The cryptocurrency market opens on Wednesday, Oct. 15, under the shadow of both whale wallets and regulators-though one might argue that the real shadow is the ever-watchful eye of the U.S. government, which seems to have a vested interest in the affairs of stolen Bitcoin. 🐺💰

Ripple is putting up $200,000 for white hats to attack its new lending protocol, while Coinbase has announced a direct bet on India’s growing crypto economy via CoinDCX. A noble endeavor, if one can ignore the irony of paying hackers to test security. 🧠💥

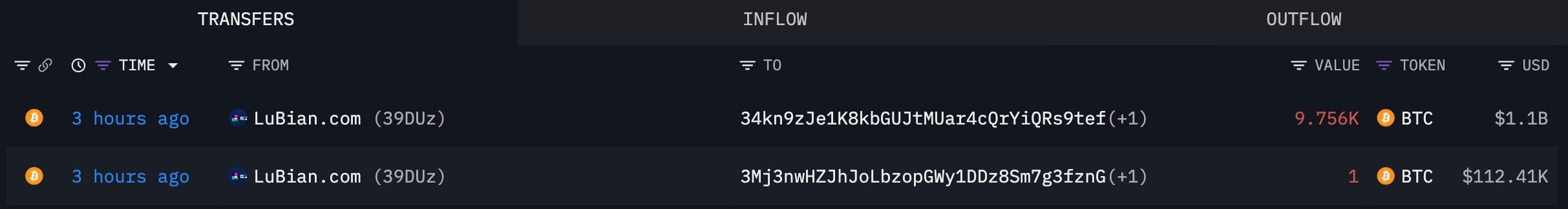

Bitcoin battles $112,000 as $1.1 billion LuBian wallet sparks fresh fears

The LuBian-linked wallet shift hit the market at the worst possible time – it is still bleeding from last Friday’s $19 billion liquidation cascade. The address is linked to the LuBian exchange hack, which was one of the biggest crypto heists ever. 🕵️♂️💸

Years ago, almost 127,000 BTC – that is $14.4 billion at today’s prices – was stolen, and the U.S. government has just announced plans to confiscate the stash. The next day, 9,757 BTC worth $1.1 billion moved after three years of nothing. One might say the U.S. government is as relentless as a persistent suitor, always chasing the stolen coins with the fervor of a man who’s lost his fortune and his dignity. 💸🕵️♂️

That timing is no coincidence. It seems that either insiders are trying to stop the seizure, or the stolen coins are being moved around to see how much surveillance the system can handle. A game of cat and mouse, but with more Bitcoin and fewer felines. 🐾💸

Bitcoin is currently trading at $112,703, after swinging between $113,239 and $112,540 today. There is a lot of activity in the $111,800-$112,000 range. Every test of $114,000 has been rejected instantly, showing that sellers still have the short-term upper hand. Drop below $111,000, and it is on to $109,500. Bulls cannot breathe easy until $114,500 is flipped or $116,000 is closed out. It’s a game of high-stakes poker, where the stakes are measured in billions and the players are as nervous as a cat in a room full of rocking chairs. 🐱💸

With $124 million of new BTC longs in the last 24 hours, traders know another wave of whale transfers could break the floor below $110,000. A reminder that in crypto, the only thing more volatile than the market is the patience of the average investor. 📉😤

Ripple to give away $200,000 on XRPL “Attackathon”

Ripple has lined up a live-fire test for the XRP Ledger’s upcoming lending protocol, putting $200,000 on the table in a joint “attackathon” with security firm Immunefi. The program runs from Oct. 27 to Nov. 29, with the full bounty unlocked if a single critical flaw shows up. It’s a curious way to test security: pay hackers to find vulnerabilities. One wonders if they’re preparing for a party or a siege. 🛡️🕵️♀️

If the system holds up, the participants will split a fallback pool of $30,000. A generous offer, though one might question whether the real prize is the bragging rights of having survived Ripple’s security gauntlet. 🏆🔐

This is one of the most ambitious updates to XRPL, as it is a fixed-term, uncollateralized loan that is settled directly on the chain, skipping the usual wrapping and smart contract layers. Instead, credit checks are kept off-chain, while repayment and liquidation logic is kept on the ledger. A bold move, though one might argue it’s akin to building a house without a foundation-exciting, but risky. 🏗️💸

XRP, in the meantime, attempts a recovery near $2.50 after sliding 12% this week, with $2.30 as the support level and $2.90 as the ceiling going into ETF decision week. A rollercoaster ride, but at least the seats are cushioned with hope. 🎢📈

The attackathon kicks off with two weeks of training for researchers, then moves on to trying to break vault solvency, liquidation triggers and admin functions. A test of skill, patience, and perhaps a touch of masochism. 🧠🧯

Coinbase wants Indian crypto market with CoinDCX investment

Coinbase entered the Indian market with a new investment in CoinDCX, the country’s top crypto exchange. The major U.S. exchange decision to move into Asia and the Middle East signals a bigger focus on these regions, where more than 100 million people already use cryptocurrency. A bold move, though one might question if it’s a genuine investment or a strategic maneuver to keep up with the competition. 🌍📈

There are 100M+ crypto owners in India and the Middle East. And that’s growing, fast.

We’re excited to expand our presence in these regions through a new investment into India’s leading exchange, @CoinDCX.

– Coinbase 🛡️ (@coinbase) October 15, 2025

For CoinDCX, the deal gives them U.S. branding power and direct access to Coinbase’s liquidity pools, which will boost their position after years of building retail scale and navigating India’s shifting regulatory map. A partnership as smooth as a well-timed punchline. 🥊🤝

On the equity side, COIN stock finished Tuesday at $341, which was a bit lower than the early-month highs of around $390. The price is a bit fragile right now, and it is holding at $350. There is a chance it could drop to $325 if it breaks that level. Bulls need to bounce back quickly into the $360-$370 range to keep the chart balanced. A dance of hope and despair, with the music playing on. 🎶📉

Evening outlook

Heading into the evening, the cryptocurrency market remains fragile as liquidation data and tariff headlines set the stage for another volatile week. It’s a market as unpredictable as a Wildean epigram-full of surprises and a touch of chaos. 🌪️📉

- Ethereum: Holding $4,166, but weak under $4,200. Needs to reclaim $4,280-$4,300 to confirm upside with support at $3,900. A tightrope walk, but with more risk and less safety net. 🎭🪢

- Solana: Trading $206, base forming at $200-$201. Resistance at $210-$215, risk back to $185 if BTC weakens. A game of Russian roulette, but with tokens instead of bullets. 🎲🔫

- Bitcoin: Watch $111,800-$112,000 as key floor; $114,500 intraday and $116,000 daily close as upside gates. A fortress of numbers, but one misstep could bring it all down. 🏰💣

- Macro risk: U.S.-China tariffs remain a wildcard, while CPI data later this week is the dominant risk trigger. A geopolitical chess match with the stakes higher than a Wildean dinner party. 🏰♟️

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-10-15 13:54