In a plot twist that could only be rivaled by the most absurd of intergalactic escapades, the Lazarus Group has successfully laundered all the unfrozen funds it pilfered from the recent Bybit hack. Using THORChain’s DEX, they converted ETH tokens faster than you can say “What on Earth is going on?” This, of course, sparked a delightful cacophony of community criticisms. 🎭

Some users, in a fit of righteous indignation, pointed fingers at THORChain validators, claiming they could have stopped the transactions. Others, with a flair for the dramatic, defended the platform, insisting it’s an open-source and decentralized organization, not a law enforcement agency. Because, you know, who needs the police when you have a blockchain? 🚓

Lazarus Laundered Bybit’s Money

In a stunning revelation that could only be described as “not surprising at all,” Arkham Intelligence, the blockchain analytics platform, announced a new development in the Bybit hack saga. They posted a bounty for information about the incident, only to discover that the Lazarus Group was, in fact, responsible. Today, they confirmed that all the funds from the Bybit hack have been successfully laundered. Surprise, surprise! 🎉

“Lazarus has now fully laundered the proceeds of the Bybit hack. They have transferred 500,000 ETH mainly to native BTC. Thorchain has processed over $5.5 billion in volume since Bybit was hacked on the 21st of February,” Arkham claimed via social media, probably while sipping a piña colada. 🍹

The Bybit hack, which was the largest crime in crypto history, stole a staggering $1.5 billion in Ethereum tokens. Just two days ago, analysts confirmed that Lazarus had already laundered 70% of the stolen Bybit funds. Talk about efficiency! 🏃♂️💨

Lazarus moved with the speed of a caffeinated cheetah. Yesterday, Bybit CEO Ben Zhou noted that 83% had been converted to Bitcoin, and now the entire supply has been processed. It’s almost as if they had a plan or something! 🤔

Bybit CEO Zhou also claimed that Lazarus laundered 72% of Bybit’s assets through THORChain, a decentralized exchange/blockchain network. The vast majority of transactions converting ETH to BTC went through this exchange, which is now probably the most popular place to be if you’re a criminal mastermind. 🕵️♂️

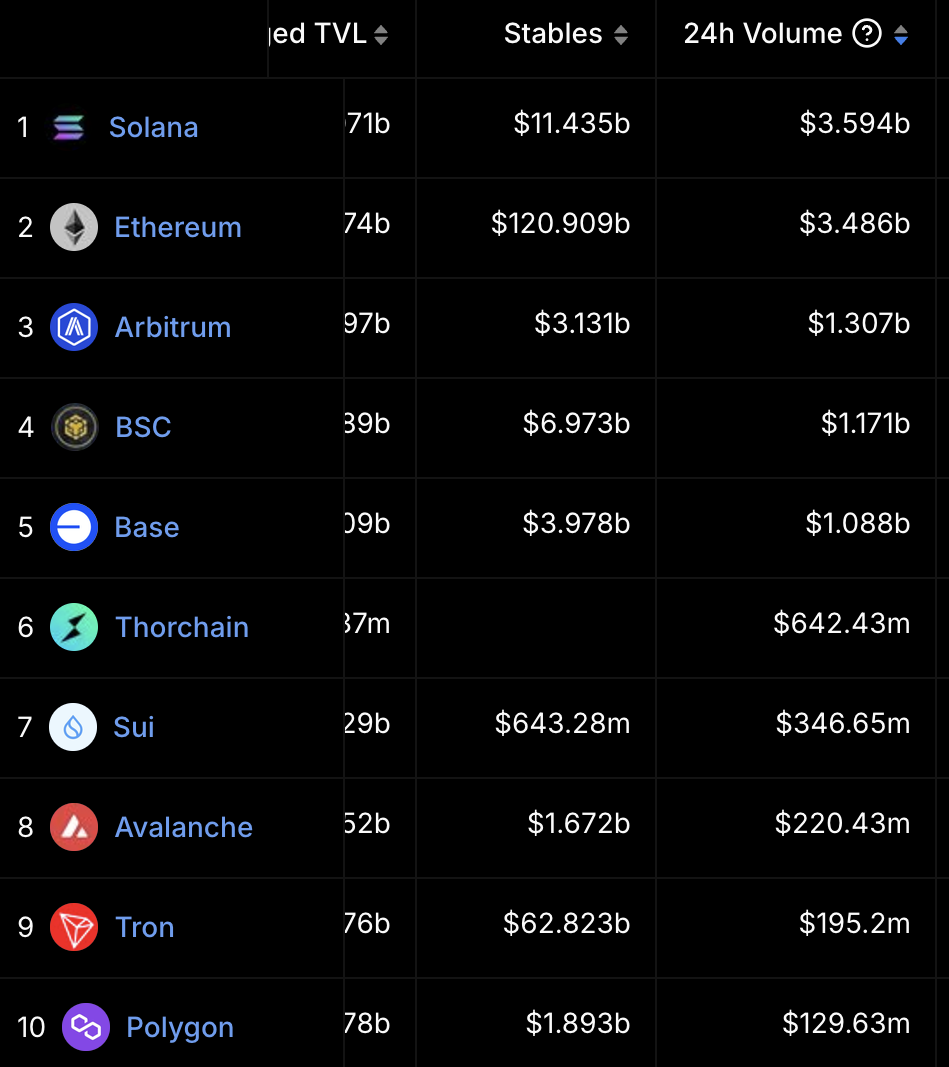

Also, THORChain’s 24-hour trading volume spiked due to the sheer size of these transactions, surpassing several much more prominent networks. Who knew laundering could be so lucrative? 💰

Already, a few people have begun blaming THORChain for the debacle. As one user pointed out, the Lazarus Group laundered huge quantities of Bybit’s money, and the exchange did nothing to stop them. It actually collected $3 million in fees from the affair. Cha-ching! 💵

Still, THORChain defenders have pointed out that it is open-source and decentralized, not a law enforcement agency. Because, of course, decentralization means you can just sit back and watch the chaos unfold. 🥳

“The only reason why people feel that THORChain should censor transactions is the general feeling that if they put enough pressure on Node Operators, they will buckle under pressure (which honestly can happen). Nobody is asking that from Bitcoin and Ethereum, because it feels impossible. Thorchain needs to win the battle of narratives,” said Runemir, Chief Narrative Officer at Qi Capital, probably while contemplating the meaning of life. 🌌

In short, the whole affair is messier than a three-headed monster at a pie-eating contest. Taking the pro-THORChain arguments at face value, decentralized institutions are structurally vulnerable to facilitating massive finance crimes. If the Lazarus Group can successfully use these platforms to launder billions, that’s simply the cost of doing business. It’s hardly an appealing picture of decentralized finance as an economic model. 🤷♂️

On the other hand, the loudest criticisms also leave something to be desired. THORChain

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

- Every Minecraft update ranked from worst to best

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

2025-03-05 03:13