So, picture this: RedStone, in a fit of spontaneity that would make a teenager’s impulse buy at a mall look like a well-thought-out investment, decided to change the terms of its RED token airdrop without so much as a heads-up. Naturally, Binance, the world’s largest crypto exchange, threw up its hands and said, “Not today, RedStone!” This led to a price crash that was more dramatic than a soap opera finale, all while the community collectively gasped in disbelief. But wait! The plot thickens!

In a twist worthy of a daytime drama, RedStone announced an extra 2% of RED tokens would be airdropped today, and Binance, in a moment of reconciliation, decided to list them after all. The price has bounced back like a rubber ball, but let’s be real—community resentment is like that stubborn stain on your favorite shirt; it just won’t wash out.

RedStone Airdrop Concerns and Binance Listing

RedStone, a DeFi oracle project that’s been riding the crypto wave like a surfer on a caffeine high, has hit a few bumps with its RED token airdrop. Over the past few months, it’s become the darling of the crypto community, garnering support from the Liquid Staking elite. But alas, the fairy tale took a turn.

Today was supposed to be the grand launch of RedStone’s native token, RED, with Binance ready to roll out the red carpet. But in a last-minute plot twist, RedStone announced that the airdrop would be smaller than a toddler’s attention span, prompting Binance to hit the brakes on the listing.

“Due to unexpected and last minute changes by RedStone to the allocation of their community airdrop distribution, the trading start time for RED will be suspended until further notice. RedStone had originally committed to distribute 9.5% of their total supply to the community via airdrop distribution. The project has now lowered this amount to 5% of the total supply,” it read.

Of course, this announcement sent shockwaves through the community, which was only exacerbated by Binance’s decision. It was like watching a car crash in slow motion—horrifying yet impossible to look away from.

Binance, the heavyweight champion of crypto exchanges, has a history of sending token prices soaring with its listings. But for a moment, it looked like RedStone was headed for a spectacular faceplant, prompting supporters to voice their frustrations:

“The RedStone airdrop situation is a mess. It looks like 95% of users received nothing, despite years of activity— people who spent 1-2+ years engaging with the project were completely ineligible. I’ve never seen a precedent like this. Every launch like this reinforces [that] there is no real transparency in airdrops, and every mistake like this damages the brand,” one user lamented.

But fear not! After Binance’s announcement, RedStone sprang into action, addressing the uproar with the grace of a cat on a hot tin roof. They amended their airdrop plan yet again, because who doesn’t love a good plot twist?

5% of RED tokens have already been distributed, and the remaining 4.5% will be doled out six months after TGE. And today, an additional 2% will be airdropped, because why not? It’s not like they have anything better to do!

After this rollercoaster of a day, Binance decided to reverse its earlier decision, and RED rallied back up, like a phoenix rising from the ashes—or at least a very confused chicken.

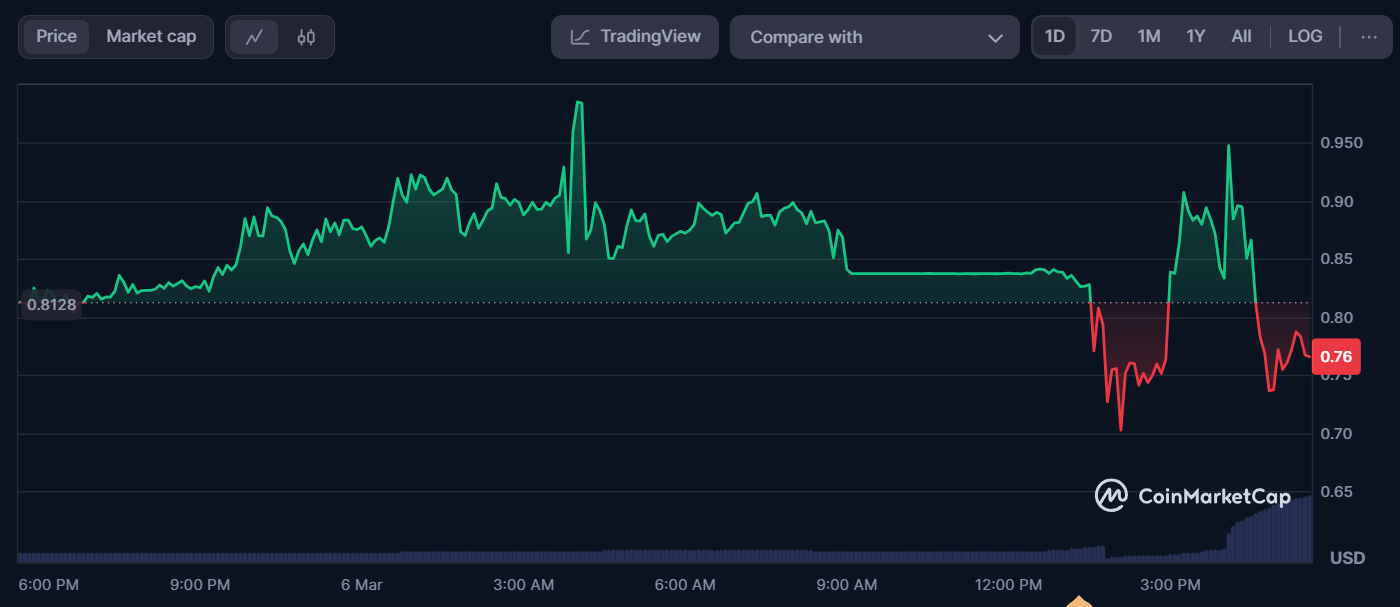

According to the ever-reliable data from CoinGecko and CoinMarketCap, RED launched at a modest $0.80 today. It briefly flirted with $0.98 after Binance’s re-listing announcement, but alas, it has yet to hit the coveted dollar mark. It’s like waiting for your favorite show to get renewed—full of hope but ultimately disappointing.

In the end, RedStone’s reputation may take a hit from this debacle, even though they scrambled to fix the mess. It’s a classic case of “you can’t unring a bell,” or in this case, “you can’t un-airdropped a token.”

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Everything We Know About DOCTOR WHO Season 2

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Every Minecraft update ranked from worst to best

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

2025-03-06 21:37