Alas! The Bybit Hack hath sent tremors through the market today, with a staggering sum of over $1.46 billion in ETH spirited away, marking one of the most audacious security breaches in the annals of history. As the ill-gotten gains are hastily liquidated, Ethereum‘s price hath plummeted by a most distressing 5%, leaving key technical indicators in a state of disarray.

Whispers of speculation abound regarding Bybit’s forthcoming maneuvers, with some daring souls suggesting a potential market buyback to appease the aggrieved users, which could, perchance, create a veritable tempest of buying pressure. Yet, the future of Ethereum’s price remains shrouded in uncertainty as this dramatic tale unfolds.

Will Bybit’s Misfortune Lead to a Fortuitous Buyback?

Earlier today, one of the grandest crypto exchanges, Bybit, fell victim to a most nefarious hack. Over $1.46 billion worth of Ethereum was pilfered from its hot wallets, marking a most lamentable chapter in crypto history.

The esteemed CEO Ben Zhou did confirm that the attackers, with cunning guile, deceived Bybit’s security system, leading wallet signers to unwittingly endorse alterations to the smart contract logic, thus granting the rogue hacker dominion.

The stolen ETH is now being liquidated, causing Ethereum’s price to descend by over 4%. Following the theft, the hacker’s addresses commenced a most curious transfer of funds to a multitude of different wallets.

Some users are engaging in lively speculation regarding Bybit’s next steps to recover the funds of their beleaguered patrons.

Analysts, with their keen insights, assert that should Bybit fail to reclaim the stolen $1.5 billion, they might resort to a market buy of ETH to safeguard users’ funds, potentially engendering bullish buy pressure. However, one must not be too hasty, for nothing guarantees this will transpire or when, as Bybit’s next steps remain a tantalizing mystery.

Recently, Arkham did proclaim on X that a Bybit Cold wallet transferred more than $500 million to another Bybit wallet, suggesting the exchange could be preparing to reimburse users following the unfortunate hack.

Indicators Suggest Stolen Assets Impacted Ethereum Price

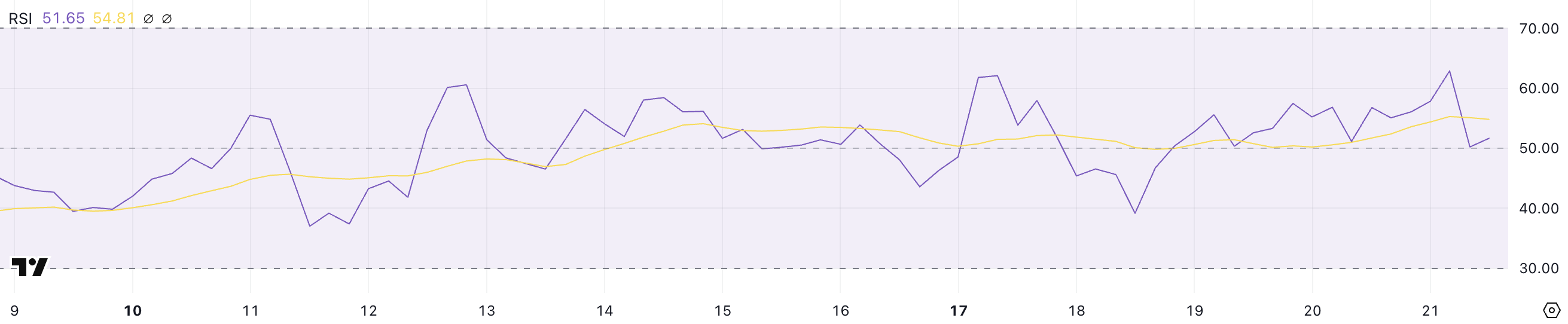

The recent calamity befalling Bybit hath caused Ethereum’s Relative Strength Index (RSI) to plummet from 62.8 to 51.6 in a mere few hours.

This precipitous decline doth indicate a sudden loss of buying momentum, reflecting an increase in selling pressure as the stolen ETH is hastily liquidated.

Though the RSI remains above the neutral 50 mark, the sharp drop doth suggest that bullish sentiment hath considerably waned.

With ETH’s RSI at 51.6, it doth linger in a neutral zone, exhibiting a balance of buying and selling pressure. Notably, ETH’s RSI hath been neutral since February 3, reflecting a period of consolidation and market indecision.

Should the RSI descend below 50, it could herald bearish momentum, whilst a rise above 60 would indicate a resurgence of buying interest.

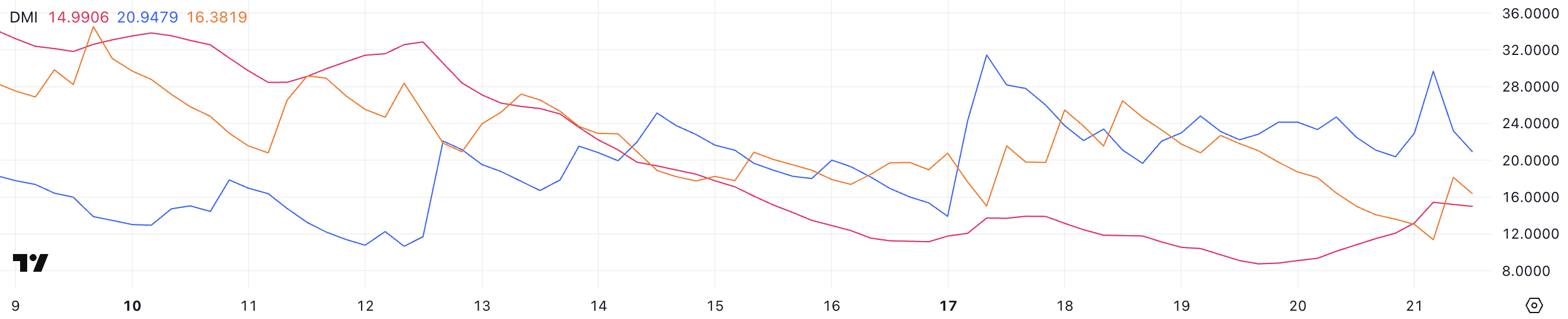

Ethereum’s Directional Movement Index (DMI) chart doth reveal that its Average Directional Index (ADX) is currently at 14.9, indicating a rather feeble trend.

Meanwhile, the +DI hath dropped from 29.6 to 20.94, showcasing a decline in buying pressure since the Bybit debacle. Conversely, the -DI hath risen from 11.3 to 16.3, demonstrating an increase in selling pressure as the stolen Ethereum hath been liquidated.

This shift doth suggest a change in market sentiment, with sellers gaining a firmer grip on the price movement.

The ADX measures trend strength, with values below 20 indicating a weak or non-existent trend, regardless of

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-22 00:40