In the grand theater of crypto, where fortunes are whispered like secrets, Binance’s latest opus unveils a tragicomedy of errors. What was once a fountain of hope now drips with the bitter taste of reduced rewards, insider shenanigans, and the relentless march of bots, all conspiring to erode the community’s faith in airdrops.

Once hailed as the engines of growth, these airdrops now teeter on the brink of becoming liabilities. Will the industry rise to the occasion, or will users find themselves adrift in a sea of disillusionment?

Binance’s Analysis of Recent Crypto Airdrops

This report lays bare the flawed machinery that transforms excitement into exasperation. Binance poses the question: Are airdrops the golden ticket to crypto paradise or merely a ticking time bomb waiting to explode?

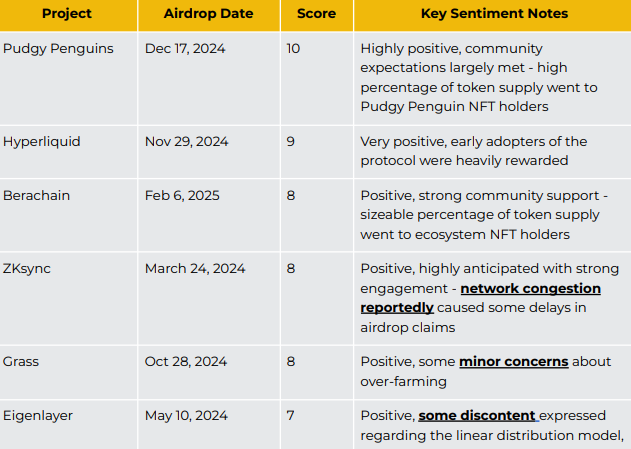

In a twist of fate, Binance’s analysis bestows a near-mythical 10/10 upon the Pudgy Penguins’ airdrop, while Hyperliquid follows closely with a commendable 9/10, having dazzled the community with generous rewards and new DeFi standards. 🐧💰

Yet, when airdrops falter, the fallout is swift and merciless. The Binance research points to Redstone (RED), which, in a dramatic last-minute twist, slashed its promised 9.5% community allocation to a mere 5%. Cue the outrage and a dismal 2/10 sentiment score, as per Binance’s Grok AI analysis. 😱

Scroll’s October 2024 airdrop joins the ranks of disasters, with vague rules and an unclear eligibility snapshot leading to a woeful 3/10 rating.

In a similar vein, Kaito’s February 2025 distribution saw 43.3% of its supply funneled to insiders, leaving a paltry 10% for the community. Influencers, like vultures, quickly dumped their holdings, leaving trust in tatters.

Moreover, the report highlights the dark art of Sybil farming, where bots hoard tokens like candy. Technical blunders, such as Magic Eden’s botched claim process in December 2024, have only stoked the fires of user discontent. 🔥

Why Most Airdrops Fail to Deliver

Beyond merely exposing flaws, Binance’s report dissects the very mechanics of failure—last-minute allocation changes, like those of Redstone, signal a lack of foresight and tarnish credibility. The fog of ambiguity, as seen in Scroll’s unclear eligibility criteria, breeds suspicion and whispers of favoritism.

Insider-heavy distributions, such as Kaito’s, alienate the very retail participants they seek to engage. Meanwhile, technical hiccups, including Magic Eden’s malfunctioning wallet claims, transform airdrops into a frustrating circus act.

With billions at stake, these issues are no longer mere inconveniences but existential threats to the very fabric of the crypto airdrop model.

“Tokens are a new asset class….Airdrops are their wild frontier,” mused Binance macro researcher Joshua Wong.

Amidst the chaos, Binance outlines a potential path to redemption for crypto airdrops. First, it calls for transparency, advocating for retroactive airdrops with clear eligibility criteria set in advance.

Engagement-based models should commit to fixed point-to-token ratios, ensuring fairness. Projects must prioritize genuine community engagement, treating tokens not merely as digital assets but as instruments for cultivating loyal ecosystems. 🌱

Finally, technical solutions like on-chain monitoring and proof-of-humanity tools, akin to those employed by LayerZero, could combat Sybil farming and restore a sense of equity.

In sum, Binance’s report serves as a clarion call: while crypto airdrops hold the promise of democratizing wealth and fortifying blockchain communities, they also teeter on the precipice of collapse under the weight of mismanagement and exploitation.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-22 12:36