After a small hiccup on Wednesday, both bitcoin and ether exchange-traded funds (ETFs) made a grand comeback on Thursday, accumulating a staggering $376 million in combined inflows. Bitcoin ETFs raked in $163 million, while ether ETFs absolutely stole the show with $213 million in net entries.

Investor Confidence Returns as Bitcoin ETFs Add $163 Million, Ether ETFs $213 Million

The tide turned on Thursday, Sept. 18, as both bitcoin and ether ETFs surged with enthusiasm, signaling the return of investor confidence in crypto-linked funds. Together, these two assets generated a collective $376 million, with ether playing the role of the lead actor in this financial drama.

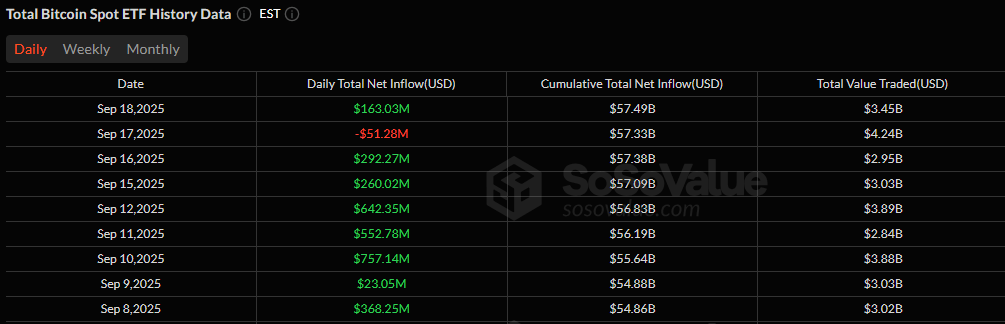

Bitcoin ETFs ended the day with $163.03 million in net inflows spread across seven funds. Fidelity’s FBTC took the top spot with a cool $97.35 million, while Ark 21Shares’ ARKB added a respectable $25 million. Bitwise’s BITB and Grayscale’s Bitcoin Mini Trust chipped in $12.78 million and $10.93 million, respectively.

Meanwhile, Franklin’s EZBC ($6.80 million), Vaneck’s HODL ($6.65 million), and Invesco’s BTCO ($3.51 million) also contributed to the green day. With no outflows in sight, the total value traded reached an impressive $3.45 billion, and net assets soared to $155.05 billion.

Ether ETFs were even more impressive, securing a jaw-dropping $213.07 million in inflows spread across five funds. Fidelity’s FETH took center stage with a hefty $159.38 million, followed by Grayscale’s Ether Mini Trust at $22.90 million. Bitwise’s ETHW grabbed $17.47 million, Grayscale’s ETHE added $9.83 million, and Franklin’s EZET brought in $3.49 million. As with their bitcoin counterparts, no ether ETFs posted outflows. The trading volumes stood at a robust $1.54 billion, with net assets rising to $30.54 billion.

The synchronized rebound across both bitcoin and ether ETFs suggests a renewed appetite among institutional investors. It’s starting to look like the recent pullbacks may have been nothing more than a brief pause-before the next wave of crypto enthusiasm sweeps through.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-19 21:24