Today, the crypto world stands on the precipice of a financial cliff, with a staggering $10.31 billion in Bitcoin and Ethereum options contracts set to expire. This colossal event could send ripples through the market, especially since both digital currencies have recently taken a nosedive. Buckle up, folks! 🚀

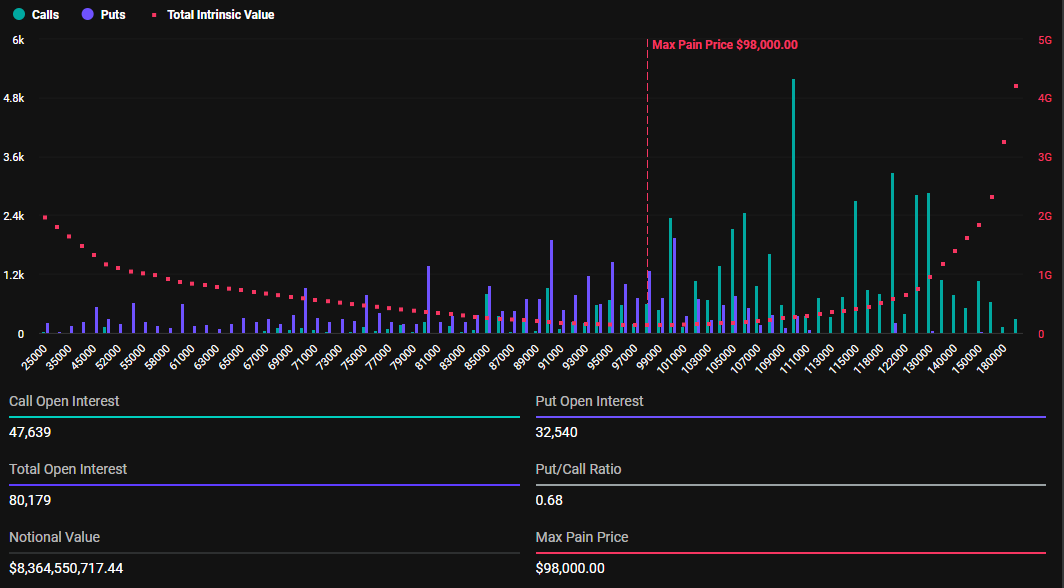

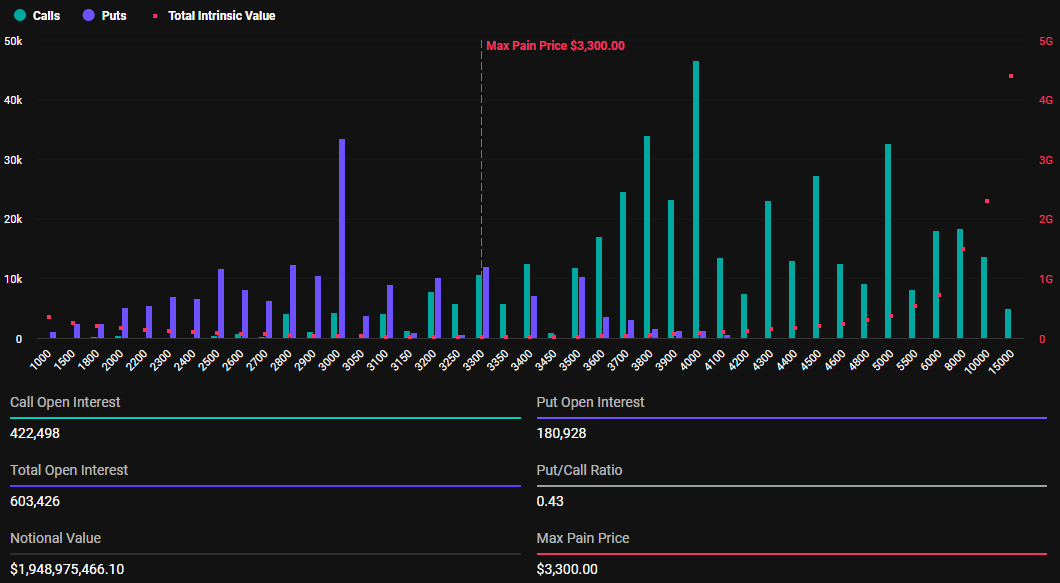

With Bitcoin options weighing in at a hefty $8.36 billion and Ethereum trailing behind at $1.94 billion, traders are preparing for a wild ride. It’s like a rollercoaster, but without the safety harness! 🎢

High-Stakes Crypto Options Expirations: What Traders Should Watch Today

Today’s options expiration is no small potatoes; it’s a significant leap from last week’s figures, as it coincides with the month’s end. According to the wise sages at Deribit, Bitcoin options expiration involves a whopping 80,179 contracts, a jump from last week’s paltry 30,645. Ethereum isn’t lagging either, with 603,426 contracts expiring, up from a mere 173,830. Talk about a party! 🎉

These Bitcoin options have a maximum pain price of $98,000 and a put-to-call ratio of 0.68. This suggests a generally optimistic outlook, despite the recent market hiccup. Meanwhile, Ethereum’s maximum pain price sits at $3,300 with a put-to-call ratio of 0.43, echoing a similar sentiment. It’s like a group therapy session for traders! 🛋️

With put-to-call ratios below 1 for both Bitcoin and Ethereum, traders are feeling a bit giddy, betting on price increases. But hold your horses! Analysts are waving caution flags, warning that options expiration often brings a tempest of market volatility. 🌪️

“This could bring significant market volatility as traders reposition ahead of expiry, expect sharp price movements and potential liquidations,” warned Crypto Dad, a popular sage on X. Sounds like a fun day at the office! 😅

As options expire, the market often resembles a game of musical chairs, with traders scrambling for stability. Meanwhile, BeInCrypto reports that Bitcoin’s trading value has dipped by 0.64% to $104,299, while Ethereum has managed a modest rise of 1.04%, now trading at $3,226. It’s like watching a slow-motion train wreck! 🚂💥

Implications of Options Expiry on BTC and ETH

With current prices, Bitcoin is comfortably lounging above its maximum pain level of $98,000, while Ethereum is playing hide-and-seek below the strike price of $3,300. The maximum pain point is a crucial metric, guiding market behavior like a lighthouse in a stormy sea. 🌊

According to the Max Pain theory, BTC and ETH prices are likely to inch closer to their respective strike prices, leading to expected volatility. Here, the largest number of options (both calls and puts) would expire worthless, leaving option buyers feeling the sting of “pain.” Ouch! 😬

On the flip side, option sellers will be laughing all the way to the bank as the contracts expire out-of-the-money, pocketing the credit received from selling the options. It’s a win-win for them, but a lose-lose for the buyers. Life’s not fair, is it? 😏

This phenomenon occurs because the maximum pain theory assumes that option writers are typically large institutions or professional traders, often dubbed the “smart money.” They have the resources and market influence to steer the stock’s closing price toward the maximum pain point on expiration day. It’s like watching a puppet show, but the puppets are billion-dollar contracts! 🎭

“Traders often monitor this level as it can influence price movements as expiration approaches,” one analyst on X noted, probably while sipping a latte. ☕

Based on this assumption, these market makers will hedge their positions to maintain a delta-neutral portfolio. As expiration looms, they offset their short option positions by buying or selling contracts, nudging the price toward the maximum pain point. It’s a delicate dance, folks! 💃

However

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-31 09:20