Well, well, well! It seems the latest CPI data has decided to throw a party, and guess what? US inflation has hit a staggering 3% year-over-year as of February 12, 2025! Core inflation is strutting around at 3.3%. Talk about a surprise guest! 🎉 And how are our dear crypto investors reacting? Spoiler alert: not well. 😬

In a dramatic twist, the overall crypto market cap has taken a nosedive of 5% today, with Bitcoin slipping below the oh-so-important $95,000 mark. Ouch! 💔

Soaring Inflation: The Kryptonite to Crypto’s Superhero Status

This inflation spike is the highest we’ve seen since June 2024. Market players are clutching their pearls, worried that the Fed might tighten its policy sooner than a pair of skinny jeans after a holiday feast. 🍽️ They’re flocking to safer assets like moths to a flame, leaving our beloved crypto in the dust. Expect some short-term volatility as traders adjust their positions like they’re trying to fit into last year’s summer wardrobe.

Investors are watching the situation like hawks. Some might just jump ship to less volatile investments, which could lead to more price swings than a toddler on a sugar high. Analysts predict the market will remain as unsettled as a cat in a room full of rocking chairs until the Fed gives us some clear signals. 🐱

In a recent Senate Banking Committee meeting, Fed Chairman Jerome Powell declared he’s not in a hurry to cut interest rates. Meanwhile, President Trump is out there pushing for bigger rate cuts like he’s trying to win a game of Monopoly. But Powell? He’s holding firm like a bouncer at an exclusive club. 🚫

Market participants are now bracing for more adjustments, waiting for the next policy update like it’s the next season of their favorite reality show. 📺

“A bit of reverse wealth effect may be the top factor to alleviate inflation, which means highly speculative crypto’s at the forefront. The US stock market added about $12 trillion of market capitalization in 2024 – the most ever and about 40% of GDP. It may be silly to expect inflation to drop until risk assets do, with the stock market cap stretched to over 2x GDP – the most in about a century,” wrote analyst Mike McGlone. Sounds like a real page-turner, doesn’t it? 📈

The market was already reeling from Trump’s earlier tariffs on Canada, Mexico, and China. The potential of a trade war and macroeconomic factors triggered a $2 billion liquidation in the crypto market on February 3. 💥

Some reports suggested that liquidations were more than $10 billion, exceeding the 2022 levels during the FTX collapse. Yikes! 😱

However, the market has since rebounded a bit after tariffs against Canada and Mexico were paused for a month. Today’s inflation data might just add a little spice to the short-term bearish sentiment. 🌶️

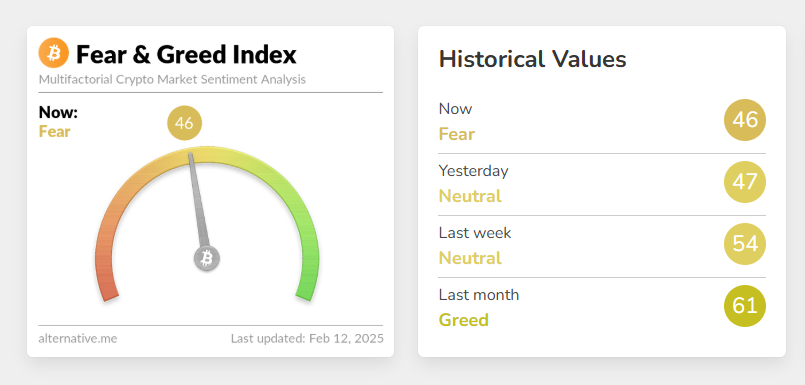

Since today’s CPI announcement, Bitcoin’s Fear and Greed index has dropped to ‘Fear.’ Many analysts, including Arthur Hayes, are predicting that BTC might plummet to $70,000 given the current uncertain macroeconomic conditions. Hold onto your hats, folks! 🎩

Yet, long-term predictions are still as bullish as a stampede of charging bulls. Most analysts believe that the asset will likely surge to new all-time highs before the year wraps up. Fingers crossed! 🤞

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

2025-02-12 18:02