Crypto ETF filings are piling up fast, with 124 registrations pressing against the market’s upper limits. Bitcoin leads, followed by tight clusters in XRP, solana, ethereum, and litecoin, signaling issuers bracing for a high-stakes battle as breakout pressure builds.

Crypto ETF Filings Stack Higher as 124 Registrations Build Breakout Pressure

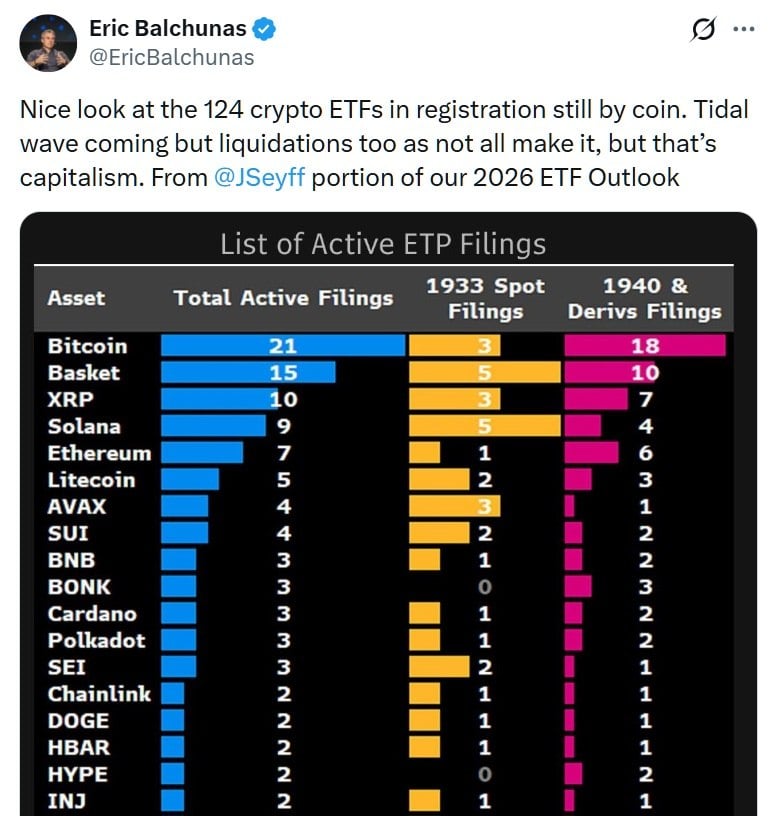

Crypto exchange-traded funds (ETFs) remain a major focus in the digital asset market as Bloomberg ETF analyst Eric Balchunas shared on social media platform X on Dec. 11, highlighting the scale of active crypto exchange-traded product (ETP) registrations. His post centered on the growing number of filings and the competitive landscape forming around them.

He said the 124 crypto ETFs still awaiting registration by coin indicate a coming surge, though he expects some to be liquidated because not all will succeed, which he described as a normal market outcome. Normal? More like a dog-eat-homework competition. 🐶📚

The accompanying data showed bitcoin (BTC) leading with 21 filings, followed by 14 basket products, 11 XRP filings, 11 solana (SOL) filings, 11 ethereum (ETH) filings, and 10 litecoin (LTC) filings, marking them as the most active categories. Additional representation for AVAX, SUI, BNB, BONK, ADA, DOT, and SEI illustrated expanding institutional exploration across mid-tier networks. The strong clustering among top assets signaled where issuers see the highest potential demand as they prepare for broader competition. Because nothing says “I’m a winner” like being part of a crowded race to the bottom. 🏁💸

The figures also listed numerous smaller assets – including APT, ATOM, AXL, BCH, CC, CRO, DOT, ENA, LINK, MELANIA, MOG, OKB, ONDO, PENGU, TAO, UNI, and XLM – each holding a single filing as issuers test viability at the edges of the market. The analyst noted that natural market filtering is likely as approvals progress, with weaker offerings winding down while stronger ones consolidate investor interest. Translation: “Some people are just born lucky. Or maybe they’re just born with better ticker symbols.” 🎲

The crypto ETF regulatory landscape is undergoing a significant easing, marked by the SEC’s streamlined approval process and a growing acceptance of digital assets. While some observers warn that rapid growth in crypto ETF submissions risks saturating the sector, supporters argue that increased product variety enhances transparency, strengthens market structure and supports broader adoption of bitcoin, ethereum, XRP, and other digital assets. Because nothing says “trust us” like throwing 124 products at the wall and hoping they stick. 🧱

FAQ 🧭

- What does the spike in crypto ETF registrations signal for investors?

It means institutions are really, really good at filing paperwork. Who knew? Also, maybe someone forgot to check the “not this again” box. 📄🤷♀️ - Which assets currently dominate pending ETF filings?

Bitcoin leads with 21 filings, followed by diversified baskets and strong interest in XRP, SOL, ETH, and LTC-showing where issuers expect the highest investor demand. Because nothing says “I’m a winner” like being in the top 5. 🥇 - Should investors expect all 124 pending crypto ETFs to launch successfully?

No-analysts anticipate a portion will be liquidated or never reach full market traction, a normal outcome as competition intensifies. Think of it as the market’s version of a ruthless game of musical chairs. 🪑💥 - What does the presence of mid-tier assets like AVAX, SUI, BNB, BONK, ADA, DOT, and SEI suggest?

It shows expanding institutional experimentation beyond blue-chip tokens, hinting at broader diversification opportunities in future ETF offerings. Or it’s just the market’s way of saying, “Here’s a menu with 100 options and zero taste.” 🍽️

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-12-11 20:54