As the crypto market flutters into 2026, it sheds its gaudy, neon-lit skin, revealing a more austere, institutional guise. No longer driven by the feverish whispers of hype, it now dances to the solemn rhythm of regulatory clarity and the slow, deliberate waltz of digital assets into traditional finance. Bitcoin, that stoic relic of the blockchain era, ended 2025 with a yawn, while ETFs gorged on $23 billion of institutional gold. Stablecoins, once the unruly children of the crypto world, now wear their legislative diapers with pride. A year of transformation looms, though the specter of volatility lingers like a disagreeable guest at a dinner party. 🧠💸

Bitcoin Price Prediction 2026

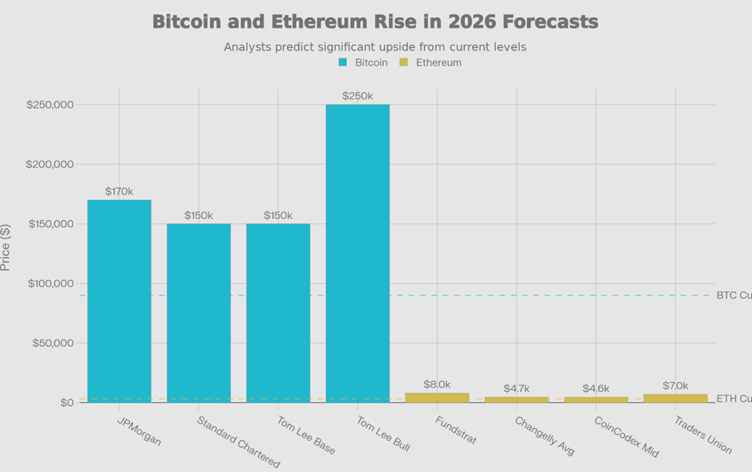

Bitcoin’s 2026 trajectory is a Rorschach test of institutional forecasts. JPMorgan, that paragon of wisdom, dreams of $170,000, while Standard Chartered dangles a $150,000 carrot. Tom Lee, ever the optimist, envisions a $150,000-$200,000 ballet, culminating in a $250,000 crescendo by year’s end. Yet, Fidelity, that cautious old soul, warns of a “year off,” predicting a $65,000-$75,000 slumber. Bloomberg’s bear case, meanwhile, imagines a $10,000 descent if liquidity tightens-a scenario as likely as a snowball’s chance in a sauna. Options markets, ever the gamblers, split their bets: $70,000 or $130,000 by mid-2026, and $50,000 or $250,000 by December. A volatile tapestry, indeed. 🎭📉

More cautious views, highlighted by Fidelity’s assessment that Bitcoin faces a “year off” within its four-year cycle, suggest consolidation between $65,000 and $75,000. Bloomberg Intelligence’s bear case pushes toward $10,000 if liquidity tightens materially.

Options markets currently price roughly equal odds of Bitcoin trading at $70,000 or $130,000 by mid-2026, and equal odds of $50,000 or $250,000 by year-end, a massive volatility band showing uncertainty about monetary policy, leverage conditions, and the sustainability of recent ETF demand.

Ethereum Price Prediction 2026 by Major Analysts

Ethereum, that mercurial chameleon, faces a 2026 marked by volatility and the faint glimmer of hope. Our ETH market prediction estimates cluster between $4,500-$7,000, with bullish cases pushing toward $11,000 as RWA tokenization and DeFi expansion accelerate. 🏦📈

Tom Lee projects ETH trading between $7,000-$9,000 early 2026, influenced by tokenization and institutional demand for stablecoin settlement layers. He predicts that ETH price could touch $20,000 by the end of 2026.

BitMEX co-founder Arthur Hayes has shared similar views. Speaking with Lee on the Bankless podcast, Hayes stuck to his $10,000 Ethereum target.

Standard Chartered has also turned more bullish, raising its Ethereum target to $7,500 and lifting its 2028 estimate to $25,000.

Meanwhile, Joseph Chalom, CEO of Sharplink, believes Ethereum’s total value locked could grow 10x in 2026. However, some analysts remain bearish on ETH price forecast 2026. Crypto analyst Benjamin Cowen says Ethereum probably won’t reach new all-time highs next year, pointing to the current state of Bitcoin’s market and overall liquidity conditions as key reasons.

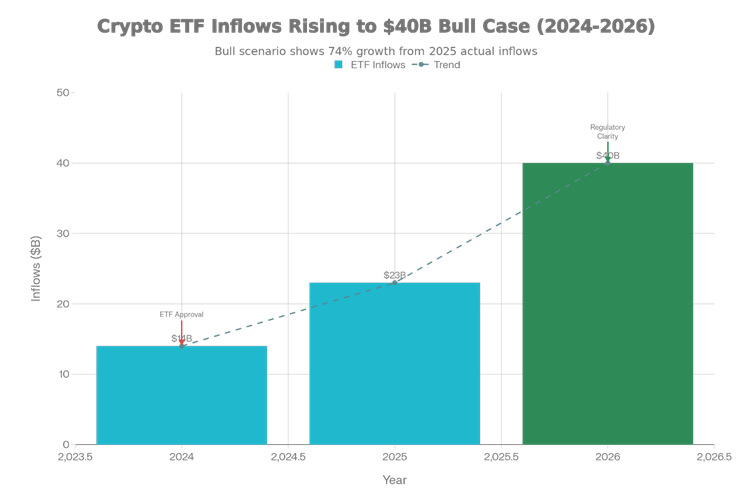

Crypto ETF Inflow Could Touch $40 Billion

The approval of spot Bitcoin and Ethereum ETFs in 2024 created a regulated institutional onramp. 2025 saw $23 billion in net inflows; Bloomberg Intelligence’s senior ETF analyst Eric Balchunas projects 2026 could reach $15 billion in a conservative base case or surge toward $40 billion under favorable conditions.

Galaxy Digital and other institutional forecasters expect inflows exceeding $50 billion as wealth management platforms remove restrictions and add crypto to model portfolios. Bitwise expects ETFs to buy more than all of the new Bitcoin, Ethereum, and Solana coming onto the market in 2026. In other words, ETF demand could be stronger than new supply. This might help support prices through simple supply-and-demand pressure.

Crypto ETF Inflows and DeFi TVL Growth Trajectory (2024-2026)

Bitcoin ETF assets under management are expected to reach $180-$220 billion by year-end 2026, up from approximately $100-$120 billion currently. The critical drivers are Fed rate cuts (expected throughout 2026), approval of additional altcoin ETFs (likely for Solana, XRP, and others), and potential public allocation announcements from major pension funds or sovereign wealth funds.

Assets under management across all crypto ETPs are expected to surpass $400 billion by year-end 2026, doubling from roughly $200 billion currently. Over 100 new crypto ETFs are anticipated to launch, including 50+ spot altcoin products following the SEC’s approval of generic listing standards.

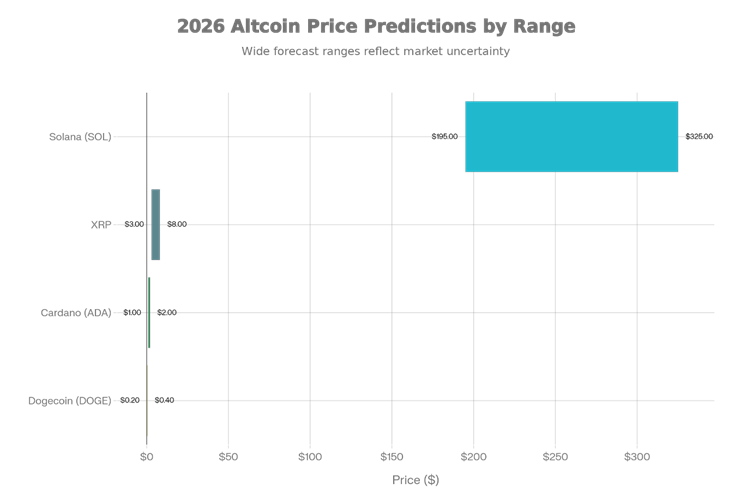

Altcoin Price Trends: Solana, XRP, and Beyond

Top altcoins show different risk-return profiles influenced by institutional adoption, regulatory clarity. Solana (SOL) is seen as the leading smart contract alternative to Ethereum, with 2026 price predictions ranging from $195 (average) to $325+ (bullish). Traders Union forecasts point toward $210-$270 by mid-2026 with potential for $412 by 2029.

The bullish view depends on Solana’s Internet Capital Markets growing from about $750 million to $2 billion. This is because more institutional capital markets activity moves on-chain and as the ecosystem shows it’s move beyond meme-driven trading.

Solana’s DeFi total value locked is currently around $9.19 billion, making it the fastest-growing alternative ecosystem after Ethereum, which still leads with about $71 billion.

XRP (Ripple) faces the highest forecast spread. Standard Chartered, the most bullish institutional voice, projects XRP reaching $8 by end-2026, representing 330% upside from current levels. This target assumes continued institutional adoption in cross-border payments, ETF inflows, and SEC commodity classification.

1 backing in short-term treasuries or currency, comply with KYC/AML rules, and disclose reserve composition monthly.

This framework has boosted TradFi partnerships, with nine major global banks: Goldman Sachs, Deutsche Bank, Bank of America, Banco Santander, BNP Paribas, Citigroup, MUFG, TD Bank, and UBS exploring stablecoin launches on G7 currencies.

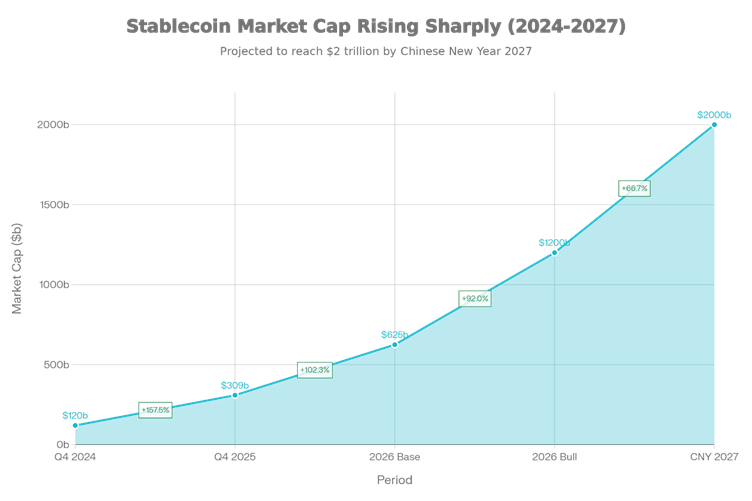

Global Stablecoin Market Cap Growth Trajectory (2024-2027)

The stablecoin market has expanded from approximately $120 billion at end-2024 to $309 billion in late 2025, a 158% increase in one year. The market is dominated by Tether (USDT) at $187 billion and Circle (USDC) at $77 billion, with new players including PayPal Stablecoin (PYUSD, $3.8 billion) and emerging TradFi competitors.

JPMorgan projects the stablecoin market reaching $500-$750 billion by 2026 under a conservative base case, with bull-case scenarios reaching $1-2 trillion by end-2026 or Chinese New Year 2027. Citi’s research projects base-case issuance of $700 billion and bull-case issuance of $1.9 trillion.

Stablecoins are predicted to overtake ACH (Automated Clearing House), the legacy banking transaction system, in transaction volume by 2026. Galaxy Digital predicts that top-three global card networks (Visa, Mastercard, American Express) will route more than 10% of cross-border settlement volume through public-chain stablecoins in 2026, though consumers will see no change in user experience, with stablecoins operating invisibly as back-end settlement rails. Stablecoin supply is expected to grow at 30-40% compound annual growth rate, boosting transaction volumes significantly.

Stablecoin and RWA Demand Rise

Recent institutional entries show this trajectory: Western Union launched a US Dollar Payment Token on Solana; Sony Bank is developing a stablecoin for integration across its ecosystem; and SoFi Technologies introduced SoFiUSD on Ethereum for efficient bank-to-bank settlement. This consolidation around TradFi partnerships positions 1-2 dominant stablecoins per region as preferred settlement rails, accelerating adoption through familiarity and network effects.

On the other hand, Real-world asset tokenization is breaking into mainstream capital markets. Fortune 500 companies: banks, cloud providers, and e-commerce platforms are launching corporate Layer-1 blockchains that settle more than $1 billion in real economic activity annually and bridge to public DeFi for liquidity discovery.

Major banks will begin accepting tokenized equities as collateral equivalent to traditional securities. The SEC is expected to grant exemptive relief (potentially under an “innovation exemption”) enabling non-wrapped tokenized securities to trade directly on public DeFi chains, with formal rulemaking commencing in H2 2026.

Cryptocurrency Adoption: Institutional, Corporate, and Sovereign

Institutional adoption is accelerating rapidly. Seventy-six percent of global investors plan to expand digital asset exposure in 2026, with 60% expecting to allocate more than 5% of AUM to crypto. Over 172 publicly traded companies held Bitcoin as of Q3 2025, up 40% quarter-over-quarter, collectively holding approximately 1 million BTC (roughly 5% of circulating supply).

On the other hand, the U.S. Office of the Comptroller of the Currency granted conditional approval for five national trust bank charters tied to digital assets: BitGo, Circle, Fidelity Digital Assets, Paxos, and Ripple. This moves stablecoin and custody infrastructure inside the federal banking perimeter, providing institutional-grade compliance and risk management. Sovereign adoption is expected to accelerate as well in 2026 as Brazil and Kyrgyzstan have passed legislation enabling Bitcoin purchases for national reserves.

Regulatory Clarity Increases Under Trump Era

The shift from “regulation by enforcement” to explicit rule-setting represents a strong turning point. The GENIUS Act establishes federal stablecoin standards; the House-passed CLARITY Act addresses market structure and jurisdictional clarity; and regional frameworks (EU’s MiCA, UK standards, Singapore’s MAS stablecoin regime, UAE guidelines) are creating compliant, scalable environments for institutional participation.

Expected interest rate cuts from the Federal Reserve, talks around fiscal stimulus, and the possibility of a more dovish Fed Chair taking over in May 2026 could all give a boost to risk assets including crypto.

At the same time, regulation is becoming more structured. Governments are increasingly viewing blockchain networks through a national security lens instead of just financial innovation. Concerns about sanctions evasion, illegal activity, and state-backed actors are creating a clear split between regulated, institution-friendly crypto markets and offshore platforms operating on the edges.

This is likely to favor institutional-grade platforms and compliant assets, while putting pressure on privacy-focused tokens and unregulated exchanges.

Market Derivatives and Options Trend in 2026

On January 1, 2026, over $2.2 billion in Bitcoin and Ethereum options expired. Bitcoin dominated with $1.87 billion in notional value trading near the $88,000 max pain level, while Ethereum accounted for $0.33 billion.

This highlighted the beginning of significant derivatives activity in 2026, with notable concentration in March and June maturity dates. It suggests traders are positioning for both short-term volatility and massive upside through H1 2026.

Conclusion

2026 is the year when the cryptocurrency market achieves robust things. For example, stablecoins become payment solutions; real-world assets migrate on-chain; institutional capital flows increase; and regulatory frameworks welcome rather than restrict crypto adoption.

Bitcoin price targets remain wide ($50,000-$250,000 by year-end), but institutional adoption and ETF demand create massive support floors. Ethereum could reach $7,000-$11,000 as DeFi and tokenization expand. Solana, XRP, and other altcoins prepare for 2-4x growth this year.

However, managing risk remains essential, as regulatory changes, reduced leverage, economic shocks, or technical failures at major platforms could quickly erase gains. Still, 2026 strongly appears to be a turning point, shifting the market’s focus from hype toward building a long-term potential in the crypto market.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Anime Series Hiding Clues in Background Graffiti

2026-01-05 18:40