Ah, today, a day like no other, over $3 billion worth of Bitcoin and Ethereum options are set to expire. A staggering $2.5 billion in BTC and nearly $500 million in ETH contracts will be settled. One wonders, how will the prices of these digital treasures react? Perhaps with a dramatic flourish, or a mere shrug?

As the clock strikes 8:00 UTC on Deribit, the crypto market may very well be inspired to dance a wild jig of volatility. 🎭

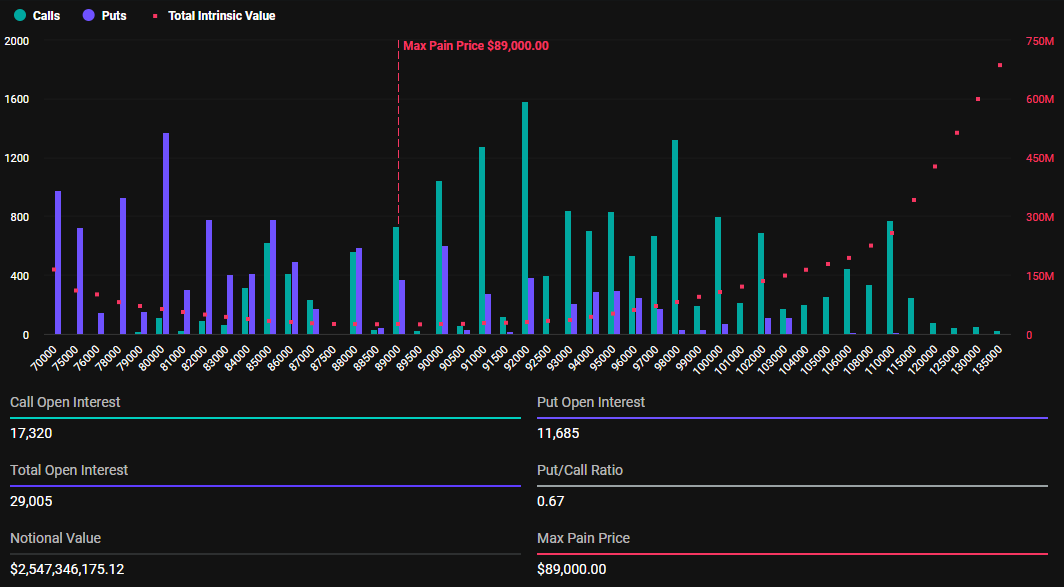

Bitcoin Faces $89,000 Max Pain in Today’s Options Expiry

On this fine day, March 7, a staggering 29,005 Bitcoin contracts, valued at $2.54 billion, are poised to meet their fate. According to the wise sages at Deribit, Bitcoin’s put-to-call ratio stands at a curious 0.67. The maximum pain point—the price that will bring the most financial woe to the greatest number of holders—is a rather specific $89,000. How poetic!

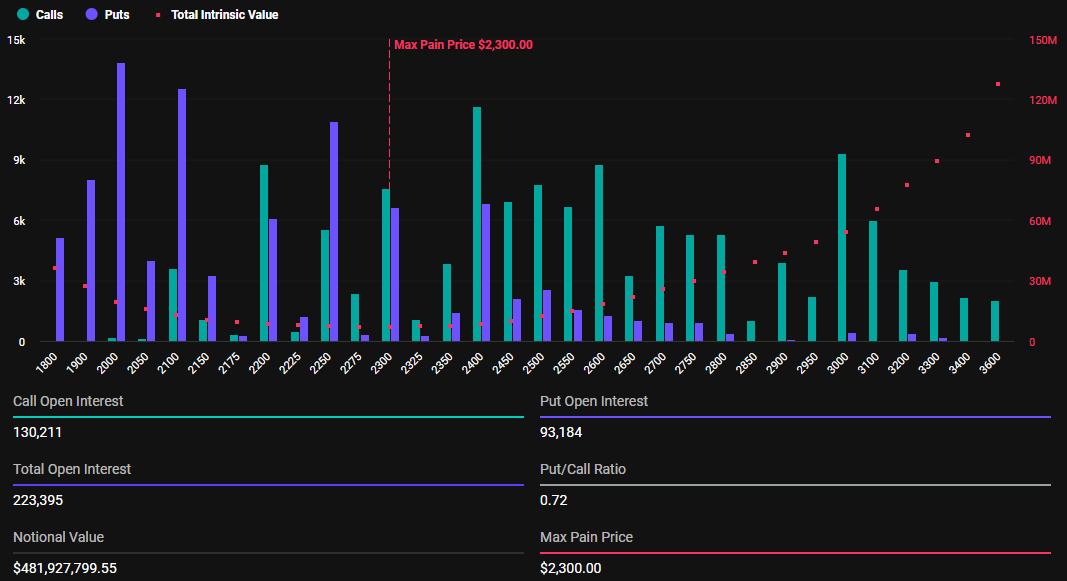

Meanwhile, Ethereum, that ever-elusive creature, sees the expiration of 223,395 contracts worth $481.9 million. Its maximum pain point is a modest $2,300, with a put-to-call ratio of 0.72. Ah, the numbers dance like leaves in the wind!

The maximum pain point in this curious crypto options market represents the price level that inflicts the most financial discomfort on option holders. A delightful irony, wouldn’t you say? The put-to-call ratios, both below 1 for Bitcoin and Ethereum, suggest a greater inclination towards purchase options (calls) over sales options (puts). A sign of optimism, or mere folly?

Insights from the oracle known as Greeks.live reveal a prevailing bearish sentiment, with traders expressing their frustrations over the extreme volatility and choppy price action. It seems the market is akin to a tempestuous lover—unpredictable and often disappointing.

Bitcoin’s sharp intraday swings, including a recent $6,000 leap, have led traders to describe the situation as “scam both ways.” How charming! According to the analysts at Greeks.live, establishing a clear directional trend is akin to finding a needle in a haystack.

“Most traders are watching the 87,000-89,000 range as key resistance, with 82,000 noted as a recent bottom, though there is significant disagreement on whether a sustainable bottom has been found,” mused Greeks.live.

Moreover, the pronounced put skew reflects a broader pessimism, as traders cling to their downside protection like a child to a security blanket, despite the occasional upward moves. The analysts observe that traders are adjusting their strategies amidst this high volatility, as if they were dancers in a chaotic ballet.

“Several traders are selling calls at the 89,000-90,000 range as a preferred strategy in this environment, with one trader lamenting they’re at -260% on calls bought at lower levels,” added the ever-astute Greeks.live.

The belief that the market is currently in a liquidity-driven phase has led to a focus on quick entries and exits. This level of caution is wise, as longer-term positions remain vulnerable to abrupt swings. External macro factors, such as shifting trade policies and tariff announcements, add to the uncertainty, like a cloud of smoke in a dimly lit room.

As a result, many traders are choosing to remain on the sidelines, waiting for clearer signals before committing to new positions. A prudent choice, indeed!

“With markets on edge, where do you think price action will land? Above or below max pain?” posed Deribit in a post on X (Twitter). A question for the ages!

Nonetheless, traders must remember that option expiration has a short-term impact on the underlying asset’s price. Generally, the market will return to its normal state shortly after, perhaps even compensating for strong price deviations. A comforting thought, if one can find solace in such chaos.

Traders should remain vigilant, analyzing technical indicators and market sentiment to navigate potential volatility effectively. Meanwhile, these developments come after US President Donald Trump signed the strategic Bitcoin reserve order, a move that has left many scratching their heads.

Notably, the order

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-07 09:40