CrowdStrike (CRWD), a company that somehow convinced the universe to reward its shareholders with an 1,100% post-IPO surge (despite the distinct lack of actual dividends), continues its existential tightrope walk between “unstoppable tech titan” and “overvalued space rock hurtling toward a gravity well of skepticism.” Its Falcon platform, a digital Swiss Army knife with 30 modules for thwarting cyber-goblins, remains the centerpiece of this interstellar opera.

The stock recently staged a modest comeback after reporting fiscal Q2 results that could charitably be described as “less panic-inducing than expected.” Revenue hit $1.17 billion (21% YoY growth, a reacceleration that felt suspiciously like financial prestidigitation), while adjusted EPS of $0.93 trounced guidance by a margin usually reserved for parliamentary elections in banana republics. Yet the P/S ratio of 25.3 suggests investors are paying roughly $25 for every $1 of sales-a valuation strategy that makes sense only if you’ve misplaced your financial compass in a parallel universe.

Falcon: The Cybersecurity Equivalent of a Universal Remote

While most cybersecurity vendors obsess over niche threats like “quantum cryptographers with commitment issues,” CrowdStrike’s Falcon platform operates under the radical premise that enterprises might prefer not hiring 30 different specialists to protect their digital assets. It’s the cybersecurity world’s answer to a black belt in everything: cloud networks, endpoints, identities, and other ephemeral digital entities that exist primarily to keep IT departments employed.

The platform’s AI, which automates threat detection with the enthusiasm of a caffeinated squirrel, recently gained a virtual assistant named Charlotte. This digital sleuth apparently saves managers 40 weekly hours of investigative work-though skeptics wonder whether those hours are simply being reallocated to explaining to confused executives why the AI hasn’t yet achieved sentience. (A spokesperson for Charlotte declined to comment, citing “priorities that transcend mortal comprehension.”)

Growth Reacceleration: A Brief Anomaly in the Space-Time Continuum

The 21% YoY revenue growth-CrowdStrike’s first acceleration since the Paleozoic Era of tech investing-owes much to Falcon Flex, a subscription model that lets customers shuffle spending between modules like a financial version of musical chairs. Over 1,000 clients have embraced this “choose your own adventure” approach, with 100 already returning for second helpings like caffeinated gamblers at a slot machine.

Management’s $10 billion ARR target by 2031 sounds ambitious until you consider their total addressable market is expanding faster than a budget over Black Friday. Whether this qualifies as optimism or cosmic-level hubris depends on whether you’ve read the fine print in their 10-K or simply ingested it intravenously during earnings season.

Valuation: The Black Hole in the Room

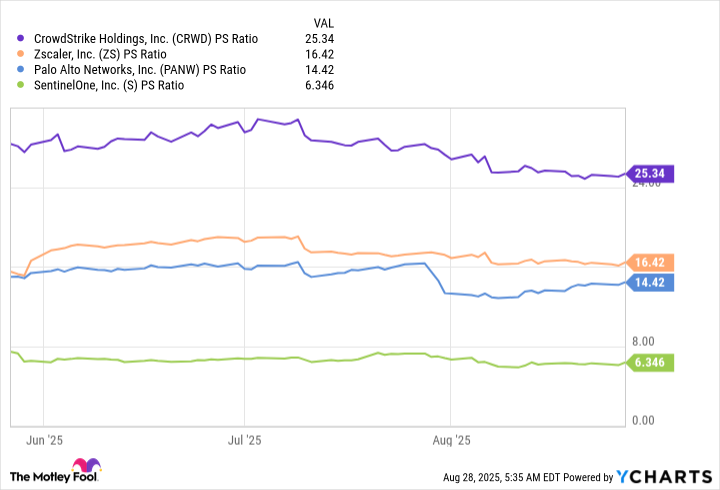

At 25.3x sales, CrowdStrike trades at a premium usually reserved for companies that promise immortality or time machines. Its 54% valuation edge over Palo Alto Networks (the cybersecurity equivalent of a grumpy uncle who still uses fax machines) suggests investors are paying extra for the privilege of anxiety-dreaming about short squeezes.

While long-term ARR growth could eventually justify today’s price-assuming no unforeseen asteroid strikes or AI uprisings-the lack of dividends makes this a speculative play rather than a retirement portfolio staple. Those seeking immediate gratification should recalibrate expectations to “high-risk lottery ticket” levels; patient investors might consider it a cosmic bargain, provided they’ve arranged childcare for the next five years.

In the grand tapestry of markets, CrowdStrike remains a fascinating paradox: a company whose valuation defies gravity yet continues attracting buyers who apparently enjoy playing chicken with financial entropy. 🌌

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

2025-08-30 11:48