Yesterday, Bitcoin decided to throw a party and hit a new record: $111,968. Yes, that’s right, the number practically screams, “Look at me!” So naturally, investors, perhaps fearing they’d miss the boat, flooded into spot Bitcoin ETFs with more than $900 million. Because who doesn’t love throwing money into a digital treasure chest that’s essentially a roller coaster? 🎢💸

That’s the biggest single-day money meltdown since April 22. Seems like Bitcoin’s runway show is back on, and everyone’s eager to get front-row seats.

$934 Million Flood into Bitcoin ETFs in a Day

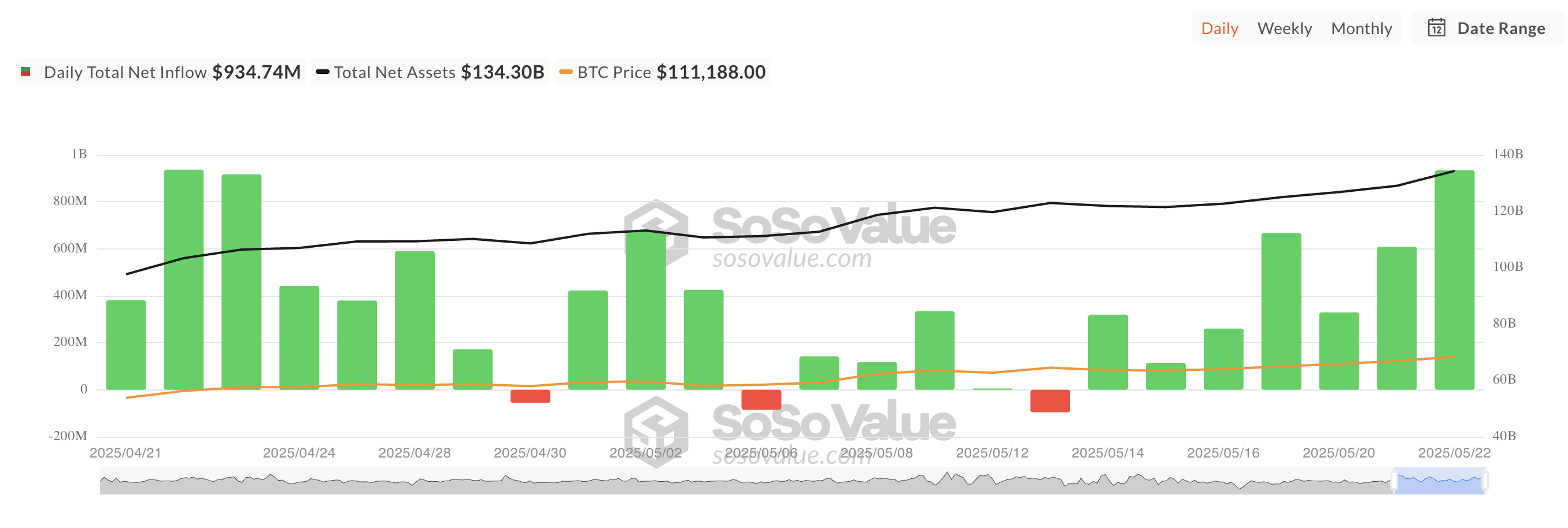

Yesterday, folks managed to stash away an astounding $934.74 million into BTC-backed funds. That’s the kind of inflow you’d expect if everyone suddenly believed their cryptocurrencies came with a money-back guarantee. According to SosoValue (which sounds like a slightly confused psychic), it was the seventh straight day of positive cash flow, proving that even institutions are annoyed enough to finally jump on the bandwagon.

Bitcoin’s upward performance this week appears to have ignited a burning desire for ETFs, which seems to be less about short-term gains and more about finally convincing people that this digital gold might actually be worth something someday. Or at least that’s what they hope, right?

On Thursday, BlackRock’s ETF IBIT took the cake with a $877.18 million daily influx, bringing its grand total to $47.55 billion. That’s billion, with a B. Meanwhile, Fidelity’s ETF FBTC scooped up a modest $48.66 million, pushing its total to a hefty $11.88 billion. Nothing says “we’re in it for the tech” like billion-dollar figures.

BTC Pulls Back Slightly as Traders Lock In Gains

Now, the glorious rally took a tiny breather. Bitcoin dipped to $110,752—a 1% drop, or about the price difference between a fancy latte and a decent sandwich. Many traders decided, “Hey, I’ve enjoyed my moment in the sun. Time to take profits.” It’s like the digital equivalent of grabbing a croissant from the bakery before everyone else does.

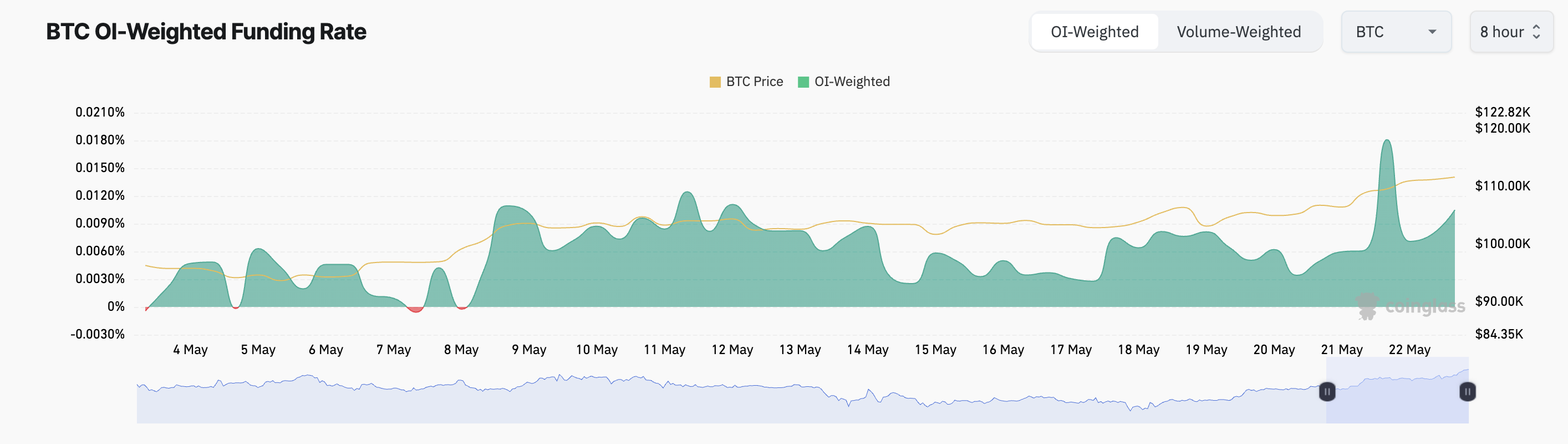

That said, the bulls aren’t retreating. Futures traders continue to show resilience, happily paying a small premium—0.0105%—to stay long. Apparently, those guys think Bitcoin has a little more juice left in its tank.

This persistent demand to leverage up suggests traders are betting on more upside, or perhaps simply refusing to accept that today’s dip is anything more than a quick pit stop on the way up. Healthy, right?

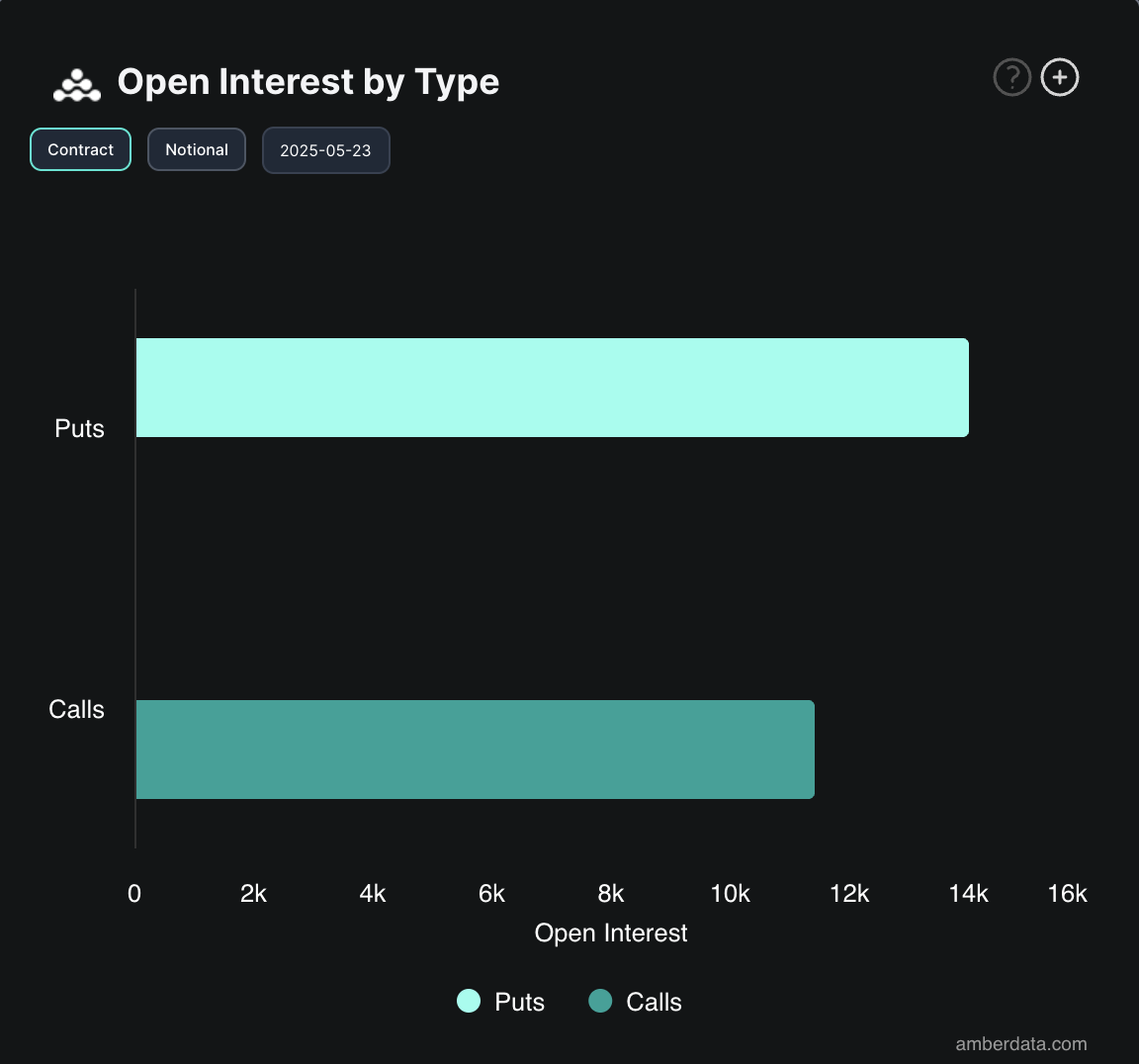

But then, reality sneaks in. The options market—and by that I mean, the cryptic exchange where yes, people are paying premium for downside protection—shows more put options than calls. Basically, traders are hedging their bets like nervous grandparents at a roulette wheel, fearing the whole thing might fall apart.

So, amidst all this exuberance, there’s a cloud of cautious skepticism lingering in the background, proving once again that the crypto world is equal parts bubble and genius—just like your uncle’s questionable investment schemes.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2025-05-23 10:53