Oh, the irony! Americans may have missed out on up to $2.64 billion from cryptocurrency airdrops.

According to a study by CoinGecko, this figure could be as high as $5.02 billion. But why, you ask?

Why Americans Can’t Have Nice Things (Like Crypto Airdrops)

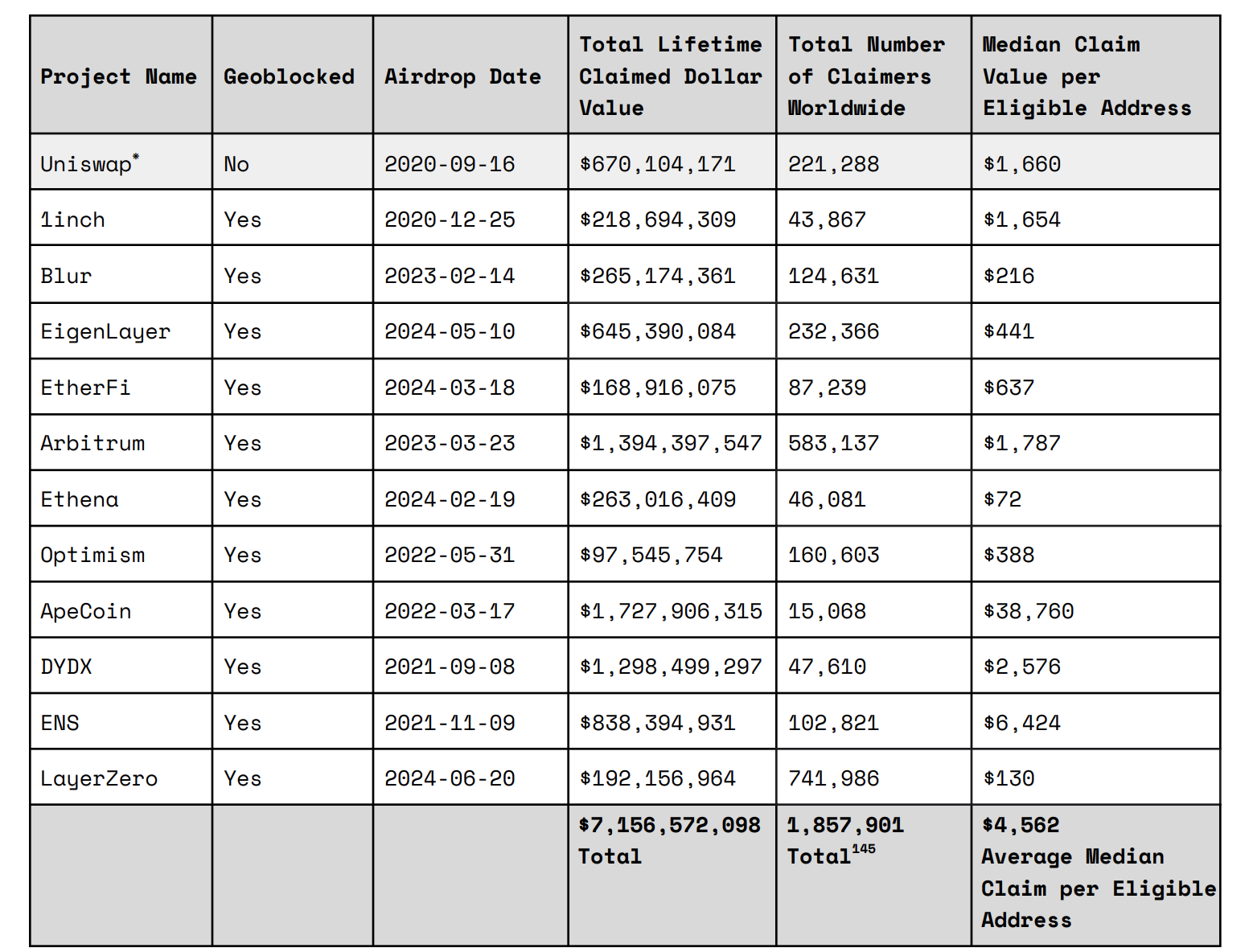

Dragonfly’s research findings are based on 12 cryptocurrency airdrops, including Uniswap and 1inch. Of these, 11 airdrops imposed restrictions on US IP addresses. The number of Americans affected by this IP blocking ranged from 920,000 to 5.2 million active users.

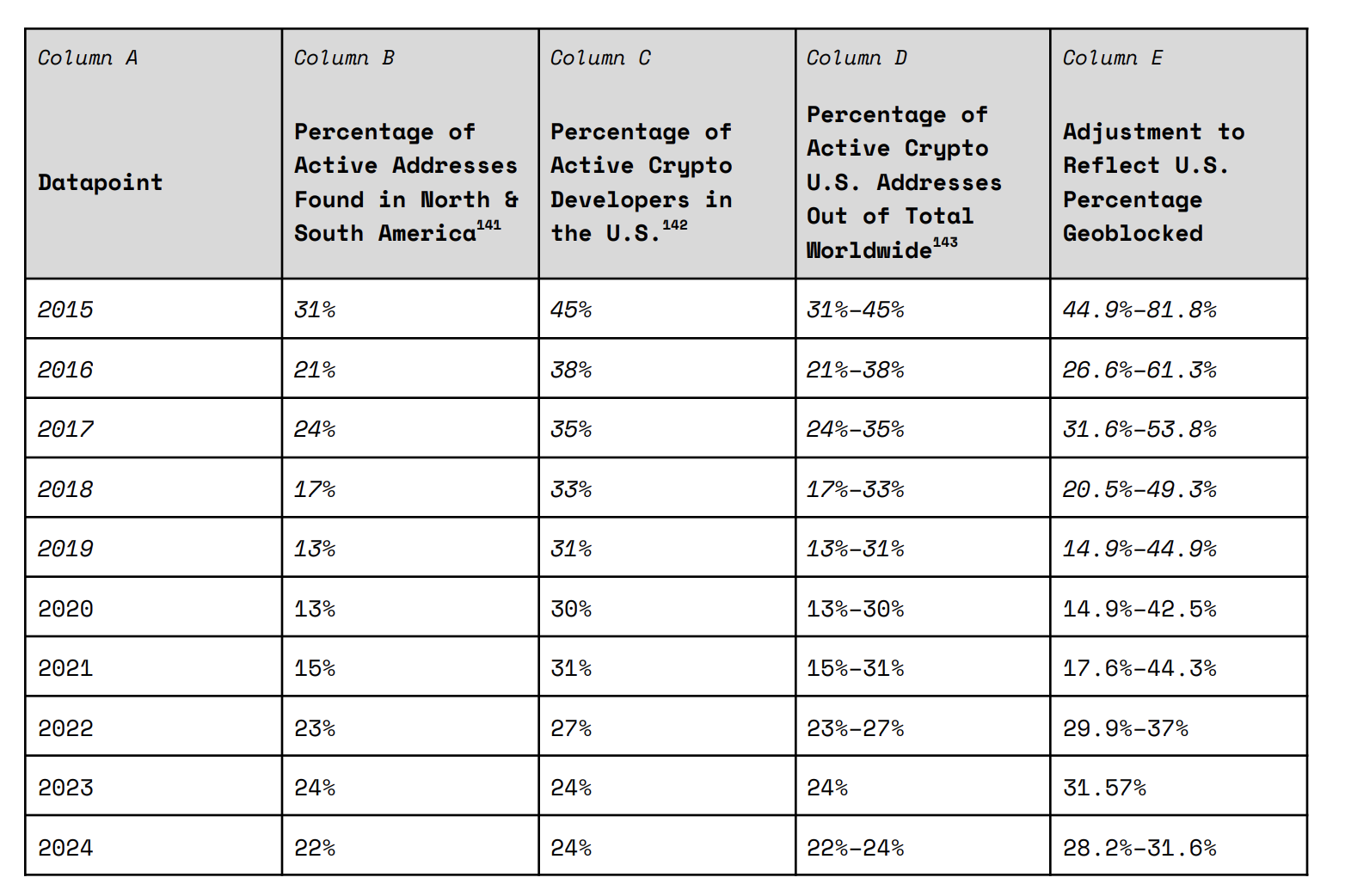

Approximately 22–24% of all active cryptocurrency addresses worldwide are US residents. The total value of the airdrops in Dragonfly’s sample amounted to around $7.16 billion. Approximately 1.9 million people globally claimed airdrops, with an average value of about $4,600 per eligible wallet address.

Based on these figures, Dragonfly estimates that Americans lost between $1.84 billion and $2.64 billion from 2020 to 2024 due to the 11 airdrops that blocked US users. Notably, CoinGecko conducted a similar analysis but with a larger sample size. Evaluating 21 airdrops that excluded Americans, CoinGecko estimates the losses could range from $3.49 billion to $5.02 billion.

The exclusion of US IP addresses from participating in crypto airdrops is a measure to avoid penalties from regulatory bodies like the Securities and Exchange Commission (SEC).

The US Government: Losing Billions Due to Stringent Policies

The lost federal personal income tax revenue from geoblocked airdrops, based on CoinGecko’s sample from 2020 to 2024, is estimated to range from $418 million to $1.1 billion. The estimated lost state tax revenue ranges from $107 million to $284 million. This represents an estimated tax revenue loss of $525 million to $1.38 billion.

The relocation of cryptocurrency operations overseas has also significantly reduced US tax revenue. The report cites Tether as an example. Companies like Tether establishing headquarters in El Salvador may have cost the US approximately $1.3 billion in federal corporate taxes and $316 million in state taxes.

Crypto projects show caution amid potential legal challenges ahead of the new acting SEC Chair under President Trump’s administration. Blocking and losing a portion of US users is considered a safer option than facing costly litigation as is the case with Ripple, Kraken, or Coinbase.

And so, dear Americans, it seems you’ll have to watch from the sidelines as the rest of the world enjoys their crypto airdrops. 💸😒

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-03-12 13:29