So, here we are in 2025, where centralized exchanges (CEXs) are having a bit of an identity crisis and are now flirting with decentralized exchange (DEX) features. It’s like watching your conservative aunt suddenly take up yoga and start talking about chakras. Who knew blending centralization and decentralization could be so trendy? 😏

With all the regulatory drama—think KYC and AML requirements—CEXs are feeling the heat. Enter DEXs, the cool kids on the block, offering anonymity and a laid-back vibe. Integrating DEX features is like putting on a pair of trendy sunglasses for CEXs; they can keep their users while still playing nice with the regulators. How very 2025! 🕶️

CEX-DEX Integration for Growth

CEXs and DEXs are like the odd couple of the crypto world. They’re both trying to figure out how to coexist without driving each other crazy. The lines are getting blurrier, and it’s all about combining strengths to keep users happy. Who knew crypto could be so… romantic? 💔

Recently, several CEXs have jumped on the hybrid bandwagon. Take Binance, for example. They’ve rolled out Binance Alpha 2.0, which lets users buy DEX tokens without the hassle of withdrawals. It’s like ordering takeout without the delivery fee—convenient and oh-so-tempting! 🍕

Then there’s MEXC with its DEX+, which is blending on-chain and off-chain trading like a master chef. It’s all about that seamless experience, darling! This trend is clearly aimed at wooing both traditional users and DeFi enthusiasts. Talk about a love triangle! 💞

“This is a brilliant move. Allowing CEX users to buy any DEX tokens directly from the CEX, no withdrawals needed,” said former Binance CEO CZ, probably while sipping a fancy latte. ☕

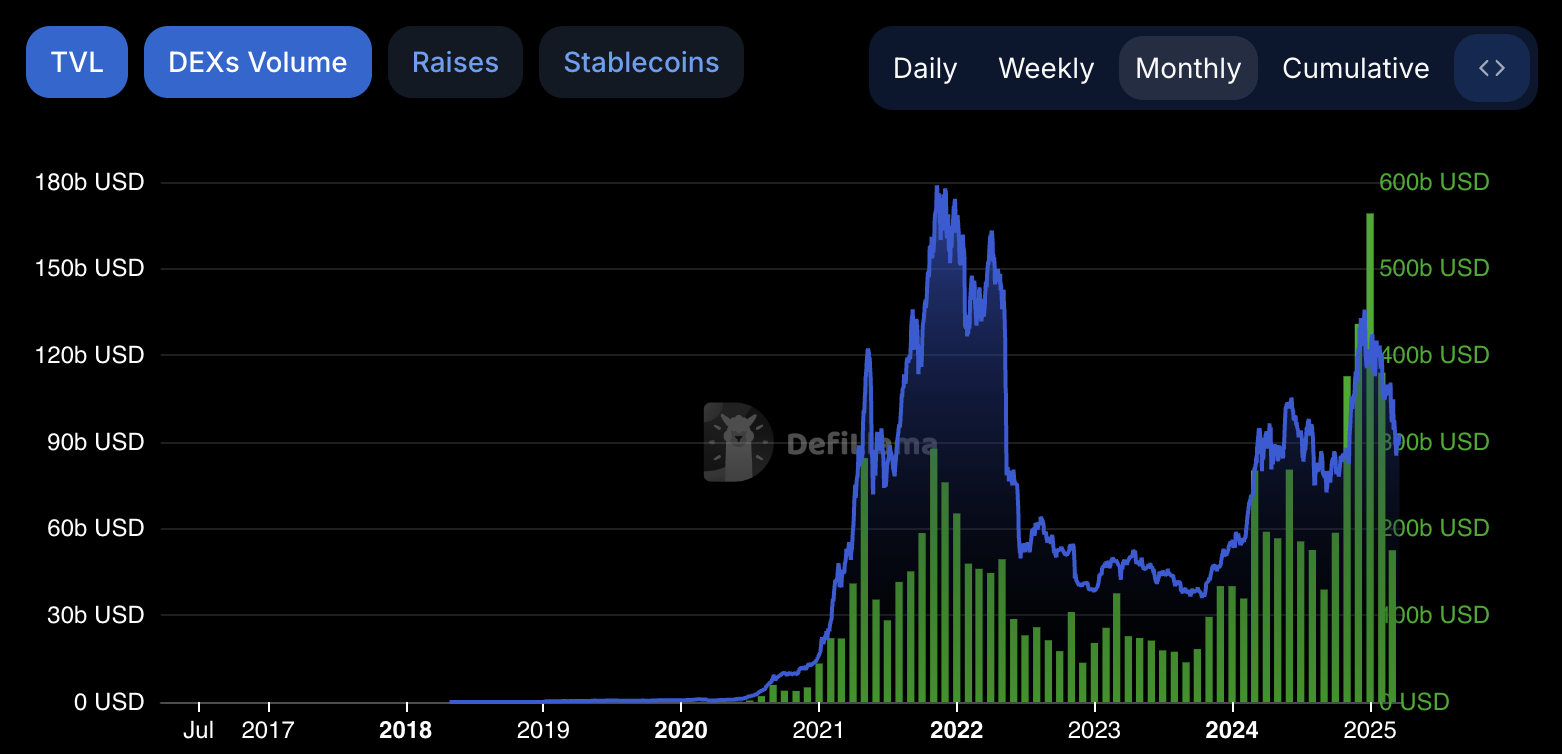

DEXs started making waves back in 2020, slightly outpacing CEXs in on-chain trading volume. But like a one-hit wonder, they peaked in 2021 and then… well, let’s just say they lost their groove in 2022 and 2023. 😬

According to OAK Research, at the start of 2024, DEXs held a mere 9.3% of the trading volume market share. But hold onto your hats! By January 2025, they soared past $320 billion in monthly trading volume, capturing over 20% of the spot trading volume for the first time in crypto history. Talk about a comeback! 🎉

Similarly, DeFiLlama reported that the Total Value Locked (TVL) in DEX was around $163.6 billion at the beginning of 2022. Fast forward to 2023, and it plummeted to about $52 billion. But wait! By December 2024, it surged back to around $140 billion. It’s like watching a soap opera—full of twists and turns! 📈

According to CoinGecko, there are now about 959 DEX platforms active in 2025, compared to just 217 CEXs. It’s a DEX party, and everyone’s invited! 🎊

Benefits and Challenges of CEX-DEX Integration

The differences between CEX and DEX are like a bad breakup—messy and full of misunderstandings. Users are craving the best of both worlds: the speed and liquidity of CEXs with the control and transparency of DEXs. The launches of Binance Alpha 2.0 and MEXC DEX+ are like relationship counseling for exchanges. 💔➡️❤️

Moreover, DEXs have been the innovators in this cycle with AMMs and liquidity pools, forcing CEXs to step up their game. It’s like a race, and nobody wants to be left behind! 🏁

With all the regulatory pressure on CEXs, the allure of DEXs is hard to resist. DEX integration allows CEXs to keep their users while tiptoeing through compliance. It’s a delicate dance! 💃

However, creating hybrid platforms isn’t all sunshine and rainbows. Integrating on-chain and off-chain systems is like trying to mix oil and water

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2025-03-20 13:03