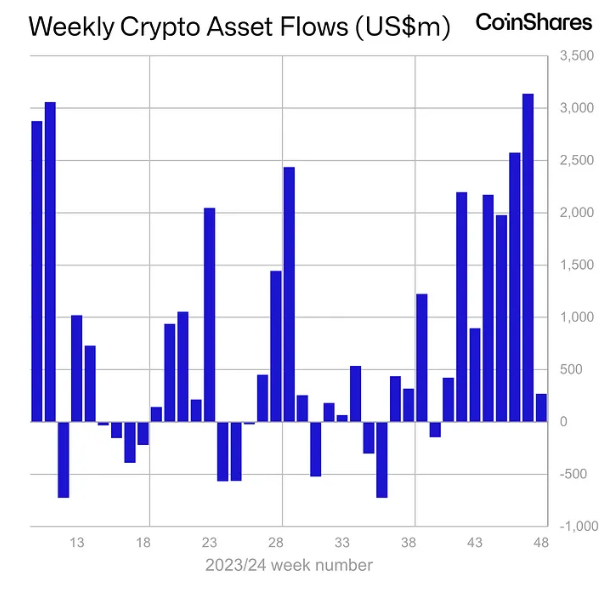

Last week saw a significant shift in crypto investments, with inflows decreasing to approximately $270 million. This downturn comes as a contrast to the robust activity seen in previous weeks.

So far this year, we’ve hit an all-time high of $37.3 billion in investments pouring into cryptocurrencies, demonstrating that institutional appetite for digital currencies remains strong, even amidst market turbulence.

Crypto Inflows Drop Amid Profit Booking

Last week saw Bitcoin experience an outflow of approximately $457 million, which represents its first significant withdrawal since early September. This comes on the heels of a string of positive investments into digital asset products, as Bitcoin hit new record highs. Notably, inflows to crypto reached a staggering $3.12 billion just the week before.

Additionally, it’s worth noting that broader economic patterns had an influence as well. Just recently, influxes amounting to $2.2 billion were observed, fueled by enthusiasm about the possibility of a Republican majority in the U.S. elections and a more lenient approach from the Federal Reserve, which in turn boosted investors’ optimism.

After the surge in investments following the election, there’s been a noticeable slowdown. The inflows have decreased since the initial post-election rally. Last week’s data shows a substantial dip compared to the $1.98 billion invested immediately after the elections. CoinShares’ James Butterfill suggests that this drop in investments could be due to investors cashing out their profits as Bitcoin neared the psychologically significant level of $100,000.

According to Butterfill’s statement, it appears that profit-taking is happening after Bitcoin tested the significant psychological price point of $100,000.

At the moment, opinions among experts on Bitcoin’s future are split. Some pessimists, such as ex-Wall Street quant Tone Vays, predict a continued decline in value.

Vays disclosed his decision to exit all long positions at $97,800, reflecting caution among seasoned traders. The analyst expressed skepticism about Bitcoin sustaining its $100,000 breakthrough this year.

He said he’s not optimistic about reaching a $100,000 mark this year, but if proven wrong, he would be thrilled. Alternatively, he’s open to buying at a discounted rate of $90,000 and might even consider shorting.

On the other hand, there are still positive outlooks that linger. Fundstrat’s Tom Lee continues to be bullish, predicting Bitcoin to reach $250,000 by 2025’s end. Nevertheless, Lee’s team is mindful of possible temporary obstacles; they believe the price could drop to around $60,000 before continuing its upward trend.

Robert Kiyosaki, the writer of “Rich Dad Poor Dad”, emphasized a similar idea, suggesting that temporary downturns or dips should be viewed as chances to invest for long-term growth and accumulation.

In simpler terms, Kiyosaki said that Bitcoin has not reached the $100,000 mark yet, but it might drop to $60,000. If this occurs, he plans to hold onto his BTC rather than selling it off.

Despite Bitcoin seeing funds leaving it, Ethereum experienced a substantial influx of $634 million, indicating a rise in investor trust towards the asset. So far this year, Ethereum’s inflows have surpassed $2.2 billion, fueled by an evolving sentiment among traders who are increasingly favoring altcoins as they navigate Bitcoin’s temporary uncertainties.

Last week, the trading volume of cryptocurrency exchange-traded products (ETPs) decreased significantly, falling from approximately $34 billion the previous week down to around $22 billion.

Despite the addition of varied choices for U.S. ETFs, their impact on total trading activity within the market has remained relatively modest, which stirs doubts about the longevity of institutional involvement with these financial tools.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- All 6 ‘Final Destination’ Movies in Order

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-12-02 20:24