In the swirling vortex of digital gold and mnemonic madness, Tuesday unfurled its peculiar charm—like a vaudeville act performed by blockchain jesters. Meme coins, those whimsical sprites named PEPE and WIF, pirouetted back into the limelight, dragging the entire market out of its slumber with a mischievous grin. Meanwhile, Bitcoin’s dominance, that ancient titan, slipped and shivered—an aristocrat in decline—while sophisticated institutional types shifted their allegiance to Ethereum, who, with a sneer, rebounded with a swagger of over 4%. Oh, the irony! The savvy are whispering: “Stack before the altcoin season storms like a caffeinated elephant.”

Ethereum Poised for a Parabolic Romp? Or Just Playing Hard to Get?

Though Bitcoin and its crypto comrades cheered, ETH—like a forlorn bride—had been descending since its December affair peaked near $4,106. But then, the Pectra upgrade, as if by magic, turned the tide. The uptick in staking and Layer-2 adventures lured institutional suitors, forcing a grand capitulation of funds from Bitcoin, sweeping Ethereum into a gleaming new orbit, like a diva reclaiming her stage.

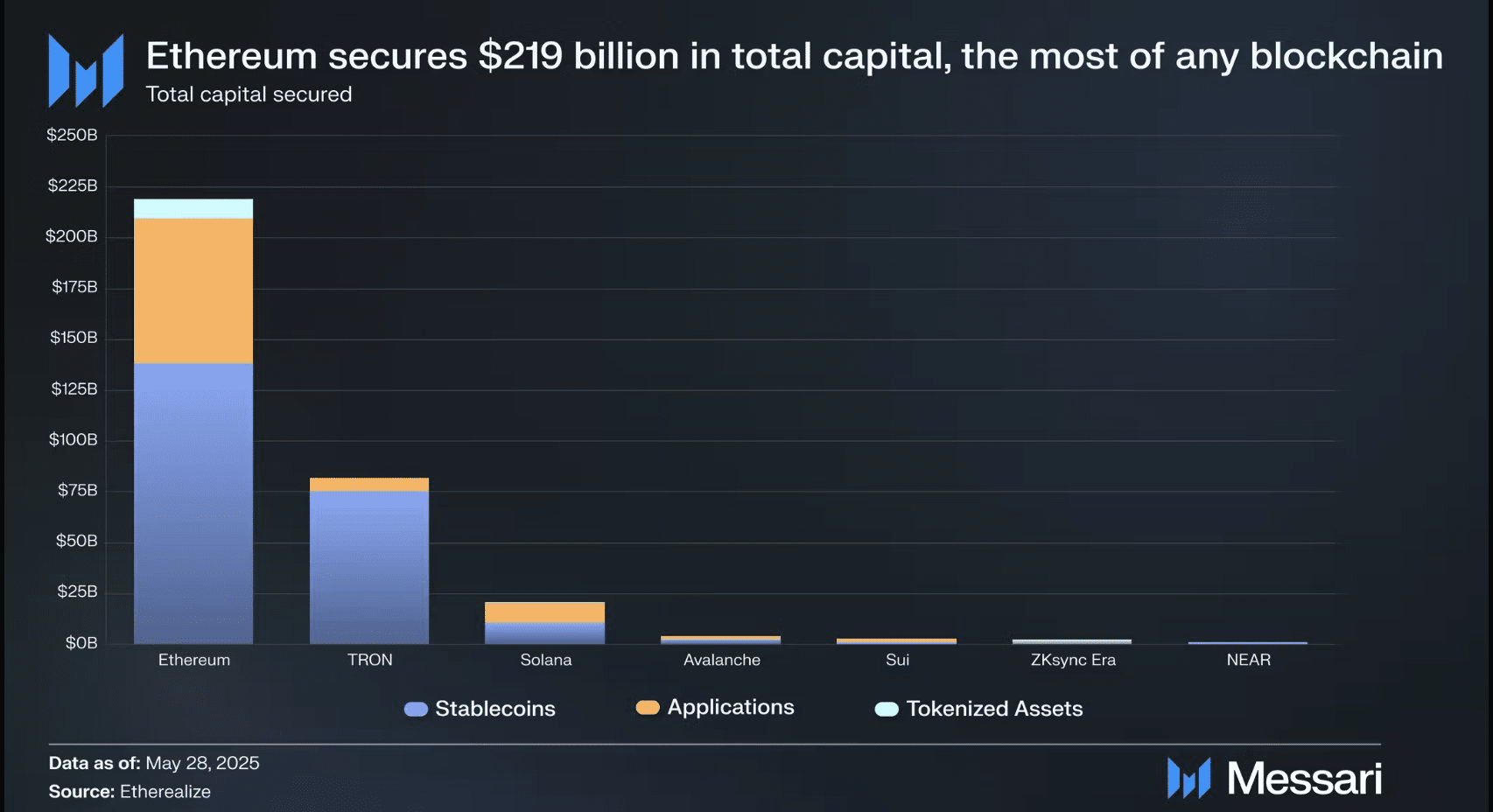

According to a rather serious report by Messari, Ethereum amassed an eye-watering $219 billion in capital—more than the entire spoils of Tron and Solana combined! That’s more dough than a bakery on bake sale day. Meanwhile, the silent ballet of ETFs revealed Ethereum’s net inflow on Monday was a hefty $78.2 million, while Bitcoin’s ETFs sobbed and lost $267.5 million—talk about a rollercoaster of fortunes!

CoinShares’ latest fund flow report indicates ETH has been on a tear since 2024’s lull, drawing both retail fans and institutional rulers alike, leaving Bitcoin and XRP nibbling in its shadow. The wise Rekt Capital suggests ETH is aiming to claim $2,500 as support—visionary enough to make Nostradamus look like an amateur. The ascent above $3,000 seems inevitable—like a cake surfing on a wave of speculation.

Another prophet, Michael van de Poppe, spotted a bullish divergence—like a secret wink from the market—hinting that ETH might just break out and dance past the $2,500 mark, with others whispering epic tales of parabolic glory ahead. ETH’s price has gained over 4% recently, trading at a brisk $2,613, with volumes soaring by 61%, as if traders suddenly remembered they own a pulse.

Meme Coins WIF and PEPE: The Clown Brigade Strikes Back

Meanwhile, in the carnival of chaos, meme coins WIF and PEPE—those digital jesters—led the charge today, rebounding fiercely after being knocked down in the recent market melee. Fresh traders, perhaps feeling the spirit of Robin Hood, flooded in to buy the dip, pushing prices skyward with a flair for dramatics. Shorts were liquidated in colossal waves—$6.3 million in PEPE short-squeezes and $3.25 million in DOGE—turning bearish despair into bullish carnival rides.

WIF, not to be left behind, vaulted nearly 13%, trading at $0.96, with daily lows at $0.843 and highs flirting with $1.001—classic meme coin volatility in full display. The market’s underbelly bristles with excitement—perhaps the next story to tell around the digital campfire is whether these jester-tokens truly hold the crown or are just fleeting sparks of meme-fueled folly.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-06-03 09:41