Ah, the crypto market, that fickle mistress, continues to unleash her tempestuous wrath as digital asset investment products suffer their most extravagant weekly outflows to date.

Investor sentiment, it seems, is as sour as a lemon left out in the sun, with Bitcoin (BTC) clinging desperately to the psychological threshold of $90,000, despite the grand proclamations of President Donald Trump’s crypto reserve policy. One might wonder if the crypto gods are having a laugh at our expense! 😂

Crypto Outflows: A New Record of Absurdity

In a week that could only be described as a tragicomedy, crypto outflows have reached a staggering $2.9 billion, bringing the three-week total to a jaw-dropping $3.8 billion. This marks the third consecutive week of capital fleeing the crypto sector, a stark contrast to the preceding 19-week inflow streak, which saw a delightful $29 billion cascade into the market. Oh, how the mighty have fallen! 🥴

The latest CoinShares report, in its infinite wisdom, attributes these negative flows to a weakening sentiment across the crypto landscape. It cites the recent Bybit hack as a key player in this drama, alongside a more hawkish Federal Reserve and the ever-looming specter of macroeconomic concerns. Truly, a recipe for disaster! 🍵

//beincrypto.com/wp-content/uploads/2025/03/BTCUSD_2025-02-27_11-07-53-6.png”/>

Nevertheless, short Bitcoin positions saw minor inflows totaling $2.3 million, suggesting some investors are preparing for further downside. A curious strategy, indeed! 🤔

Despite the overall gloom, some digital assets have managed to attract inflows. Sui emerged as the best performer, charming investors with $15.5 million, while XRP followed with $5 million in inflows. These gains suggest that while the broader market is under pressure, certain projects continue to bask in the limelight. 🌟

For XRP, the sentiment remains bullish, driven by increasing anticipation of a US SEC (Securities and Exchange Commission) decision on an XRP ETF. The deadline for the SEC to approve or reject certain ETF applications has begun, and investors remain hopeful that XRP will gain regulatory clarity. Including XRP in Trump’s crypto reserve in the US could enhance this sentiment. A delightful twist, wouldn’t you say? 🎉

Notwithstanding, the latest round of outflows follows a concerning trend developed over the past few months. The previous week saw crypto outflows of $508 million, further exacerbating investor fears. Before that, the Federal Reserve’s hawkish rhetoric and concerning Consumer Price Index (CPI) data had already triggered the first major crypto outflows of 2025, with $415 million exiting the market. A veritable exodus! 🏃♂️💨

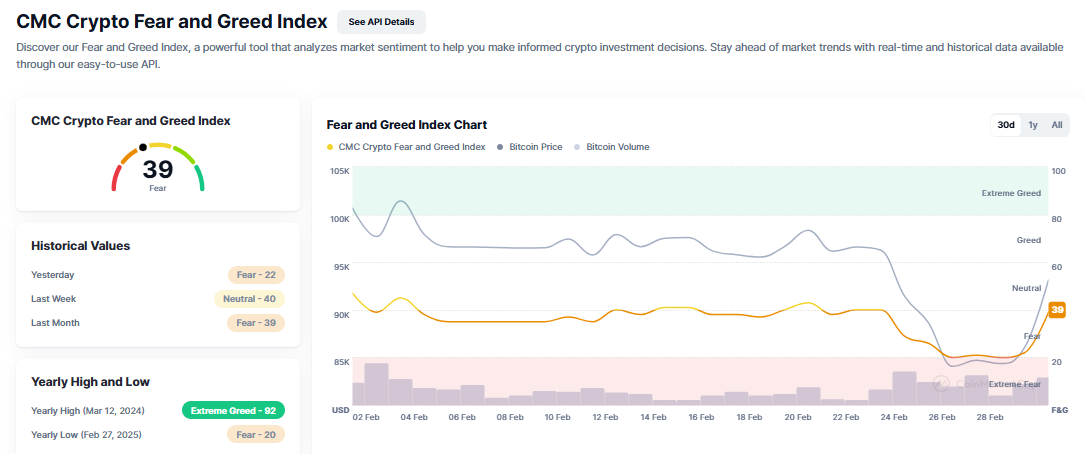

This series of unfortunate events has led some analysts to point to macroeconomic factors as the primary driver of the selloff, with investor sentiment still showing fear.

However, others argue that external policies like President Donald Trump’s tariffs have contributed to the uncertain market environment, stoking inflation fears and making risk assets like crypto less attractive. A classic case of blame-shifting!

Read More

- NRN PREDICTION. NRN cryptocurrency

- How Many Main Quests Are There in Monster Hunter Wilds?

- ONT PREDICTION. ONT cryptocurrency

- PUFF PREDICTION. PUFF cryptocurrency

- NFP PREDICTION. NFP cryptocurrency

- ATH PREDICTION. ATH cryptocurrency

- EUR INR PREDICTION

- LDO PREDICTION. LDO cryptocurrency

- MSOL PREDICTION. MSOL cryptocurrency

- ORDI PREDICTION. ORDI cryptocurrency

2025-03-03 17:11