In a scene reminiscent of a cat trying to leap over a puddle, the House of Representatives found itself in a bit of a muddle, failing to pass a procedural rule to push forward three shiny crypto-related bills. Among these was the illustriously titled GENIUS Act, a bill so high-profile it practically wore sunglasses indoors, purportedly aimed at regulating those slippery little critters known as payment stablecoins. Alas, the plans of the GOP leadership to whip America’s crypto policy into shape before everyone scattered for August recess fell flatter than a pancake under a particularly heavy elephant.

Not one to miss an opportunity to tweet out a political storm, Trump — our MAGA maestro — unleashed a clarion call from the glittering kingdom of Truth Social on a Tuesday morning, demanding Republicans get their act together and “get the first vote done this afternoon.” Such a rallying cry could inspire the sort of fervor found in a school of fish trying to avoid a shark, but it turns out even his magical sway couldn’t prevent the pesky matter of reality.

In an unexpected plot twist worthy of a soap opera, thirteen heroic Republicans — the kind you’d more likely find in a tavern than a congressional chamber — decided to abandon their party leadership in favor of playing footsie with the Democrats. The result? A spectacular crash and burn of the procedural vote, which is a bit like crashing a very unfortunate wedding where everyone’s told not to bring their own drinks.

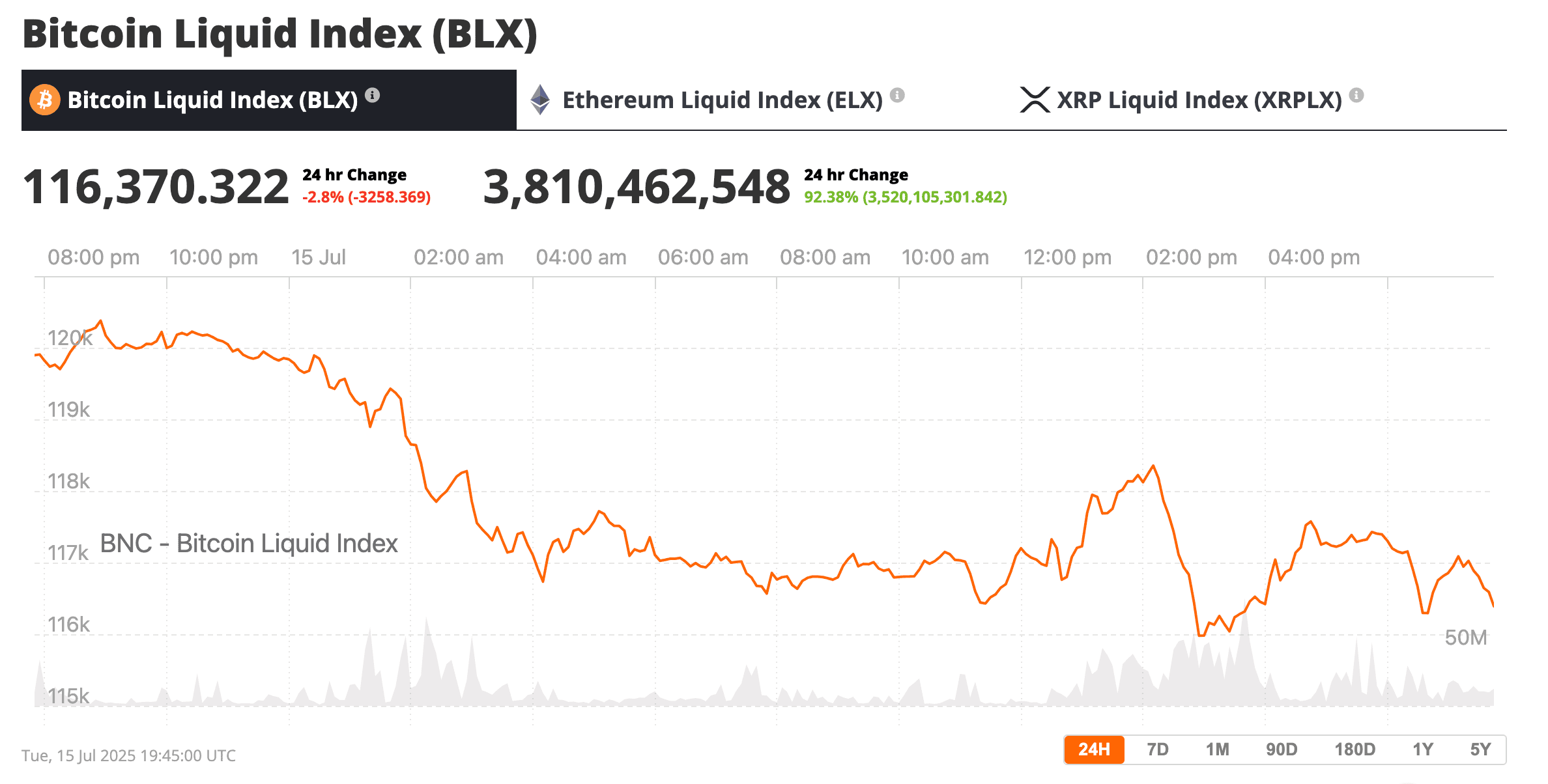

The reverberations sent a delightful shudder through the digital asset markets, with Bitcoin (BTC) and Ethereum (ETH) dropping approximately 0.5%, a statistic that resulted in gasps of horror from day traders and more people trying to calculate their losses than a room full of accountants on Tax Day.

The legislative package, dubbed “Crypto Week” by its proud GOP creators, included bills focusing on market structure, stablecoin regulation, and a framework so robust it might just compete with the best the Founding Fathers could whip up (minus the wigs, naturally). The GENIUS Act had already wormed its way through the Senate with bipartisan cheerleading — a feat even Olympic gymnasts might envy.

Although House Speaker Mike Johnson hinted at another vote that could occur later that very day, this setback uncorked a fine bottle of GOP discord, especially among the House Freedom Caucus members who were chafing under the Senate’s reign like a horse wearing a saddle two sizes too small.

Behind-the-Scenes Scramble with a Side of Suspicion

Trump’s vocal support for the GENIUS Act has raised eyebrows akin to those of a particularly inquisitive cat. Critics are now pointing fingers at potential conflicts of interest faster than a magician’s assistant can pull a rabbit from a hat, all tied back to World Liberty Financial (WLF), a crypto firm with ties to the Trump family deep enough to plant a flag in. WLF has proudly introduced its own stablecoin, USD1, which was co-developed with a partner who, rumor has it, might have a penchant for elaborate magic tricks (and possibly shady deals).

This revelation sent bipartisan shockwaves through Congress, prompting Rep. Maxine Waters (D-CA) to declare, with all the solemnity of a grave historian:

“Foreign investment is not just a business deal; it’s a direct payment to the sitting US president with the goal of currying favor and influence within the White House.”

Feeling their oats, Democrats promptly declared an “anti-crypto corruption week” of their own, a move just as likely to garner attention as a catwalk model tripping over her own feet, calling for ethics reforms to prevent the president, vice president, and Congress members from holding or promoting digital assets. Ah, the irony!

Crypto Week: Not Quite in the Grave Just Yet

Despite the initial vote hiccup that sent the crypto world into a spiral reminiscent of a rollercoaster ride, the momentum behind this grand legislative venture still holds some promise. Lawmakers are anticipating more vote action as soon as Wednesday or Thursday, with supporters asserting that these bills will finally shine a much-needed light on the murky waters of digital asset markets and protect consumers — or at least prevent them from stepping on too many Lego pieces.

However, the legislative sausage-making process appears to be less of a gourmet affair and more like a backyard BBQ gone awry. While procedural hiccups are par for the course in the House, this latest intra-party rebellion, especially after a direct Trump endorsement, signifies a significant ideological rift within the GOP regarding how to approach crypto regulation and the extent to which Trump’s business endeavors should shape policy.

If the bill manages to wiggle its way past these hurdles this week, then the current dip might just be the opportune moment for crypto enthusiasts to dive in, armed with wallets at the ready. Or perhaps just a lot of popcorn to watch this show unfold.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Wuthering Waves – Galbrena build and materials guide

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- 📢 New Prestige Skin – Hedonist Liberta

- The Most Anticipated Anime of 2026

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2025-07-15 23:48