As a seasoned crypto investor with roots deeply entrenched in this ever-evolving digital landscape, I find myself increasingly captivated by the latest findings from Chainalysis’ report. The surge in wallet activity is not just a blip on the radar, but a testament to the burgeoning acceptance of cryptocurrencies as a legitimate and integral part of our global financial system.

Chainalysis’ latest report reveals an increase in wallet activity, suggesting a broader adoption of digital currencies. Although each wallet address does not necessarily equate to a single user, the escalating figures demonstrate a consistent growth in blockchain participation.

The Chainalysis team pointed out that we’re experiencing a massive change, not just in how things are viewed, but also in their practical application. They noted that traditional financial institutions are gradually merging with the digital economy by introducing offerings such as exchange-traded funds (ETFs) and tokenized assets.

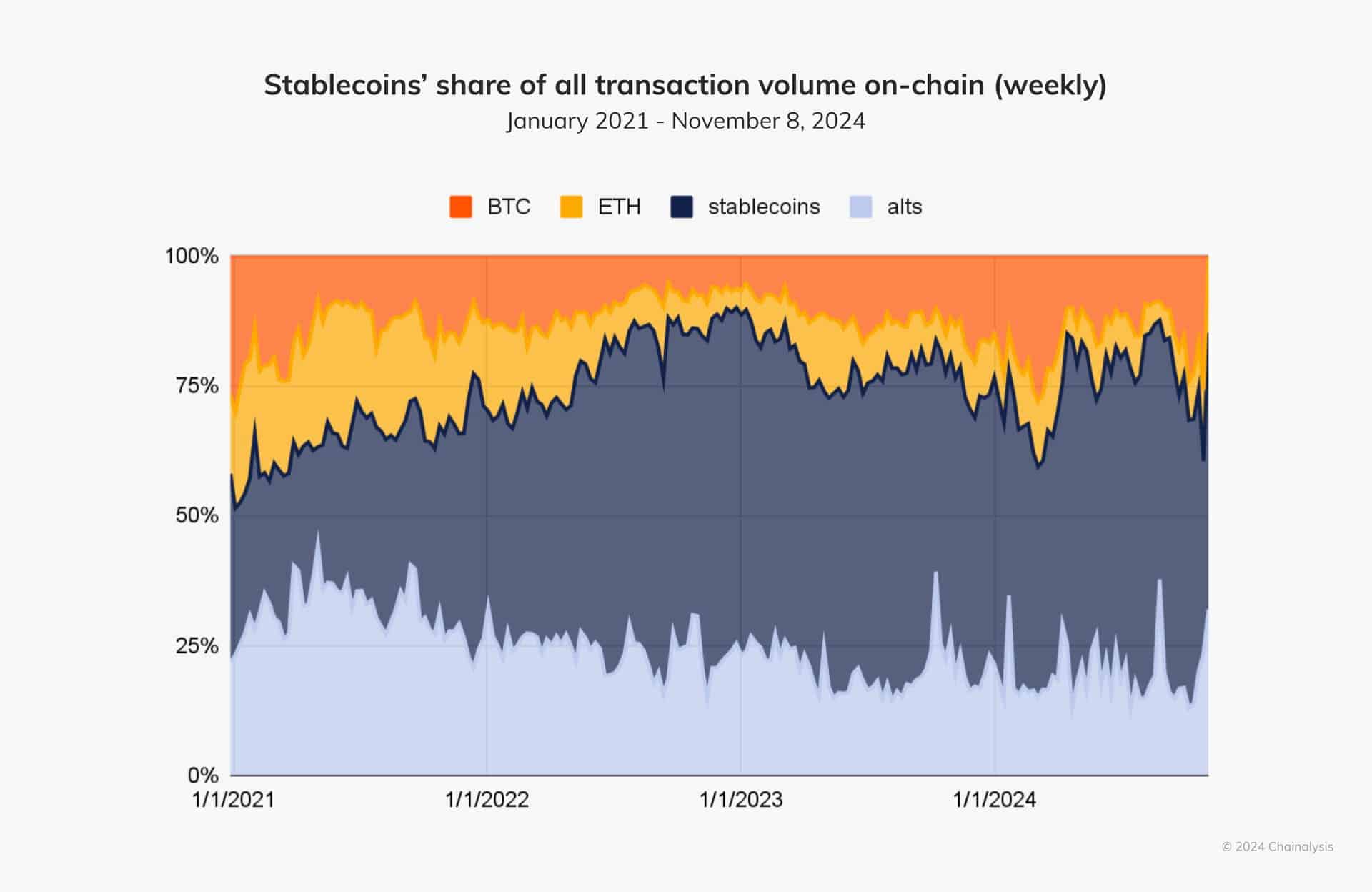

Stablecoins Dominate On-Chain Transactions

The report underscored the crucial part that digital currencies known as stablecoins play in the expansion of cryptocurrency usage. From the start of 2024, stablecoins have been responsible for between 50% and 75% of all on-chain transactions. Initially perceived as gateways to fiat currency within the crypto market, stablecoins are now also becoming popular as a means of storing value, especially in developing economies.

In regions like Venezuela and Latin America, stablecoins pegged to the U.S. dollar are increasingly used for remittances and to provide liquidity in jurisdictions facing economic instability or stringent capital controls.

Chainalysis pointed out that stablecoins provide a crucial resource in regions where access to dollars is scarce, showcasing their value for purposes beyond just speculative investment.

Support from Financial Leaders

The utility of stablecoins has not gone unnoticed by policymakers. In an Oct. 18 speech at the Institute of Advanced Studies, U.S. Federal Reserve Governor Christopher Waller recognized the potential of stablecoins to reduce cross-border transaction costs.

In a similar vein, a recent report by the U.S. Treasury’s Borrowing Advisory Committee (Oct. 30) emphasized that dollar-backed stablecoins increase the demand for Treasury bills and simplify the process of issuing Treasury assets. This viewpoint aligns with the assertions made by Charles Cascarilla, CEO of Paxos, in his letter to lawmakers on October 29, who argued that stablecoins are crucial for preserving the dollar’s significance in an ever-expanding digital economy.

Institutional Interest and Future Outlook

The Chainalysis report emphasized the growing intersection of conventional finance and cryptocurrency, fueled by advancements such as ETFs and tokenized investment solutions. Institutions are devising strategies to incorporate blockchain technology into their existing structures, thereby strengthening the link between digital and traditional financial systems.

As more than 400 million wallets are now in use, and stablecoins are increasingly essential in international finance, it seems that the cryptocurrency sector is set for even greater expansion. Regulators and traditional financial bodies are still trying to understand its impacts, but it’s clear that integrating crypto into the global economy is no longer a matter of “if” – it’s now a question of “when.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2024-12-08 16:06