As someone who has been navigating the complex world of finance for most of my career at Goldman Sachs and now as an independent macroeconomic expert, I must admit that I was initially skeptical about the potential of cryptocurrencies and NFTs. However, after delving deeper into the fascinating realm of crypto art, I find myself captivated by its transformative power and the immense opportunities it presents for both art enthusiasts and investors like me.

Pal’s comparison of NFTs to Manhattan real estate resonates with my understanding of market dynamics. Just as prime property commands a premium in the physical world, so does exceptional digital art in the realm of crypto. The scarcity factor, coupled with growing demand from younger generations who are more attuned to digital assets, makes investing in crypto art an exciting proposition.

The efficiency and cost-effectiveness of NFTs as investment vehicles are also compelling reasons for me to invest in this space. Unlike traditional art or real estate, which can be burdensome to maintain and store, crypto art is relatively hassle-free. Plus, the added benefit of using NFTs as collateral makes them even more attractive to investors like myself who are always on the lookout for smart investment opportunities.

I must admit, I find it amusing that I, a former Goldman Sachs executive, am now advocating for digital art as a legitimate asset class. But as they say, every great revolution was once considered a foolish idea! As we move forward into this brave new world of digital culture and investment, I can’t help but feel like we’re on the cusp of a new digital Renaissance – and who wouldn’t want to be a part of that?

Oh, and by the way, if crypto art is Manhattan real estate, then my collection of NFTs is now worth more than my old Goldman Sachs office building! Now, isn’t that something to smile about?

As a researcher delving into the realm of macroeconomics, I recently came across some fascinating insights from a seasoned expert, previously with Goldman Sachs. On his social media platform, he expressed an optimistic perspective about Non-Fungible Tokens (NFTs), emphasizing their transformative capacity in art, investments, and digital culture.

A New Digital Renaissance

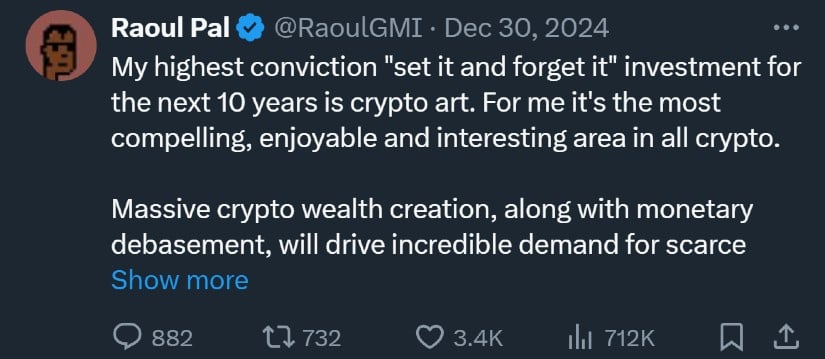

Pal contends that the Non-Fungible Token (NFT) market, especially crypto art, is poised to benefit significantly from major economic trends and generational shifts. In his view, the surge in cryptocurrency wealth creation and monetary devaluation will fuel an enormous appetite for rare, valuable assets such as digital real estate or digital artwork. Moreover, he emphasizes a growing fondness among younger generations towards digital assets over traditional physical investments.

In terms similar to comparing Bitcoin to valuable physical real estate like Manhattan, Pal pointed out that if, as [MicroStrategy founder Michael] Saylor suggests, BTC is equivalent to this prized real estate, then exceptional crypto art or NFTs could be likened to the rarest, most coveted blocks of digital space available.

Advantages of Crypto Art Over Traditional Investments

In simpler terms, Pal highlighted the effectiveness of NFTs as an investment option. Unlike conventional physical properties that require substantial maintenance and storage expenses, digital art (like NFTs) is relatively affordable to own. Moreover, just like traditional assets, NFTs can be used as collateral, making them more attractive to potential investors.

Investing in physical assets can be costly, but they’re more suitable for personal use rather than financial gains,” explained Pal. “Art bridges this gap, and holding digital art, or ‘crypto art’, is surprisingly affordable for long durations.

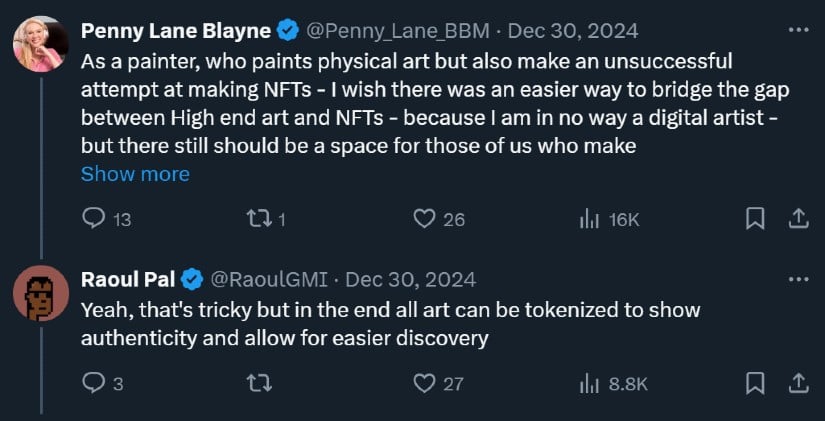

Additionally, he highlighted the cultural significance inherent in digital artwork (crypto art), underscoring its capacity to encapsulate cultural and collective moments as tokens. As such, it transcends being merely an investment opportunity; it offers a unique means for preserving and interacting with the digital realm’s culture.

The Shift to Long-Term Holding

As an analyst, I’ve noticed a substantial shift in the NFT market since its initial surge. Instead of speculative trading, there seems to be a growing emphasis on long-term ownership. To put it simply, the era of flipping art NFTs appears to be drawing to a close. Now, the strategy is to invest in and retain the works of top artists – whether they’re emerging or established. The demand for these pieces will likely continue to rise as time goes on, while the supply gradually diminishes due to long-term holdings for decades.

As per Pal’s explanation, the competitive nature of the cryptocurrency artwork market is intensified by the superior quality of these pieces, most of which are valued in Ether (ETH). He emphasized that exceptional works, like those created by renowned NFT artist Beeple, have consistently surpassed the performance of Ethereum itself.

Resilience in the NFT Market

2024 saw some hurdles, but the NFT market proved its tenacity but good measure. Global sales volumes for the year hit an impressive $8.8 billion, just a slight increase from the $8.7 billion registered in 2023. This surge was accompanied by a significant 69% rise in active buyers and a corresponding 7% growth in sellers. High-profile projects such as Pudgy Penguins, Azuki, and Lil Pudgys experienced exceptional growth in sales, indicating a thriving market.

This action underscores a larger pattern: Non-Fungible Tokens (NFTs), particularly high-quality crypto art, are increasingly being recognized as a valid investment class. As evidence, well-known collections such as CryptoPunks, Bored Apes, and Grifters were cited as ongoing projects that captivate both collectors and investors.

The Next Chapter in Crypto Art

Pal motivates novices to explore the crypto art market with a sense of wonder and receptiveness. He pointed out that the platforms could undergo significant transformation in the future as holograms and holodecks might become the primary carriers for digital existence, hinting at the dynamic nature of digital art and technology.

At the start of the new year, Pal’s strong support underscores a growing agreement: digital artwork (crypto art) and Non-Fungible Tokens (NFTs) are moving away from being unusual trends and are becoming a powerful influence, changing both the art world and investment sectors. Combining cultural relevance, technological advancements, and financial opportunities, crypto art seems ready to alter our perception and preservation of value in the digital era.

Read More

2025-01-02 20:22