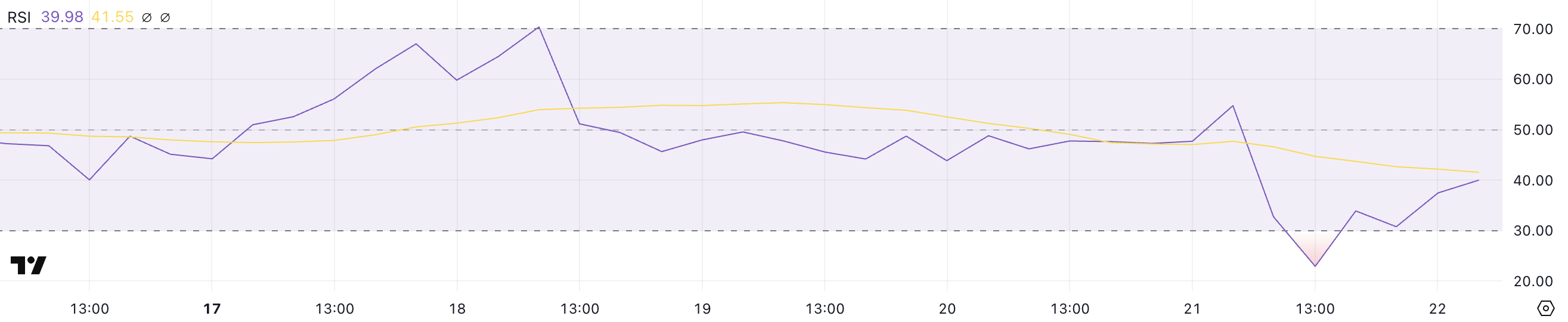

Well, folks, it seems our dear friend Mantle (MNT) has taken a nosedive of over 10% after the Bybit hack, where a staggering $174 million of cmETH—yes, that’s a Mantle-based coin that’s supposed to keep the ETH waters calm—was spirited away. The culprits? None other than the infamous North Korean Lazarus Group, who seem to have a knack for turning digital wallets into empty pockets. Panic selling ensued, and MNT’s Relative Strength Index (RSI) plummeted faster than a cat in a bathtub. 🐱💦

Now, while MNT’s RSI has managed to claw its way back to 39.9, it’s still lounging in the bearish territory, like a grumpy cat on a rainy day. The Chaikin Money Flow (CMF) is attempting a comeback but is still as negative as a pessimistic parrot, while the Exponential Moving Average (EMA) lines are waving goodbye to any upward momentum.

MNT RSI Took a Dive After Bybit’s Hack—And Not the Fun Kind!

In a matter of hours, Mantle’s RSI took a sharp plunge from 54.7 to 22.9, all thanks to the Bybit hack, where the Lazarus gang made off with a cool $1.5 billion—yes, you heard that right, billion! Among the loot was cmETH, the very coin meant to keep the MNT ecosystem afloat. Talk about a sinking ship! 🚢💔

This massive outflow of funds sent investors into a frenzy, leading to a significant decline in MNT’s RSI. For those unacquainted, RSI is a momentum oscillator that measures the speed and change of price movements, typically ranging from 0 to 100. It’s like a mood ring for stocks—values above 70 mean it’s feeling overbought, while below 30 suggests it’s in the dumps. With an RSI of 22.9, Mantle was practically begging for a hug amid the hack’s fallout.

After this dramatic plunge, Mantle’s RSI has perked up to 39.9, showing signs of life like a zombie in a horror flick. An RSI below 30 usually means an asset is oversold and could be due for a bounce, as selling pressure eases. Now, as RSI inches closer to the neutral zone (30-50 range), it hints that the extreme selling frenzy has calmed down, possibly luring in some bargain-hunters or bottom-fishers. If RSI keeps climbing, we might just see a bullish revival! 🎉

But hold your horses! If RSI can’t break above the 50 mark, it could spell continued uncertainty and a lack of buying strength, leaving MNT as vulnerable as a cat in a dog park.

Mantle CMF Is Trying to Recover, But It’s Still in the Doghouse

MNT’s Chaikin Money Flow (CMF) was already in the red before the Bybit debacle, reflecting a bearish trend and selling pressure. But after the hack, MNT’s CMF took a nosedive, hitting a negative peak of -0.35 yesterday. Ouch! 😬

CMF measures the volume-weighted average of accumulation and distribution over a set period. It ranges from -1 to 1, with positive values suggesting buying pressure and negative values indicating selling pressure. The sharp drop to -0.35 was like a neon sign flashing “SELL!” amid the market’s fear and uncertainty.

After hitting rock bottom, MNT’s CMF has started to recover, currently sitting at -0.24. While still far from positive, this upward movement suggests that selling pressure is gradually easing, like a bad hangover after a wild night. 🍹

A rising CMF, even while negative, can indicate that bearish momentum is losing steam. If buying volume continues to increase, we might just see a price stabilization or even a reversal. But as long as CMF remains in the red, MNT’s price is likely to face resistance like a stubborn mule.

A shift to positive CMF would be a more convincing sign of bullish sentiment returning,

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Everything We Know About DOCTOR WHO Season 2

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- 9 Kings Early Access review: Blood for the Blood King

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2025-02-22 14:58