Ah, dear participants of the crypto bazaar! This week, as the winds of US economic data blow fiercely, one must prepare for the tempest that may rattle their portfolios. The echoes of the Consumer Price Index from last week still linger, casting shadows of volatility upon the market.

And lo! On this fine Monday, while the nation celebrates President’s Day, the markets may slumber, yet Bitcoin (BTC) remains a restless spirit, trading on in the shadows.

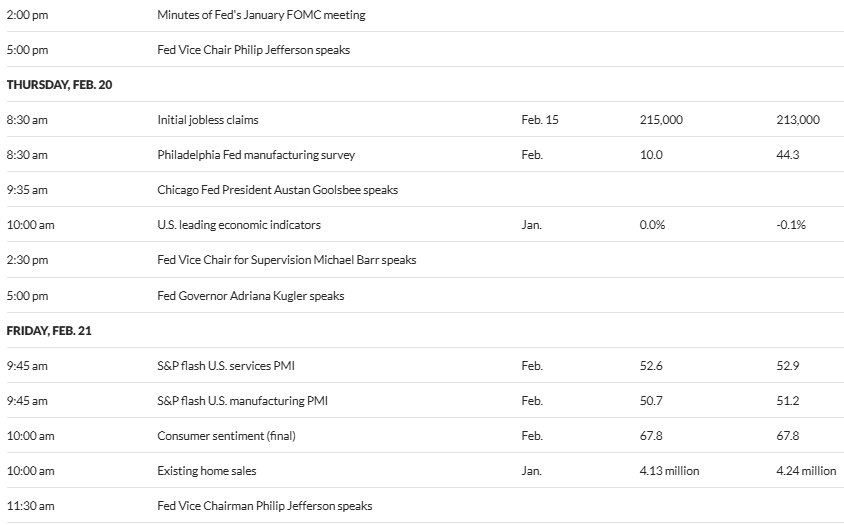

US Economic Events on the Crypto Calendar This Week

As the influence of US economic data looms large, traders and investors must keep their eyes peeled for the following revelations this week.

January FOMC Minutes

On Wednesday, February 19, the Federal Reserve shall unveil the minutes from their January gathering, a document of great import. What the wise policymakers utter may guide the market’s perception of the Fed’s interest rate intentions.

These minutes arrive on the heels of reports indicating a month-over-month inflation leap, a harbinger of bad tidings for the crypto realm. Yet, fear not, for signs of inflation re-acceleration remain elusive.

Jerome Powell, the Fed chair, with a demeanor as calm as a summer’s day, assured the Senate Banking Committee that he is in no rush to lower interest rates. Meanwhile, President Trump, ever the optimist, clamored for more substantial cuts to combat inflation, but Powell stood his ground like a steadfast oak.

Market participants now brace themselves for further adjustments, eagerly awaiting policy updates. The January FOMC minutes may shed light on whether rate cuts are on the horizon or if the policymakers lean towards a more hawkish stance.

“The minutes are expected to echo Powell’s testimony on economic conditions from last week,” quipped financial market analyst Atif Ismael.

Initial Jobless Claims

In addition to the FOMC minutes, the crypto market shall keenly observe the initial jobless claims on Thursday, a window into the labor market’s soul. For the week ending February 15, a staggering 213,000 citizens filed for unemployment insurance.

This figure, alas, fell short of expectations and was a decline from the previous week’s revised count of 220,000. The Department of Labor reported a seasonally adjusted insured unemployment rate of 1.2%. MarketWatch predicts a median forecast of 215,000 for this week’s claims.

Higher jobless claims suggest a growing economic malaise, leading to diminished consumer spending. This slowdown has prompted the Fed to ponder rate cuts, a remedy for the ailing economy.

//beincrypto.com/wp-content/uploads/2025/02/BTC-54.png”/>

Yet, before the economic revelations unfold, Bitcoin (BTC) finds itself trading at $95,984

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-17 15:35