During the course of my recent analysis, I found an extraordinary event unfolded on Friday’s trading session: the price of SPX surged by an impressive 50%. This unprecedented price spike took many market participants by surprise and sparked a cascade of short positions being closed out, resulting in significant losses for numerous short traders.

With the SPX token price poised to extend its gains, its short traders may face more liquidations.

SPX Short Traders Record Losses

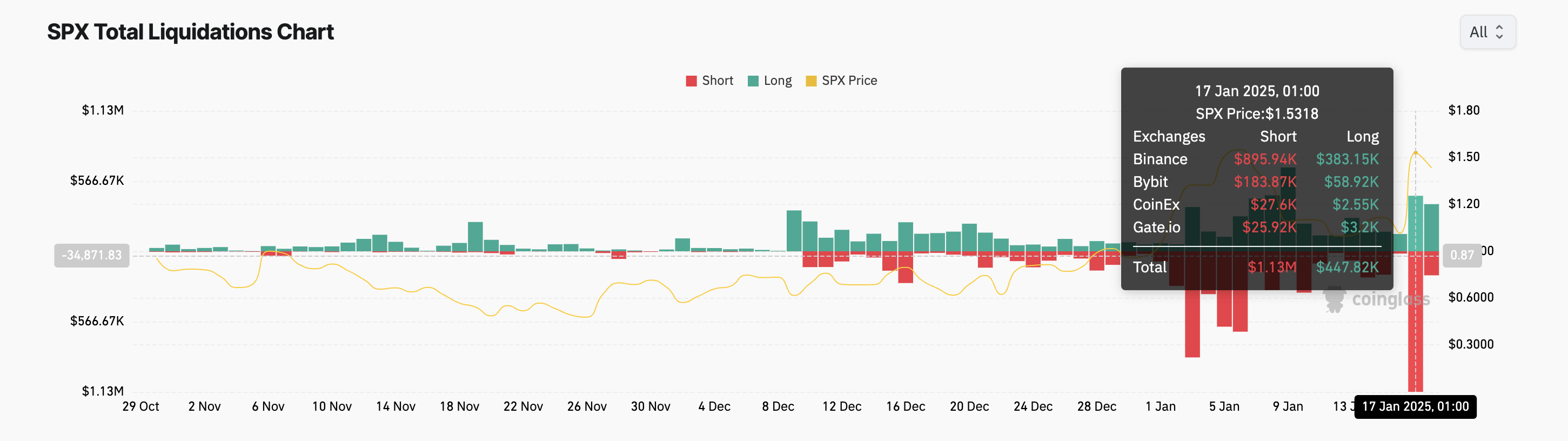

On last Friday, the SPX’s worth increased remarkably by 50%, peaking at a nine-day maximum of $1.55. This price increase sparked substantial short position closures in its futures market, amounting to $1 million as indicated by Coinglass statistics.

In the derivatives market, liquidation happens when the value of an asset goes in a direction opposite to what a trader has bet on. This situation can lead to the forcible closure of the trader’s position if they don’t have enough resources to keep it open.

In simpler terms, quick liquidations occur when individuals who have borrowed assets (short positions) are compelled to purchase them back at a higher cost due to the asset’s rising value. This happens when the asset’s price exceeds a significant threshold, causing those who anticipated its fall to leave the market.

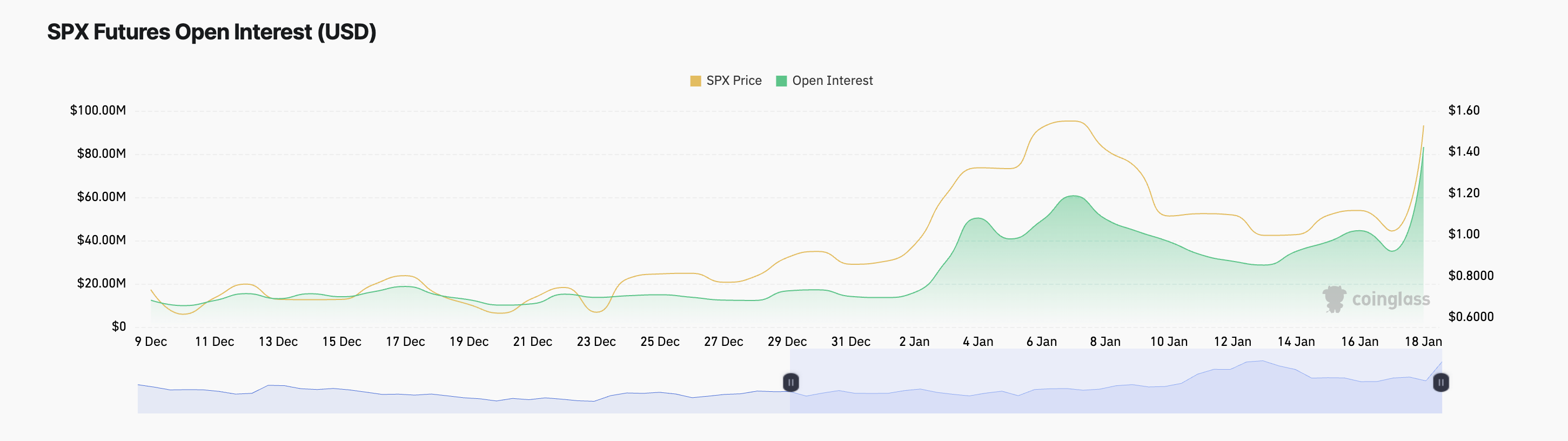

Significantly, traders of SPX may not have seen their losses cease yet, as trading activity remains high and shows no signs of slowing down. This is indicated by the rise in the token’s open interest, which has surged by 137% over the last 24 hours. This surge coincides with a 32% jump in the token’s value during the same timeframe.

As a crypto investor, I closely monitor open interest because it represents the total amount of uncashed derivative contracts, including futures and options, that are yet to be settled. A surge in open interest, particularly during a price increase such as this one, indicates heightened market engagement and faith in the continuation of the upward price trend.

Therefore, if the SPX price uptrend persists, its short traders will suffer more losses.

SPX Price Prediction: Token Eyes All-Time High

The significant 50% increase in SPX has led to a change in the Super Trend’s stance, now appearing as a supportive green line beneath the token’s price on the daily chart, providing dynamic assistance.

This tool monitors the movement and intensity of changes in an asset’s cost. On the price graph, it appears as a line that shifts color based on the present market direction: green when the trend is increasing (uptrend), and red when the trend is decreasing (downtrend).

When an asset’s cost exceeds the Super Trend line, it indicates a rising or bullish trend. This suggests that buyers are more active than sellers in the market, signaling increased demand over supply.

If the current trend persists, the SPX’s value may surge back towards its maximum historical value of $1.65. Conversely, if selling pressure arises, the SPX token might relinquish its recent growth and potentially fall to $1.23.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Everything We Know About DOCTOR WHO Season 2

- 9 Kings Early Access review: Blood for the Blood King

- Honkai: Star Rail – Hyacine build and ascension guide

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- All 6 ‘Final Destination’ Movies in Order

2025-01-18 15:23