Ah, the crypto bazaar is poised to witness a staggering $3.29 billion in Bitcoin and Ethereum options expiring today! A spectacle that promises to unleash a tempest of short-term price volatility, leaving traders clutching their pearls in anticipation of profit or peril.

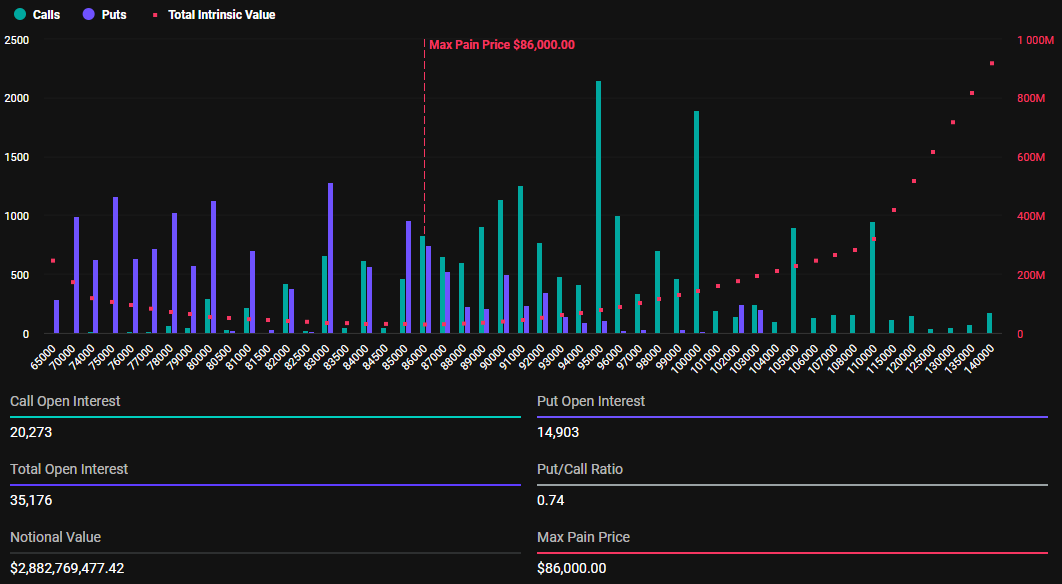

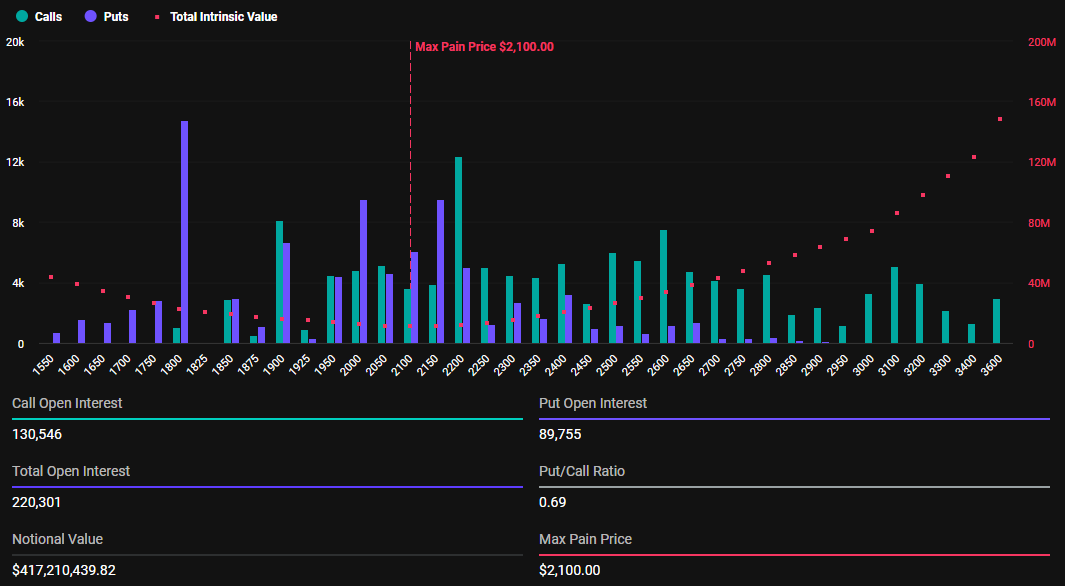

In this grand financial theater, Bitcoin (BTC) options take the lion’s share with a whopping $2.88 billion, while Ethereum (ETH) options, bless their hearts, account for a mere $417 million. One can almost hear the coins clinking in the pockets of the hopeful!

Bitcoin and Ethereum Holders Prepare for the Rollercoaster 🎢

According to the oracle of Deribit, a staggering 35,176 Bitcoin options are set to meet their fate today, a slight uptick from last week’s 29,005 BTC contracts that met their untimely demise. The put-to-call ratio stands at a curious 0.74, with a maximum pain point of $86,000—oh, the irony!

This put-to-call ratio, dear reader, suggests a generally bullish sentiment, even as our beloved Bitcoin continues its descent from the lofty heights of $90,000. One might say it’s like watching a bird trying to fly with a broken wing!

Meanwhile, 220,301 Ethereum options are also on the chopping block today, a slight decrease from last week’s 223,395. With a put-to-call ratio of 0.69 and a max pain point of $2,100, these expirations could very well send ETH’s price on a whimsical dance.

As the clock strikes 8:00 UTC today, Bitcoin and Ethereum prices are expected to waltz toward their respective maximum pain points. According to the wise sages at BeInCrypto, BTC was trading at $81,992, while ETH was exchanging hands for $1,891. A curious coincidence, wouldn’t you say?

This hints at a potential recovery for our crypto comrades, as the so-called “smart money” attempts to nudge them toward the “max pain” level. Ah, the Max Pain theory—where prices gravitate toward strike prices like moths to a flame, only to be singed in the process!

“Max pain has been ticking lower week after week. Do you see this continuing, or is a reversal coming?” pondered the analysts at Deribit, as if they were divining the future with a crystal ball.

Nevertheless, the pressure on BTC and ETH prices is likely to ease after 08:00 UTC on Friday when Deribit settles the contracts. But fear not, for the sheer scale of these expirations could still ignite a frenzy of volatility in the crypto markets—like a cat among pigeons!

Analysts Mull Over Crypto Market Sentiment 🤔

According to the seers at Greeks.live, market sentiment is predominantly bearish in the short term, despite the positive US CPI (Consumer Price Index) data that danced across our screens earlier this week.

“Traders are watching key potential support levels and discussing a potential bottom for BTC, with some suggesting $60,000 levels as a possible downside target,” the analysts mused, as if they were discussing the weather.

They also note that some believe President Trump’s tariffs and inflation are more significant market drivers than geopolitical events like a Ukraine peace deal. Oh, the irony of politics influencing our beloved crypto!

“Vladimir Putin says he agrees with proposals for ceasefire – but adds he has questions and Russia ‘now on the offensive in all areas’,” reported Sky News, as if the world were a stage and we were all mere players.

Analysts opine that peace and stability could fuel market confidence, which might just be bullish for stocks and crypto alike. This aligns with a recent JPMorgan survey, where 51% of traders identified tariffs and inflation as the top market movers for the year. Who knew economics could be so thrilling?

Elsewhere, analyst Tony Stewart delves into the labyrinth of option flows

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-03-14 09:42