In a move that could only be described as either genius or madness, Tuttle Capital has proposed a suite of crypto ETFs, targeting Solana, XRP, and—wait for it—the Melania meme coin. Yes, you read that correctly. The Melania meme coin. Because nothing says “financial innovation” like leveraging the former First Lady’s likeness for profit. 🎭

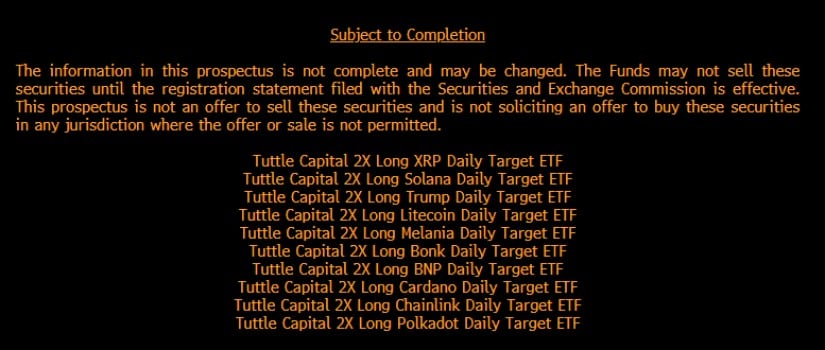

The proposed ETFs include the Tuttle Capital 2X Long XRP Daily Target ETF and the Tuttle Capital 2X Long Solana Daily Target ETF. For the uninitiated, “2X” means double the daily returns—or double the losses. Because why settle for losing half your money when you can lose it all in one day? 🤷♂️ The firm plans to use financial derivatives like swaps and call options to achieve this feat of financial engineering. Because, of course, what could possibly go wrong?

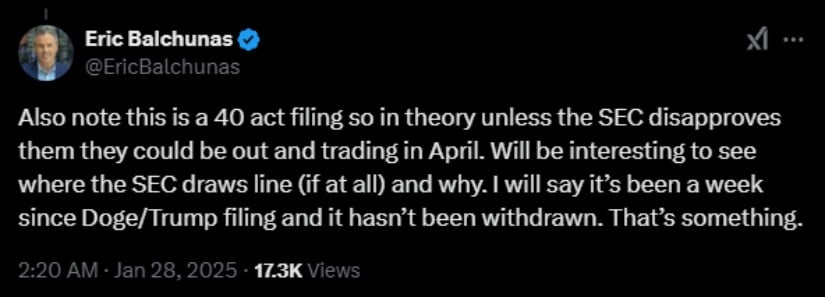

Bloomberg’s Eric Balchunas, ever the voice of reason, pointed out the obvious: leverage amplifies risk. If the underlying asset drops by more than 50%, investors could kiss their principal goodbye. But hey, who needs financial security when you can have adrenaline? The SEC has yet to disapprove, so these ETFs could hit the market as early as April. And rumor has it, a Ripple XRP ETF might even arrive sooner. Because why wait for disaster when you can rush into it? 🏃♂️

But wait, there’s more! Tuttle’s filing also includes meme tokens like TRUMP, MELANIA, and BONK. Because nothing screams “serious investment” like a 2x leveraged Melania ETF. Balchunas couldn’t help but note the absurdity of launching a 2x Melania ETF before a 1x version. Because, of course, why not? Analysts are now eagerly awaiting the SEC’s reaction to this circus. 🎪

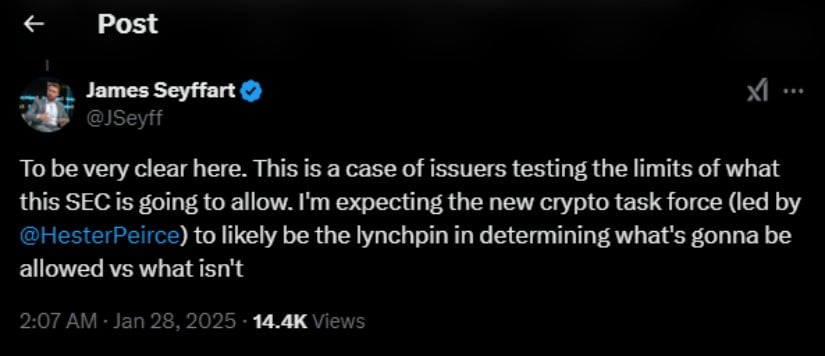

James Seyffart from Bloomberg Intelligence suggested these filings are pushing the boundaries of SEC approval. He highlighted the role of the crypto task force, led by pro-crypto commissioner Hester Peirce, in shaping the outcome. Because if anyone can make sense of this madness, it’s probably her. 🤔

While meme tokens steal the spotlight, analysts are cautiously optimistic about established assets like Solana, XRP, and Litecoin. Their larger market capitalization and decentralized structure might give them an edge in the regulatory review process. But let’s be honest, in this wild west of crypto, anything can happen. 🤠

The timing of these filings couldn’t be more interesting. The SEC is undergoing a leadership change, with pro-crypto Acting Chair Mark Uyeda replacing Gary Gensler. Industry insiders see this as a potential opportunity for regulatory breakthroughs, especially under a possible President Trump administration. Because if there’s one thing Trump loves, it’s a good meme. 🐦

KoinBX CEO Saravanan Pandian expressed optimism about the market dynamics, emphasizing the industry’s commitment to innovation. He highlighted the addition of assets like XRP and Solana, as well as newly issued tokens like TRUMP and MELANIA, as efforts to address diverse market needs. Because nothing addresses market needs like a meme coin named after a former First Lady. 🙃

The industry continues to push boundaries. Just last week, Osprey and REX Shares filed for ETFs tied to Dogecoin, BONK, XRP, and Solana. Balchunas noted that the SEC hasn’t withdrawn the Dogecoin and Trump ETF filings, calling it “something” worth noting. Because in the world of crypto, “something” is often the best you can hope for. 🎲

Read More

- NRN PREDICTION. NRN cryptocurrency

- PUFF PREDICTION. PUFF cryptocurrency

- NFP PREDICTION. NFP cryptocurrency

- ATH PREDICTION. ATH cryptocurrency

- How Many Main Quests Are There in Monster Hunter Wilds?

- ONT PREDICTION. ONT cryptocurrency

- EUR INR PREDICTION

- LDO PREDICTION. LDO cryptocurrency

- WLD PREDICTION. WLD cryptocurrency

- MSOL PREDICTION. MSOL cryptocurrency

2025-01-29 13:42