Ah, the world of crypto! This week, it seems like the universe has decided to throw a few major events into the blender and hit “frappe.” Among the top stories are a jaw-dropping Solana unlock, Aave’s debut on Sonic Layer-1 (L1), and the KernelDAO token launch. Grab your popcorn! 🍿

Each of these events promises to be a rollercoaster ride through the crypto cosmos, offering insights and potential growth opportunities that traders and investors will likely pounce on like a cat on a laser pointer. 🐱💨

$1.9 Billion Solana Unlock

This week’s pièce de résistance is the unlocking of a staggering $1.9 billion worth of Solana (SOL) on March 1. That’s right, folks—roughly 11.2 million SOL tokens will be released, which is about 2.2% of Solana’s current circulating supply (around 488 million SOL). Talk about a party! 🎉

Now, this little shindig is tied to the FTX bankruptcy estate. Yes, the same FTX that went belly-up faster than a kid on a slip-n-slide. The tokens come from FTX’s liquidation process, where they sold locked SOL at bargain basement prices of around $64 to $102 per token to big players like Galaxy Digital and Pantera Capital. Who knew bankruptcy could be so lucrative? 💸

As of this writing, SOL is trading for around $158.91, so these institutional buyers are sitting on some serious unrealized profits. The unlock happens this Saturday, and the big question is: will they hold or sell? 🤔

A mass sell-off could flood the market, potentially tanking SOL’s price faster than you can say “crypto crash.” But if they hold, we might just see Solana’s ecosystem continue to grow. Meanwhile, retail investors are already selling off SOL in a panic, fearing a dip. It’s like watching a bunch of chickens run around with their heads cut off. 🐔💨

“While the team’s, seed investors’, and foundation’s shares are locked (also about 40%), the release of such a large volume poses a risk of market shock,” a popular account on X stated. Well, no kidding! 😱

Technicals aren’t looking rosy either as Solana buyers retreat. But hey, SOL fundamentals like its fast, low-cost blockchain and rising adoption could cushion the blow long-term. Remember the last unlock? It kicked off a bull run, but that was back when the market was less mature—like a fine wine that still needs to breathe. 🍷

Aave Debuting on Sonic L1

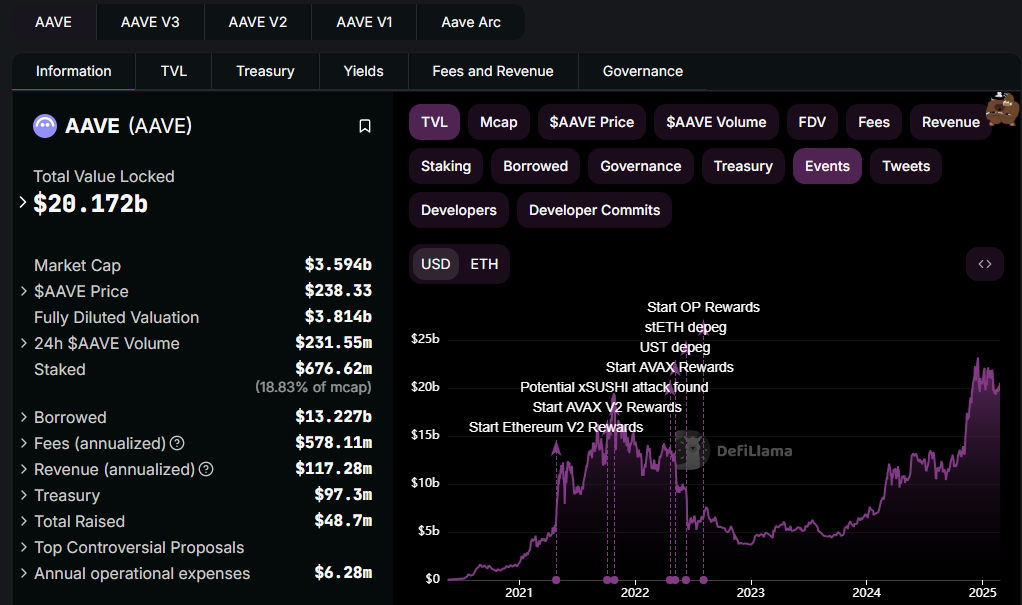

In December, Sonic Labs hinted at bringing the $22 billion lending market to Sonic. And guess what? This week, Aave is going live on Sonic! This is a big deal, considering Aave dominates the DeFi lending market with $20 billion in total value locked (TVL). Talk about a power move! 💪

Launching on the L1 means Sonic users can tap into on-chain native credit lines and offer liquidity to other investors. Sonic’s high transaction speed and fee-sharing model could be the cherry on top of this crypto sundae. 🍒

“AAVE will be the tangible breakthrough for Sonic that gets it from ‘small but promising chain’ to full-fledged powerhouse,” popular user Jack the Oiler observed. Sounds like a crypto fairy tale! 🧚♂️

This partnership also means a $63 million liquidity commitment, including contributions from various sources. The Sonic Foundation pledged $15 million, with an additional $20 million promised in Circles USD Coin (USDC). It’s like a financial buffet! 🍽️

The funding will also include up to 50 million S tokens from Sonic, while Aave would contribute $800,000 in stablecoins. This sizable liquidity commitment is like the financial backbone for Aave’s introduction to the Sonic network. Talk about a solid foundation! 🏗️

Nvidia Earnings

Nvidia’s earnings report is also on the crypto watchlist this week. The fiscal fourth quarter (Q4) report, ending January 2025, is set to drop this Wednesday, February 26. Investors are on the edge of their seats, waiting for the market to close

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-02-24 17:57