As a seasoned researcher with over two decades of experience observing global financial markets, I have witnessed many significant events that have shaped the economic landscape. However, few moments can compare to the seismic shift brought about by Donald Trump’s victory in the 2024 US presidential election and its profound impact on the cryptocurrency market.

Following Donald Trump’s win in the 2024 U.S. presidency, there was a notable increase in both adoption and investment within the cryptocurrency market. This development represented one of the largest growth spurts observed in recent times.

Trump’s supportive stance towards cryptocurrencies, coupled with his pledges for a more transparent regulatory system, has ignited worldwide curiosity and financial involvement in this field.

A New Wave of Global Crypto Investors

2024 data from a Binance survey including responses from more than 27,000 individuals in regions like Asia, Australia, Europe, Africa, and Latin America showed that nearly half (45%) of those surveyed had entered the cryptocurrency market that year.

It’s worth noting that about four out of ten participants invested less than 10% of their overall wealth in cryptocurrencies. This suggests an increasing understanding and trust in cryptocurrencies as a reliable, long-term investment option.

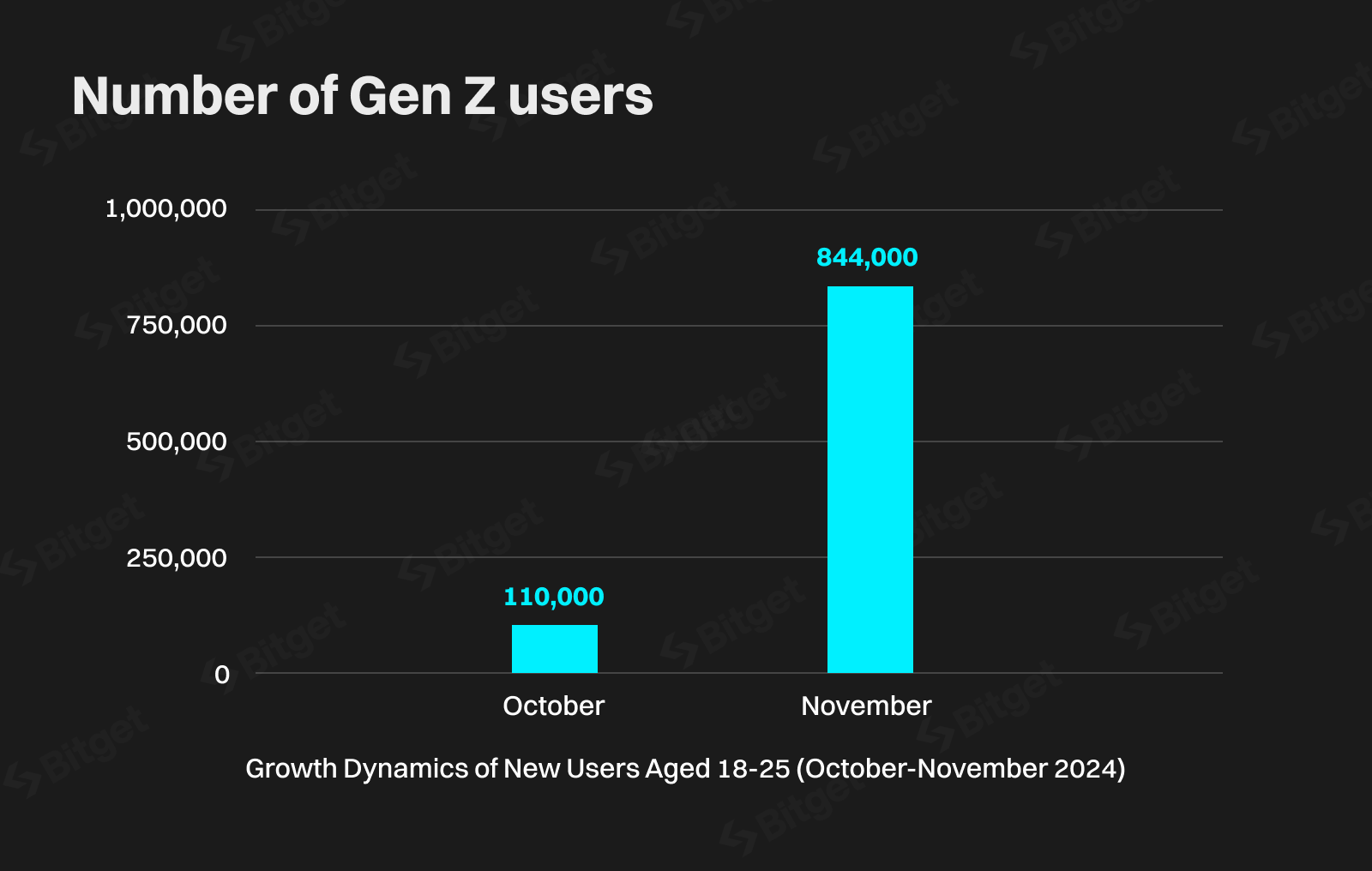

It’s not just worldwide growth we’re seeing; it’s particularly noticeable among the younger generations. As per Bitget, there was a staggering 683% increase in Gen Z users on their platform following Trump’s re-election, accounting for about half (53.8%) of all new users. This significant rise can be linked to Trump’s positive attitude towards Bitcoin and a generally optimistic financial market forecast.

According to Bitget’s report, Donald Trump’s support for cryptocurrency during his presidential campaign caught the attention of younger investors, underscoring the influence that political views can have on personal finance decisions.

European Markets Witness Parallel Growth

In Europe, the growth of cryptocurrency-related Exchange Traded Products (ETPs) is equally robust. According to Financial News London, there’s been a significant surge in crypto ETP assets in 2024, marking a significant achievement for digital assets. Data from ETFGI shows that European crypto ETPs received approximately £108 million ($135 million) in new investments in November alone, making it the third-highest investment month for these products this year.

Financial News London noted that a significant portion of the rise in crypto ETP assets in Europe, approximately $6 billion, can be attributed to Donald Trump’s victory in the U.S. presidential election on November 5th. This sparked some of the increase.

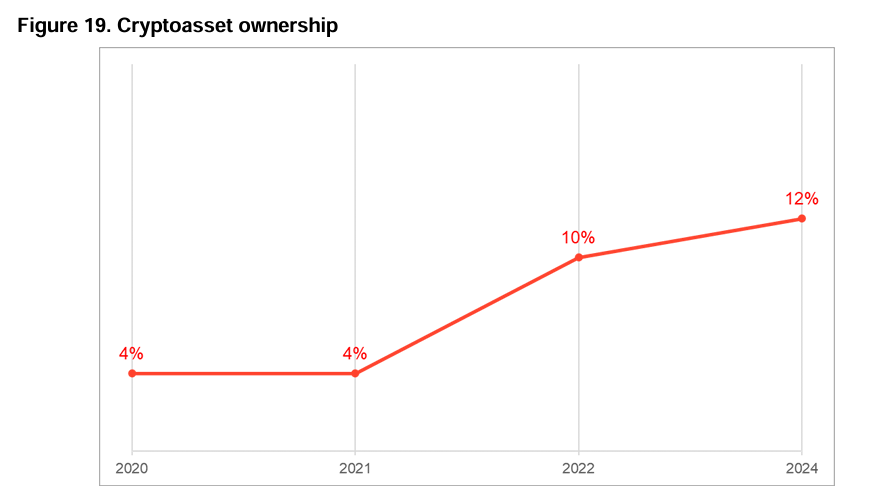

2024 saw a steady increase in cryptocurrency holdings among UK residents, as reported by the Financial Conduct Authority (FCA). According to their data, 12% of British adults are now cryptocurrency owners, which represents an uptick from the previously reported figure of 10%.

As a crypto investor, I’ve noticed an uptick in awareness about digital currencies, moving from 91% to 93%. Moreover, the average value of my crypto holdings has seen a growth, rising from £1,595 to £1,842.

As a researcher, I find myself intrigued by the prospect of increased cryptocurrency ownership among UK residents in the near future, based on current adoption rates. Following insights from the Financial Conduct Authority’s (FCA) research, it appears that these digital assets will predominantly be used for transactions such as sending and receiving payments, purchasing goods and services, and converting them to traditional fiat currencies and vice versa. Given this trend, businesses seeking growth opportunities should focus on developing user-friendly solutions that facilitate smooth crypto-fiat transactions, catering to the need for a bridge between these two economic spheres. This insight was shared by Uldis Teraudkalns, the Chief Revenue Officer at Paybis, in an interview with BeInCrypto.

Trump’s significant policy shifts, including setting up a strategic Bitcoin reserve and creating a Bitcoin and Crypto Consultative Body, have sparked unparalleled enthusiasm regarding the future of digital currencies. These decisions have propelled Bitcoin prices to unprecedented peaks, with other cryptocurrencies such as Ethereum mirroring this trend.

This election is significant as it signifies a crucial turning point for the global cryptocurrency sector, not just within the U.S. A wave of investors, ranging from novices to veterans, are actively looking for investment opportunities in this rapidly evolving market, with aspirations that this could usher in a new phase where cryptocurrencies achieve wider acceptance and standardized regulation across the globe.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2024-12-24 09:22